View of the Phoenix Medical Office Market

Market Highlights

- Total medical office inventory: 17.2M SF

- Medical office space leased in 4Q25: 143.4K SF

- 4Q25 sales volume: $104.3M

- Average Direct Rental Rate: $33.32/SF

Leasing Activity

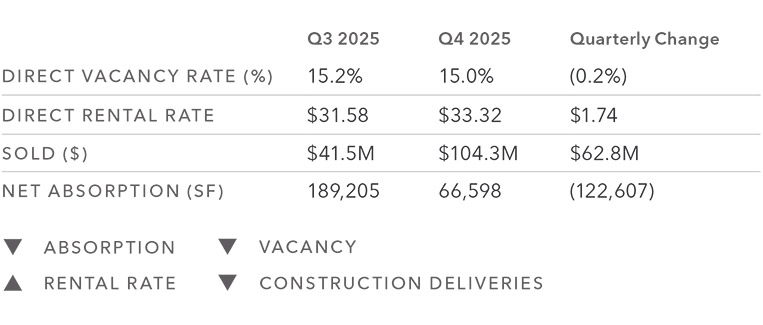

Direct vacancy tightened again in Q4, moving from 15.2% in Q3 to 15.0%, which points to a slow but steady improvement in occupancy. Asking rents increased as well, rising from $31.58 to $33.32, suggesting landlords still have pricing power for well located, high quality space. Leasing activity remains steady, but net absorption cooled to 66,598 SF versus 189,205 SF in Q3. In other words, deals are getting done, but the market saw fewer large move-ins this quarter. Construction costs remain elevated, which continues to affect tenant improvement budgets and the economics of building upgrades.

Sales Activity

Sales volume increased significantly in Q4, jumping to $104.3M from $41.5M in Q3. Buyer interest is improving, and sentiment around rates has helped bring more groups back into the market. That said, lenders remain disciplined, and tighter underwriting still plays a major role in pricing and deal structure. We continue to see a clear separation between opportunities that are priced to current conditions and those that are not. Well positioned, realistically priced deals, especially those sourced off market, are trading more consistently than aggressively priced on market offerings.

Construction

Development remains constrained as high costs continue to limit speculative starts and keep many projects in planning. Even so, we are seeing more projects move from concept to active discussion where demand is clear and preleasing supports execution. Office to medical conversions are also contributing incremental supply in select submarkets, offering a path to deliver space more efficiently than ground up development. With continued population growth across the Valley, demand for healthcare services remains strong, and that should support targeted medical office development where fundamentals and pricing align.

Market Breakdown

Read the full report at the link below.

The information in this update was composed by the Kidder Mathews Phoenix healthcare brokerage team of Michael Dupuy, Fletcher Perry, Rachael Thompson, Perry Gabuzzi, Chad Sutton, and Zack Harris.

Data source: CoStar

About the Team

The Kidder Mathews team of Michael Dupuy, Fletcher Perry, Rachael Thompson, Perry Gabuzzi, Chad Sutton, and Zack Harris specializes in healthcare real estate services with a strategic focus on the greater Phoenix region. For more information, visit their online team profile here.

About Kidder Mathews

Kidder Mathews is the largest fully independent commercial real estate firm in the Western U.S., with over 900 professionals in 19 offices across Washington, Oregon, California, Nevada, and Arizona. We offer a complete range of brokerage, appraisal, asset services, consulting, and debt & equity finance services for all property types. For more information, visit kidder.com.

Contact

Michael Dupuy, Executive Vice President

Fletcher Perry, Executive Vice President

Rachael Thompson, Senior Vice President

Perry Gabuzzi, CCIM, Senior Vice President

Chad Sutton, Senior Associate

Zack Harris, Senior Associate

Stay in the know and subscribe to our monthly Western U.S. Market Trends report and our quarterly market research.