View of the Phoenix Medical Office Market

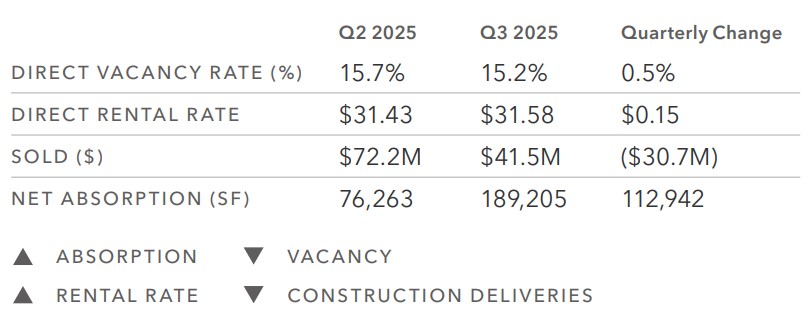

Market Highlights

- Total medical office inventory: 16.9M SF

- Medical office space leased in 3Q25: 143.5K SF

- 3Q25 sales volume: $41.5M

Leasing Activity

Direct vacancy fell to 15.2%, down from 15.7% in Q2 2025, indicating a slight improvement in occupancy. Leasing velocity remains steady and we’re seeing larger transactions being completed more frequently. We continue to feel the pressure of high construction costs but are starting to see some bright spots in the reduction of labor costs and reduced pressure on pricing from tariffs. We’re hoping to see more positive impact on the market from these factors combined with positive economic tailwinds.

Sales Activity

Sales remained active but fell by $30.7 million compared to Q2. Buyer interest is picking up and the interest rate reduction in September has led to optimism and the hope of more to come. Lenders remain firm in their underwriting standards which has caused issues with deal flow and pricing. We’re at an interesting intersection where off-market opportunities continue to present and trade while on-market opportunities at exorbitant prices remain stagnant. With $350 billion in dry powder on the sidelines across various investment firms, we expect to see significantly more trades occurring for the foreseeable future.

Construction

For the second quarter in a row, the market saw an increase in new deliveries. This time it was an addition of 100,000 square feet. Overall development continues to remain constrained, although the pressure point has been reached and we are seeing more projects in discussions to come to market. We’re continuing to see more office-to-medical conversions adding additional space to the medical office market. Phoenix is currently number 4 of 5 cities with the most amount of retail space under construction (2.2 mm SF), which is an indicator for the need for more medical office space. As the Valley of the Sun continues to expand and grow, adding more rooftops requiring more retail, those same populations need access to medical facilities in their communities.

Market Breakdown

The information in this update was composed by the Kidder Mathews Phoenix healthcare brokerage team of Michael Dupuy, Fletcher Perry, Rachael Thompson, Perry Gabuzzi, Chad Sutton, and Zack Harris.

Data source: CoStar

About the Team

The Kidder Mathews team of Michael Dupuy, Fletcher Perry, Rachael Thompson, Perry Gabuzzi, Chad Sutton, and Zack Harris specializes in healthcare real estate services with a strategic focus on the greater Phoenix region. For more information, visit their online team profile here.

About Kidder Mathews

Kidder Mathews is the largest fully independent commercial real estate firm in the Western U.S., with over 900 professionals in 19 offices across Washington, Oregon, California, Nevada, and Arizona. We offer a complete range of brokerage, appraisal, asset services, consulting, and debt & equity finance services for all property types. For more information, visit kidder.com.

Contact

Michael Dupuy, Executive Vice President

Fletcher Perry, Executive Vice President

Rachael Thompson, Senior Vice President

Perry Gabuzzi, Senior Vice President

Chad Sutton, Associate

Zack Harris, Associate

Stay in the know and subscribe to our monthly Western U.S. Market Trends report and our quarterly market research.