Entering a new decade in 2020 soon felt like the beginning of an entirely brand-new world. Nearly every area of focus for the apartment development community – urbanism, small spaces, shared amenities, co-living/co-working, transit – abruptly shifted.

Where do we go from here?

In 2021, as we begin to get our bearings, we stare down an apartment development pipeline larger than the Seattle/Puget Sound region ever experienced. The development cycle spanning 2010 – 2020 changed the face of the region – as well as expectations for every market participant. We expected reasonably consistent demand drivers, acceptable return thresholds, and linear increases in project timelines and construction costs. Each of these factors changed markedly over the last 12 months.

In addition to myriad challenges faced in our region, apartment developers must analyze how best to proceed with the development of nearly 130,000 apartment units in the current pipeline. Many projects are viable, yet others were planned, designed, and entitled under a set of assumptions that may no longer prove valid.

Understanding the apartment development pipeline – including existing inventory of apartment units – remains crucial. Our Team stands at the ready through this market shift to help you achieve your apartment development and investment goals through our valuation, advisory, and brokerage services.

Please utilize this research report, and our expertise, in these changing and challenging times to make the best possible investment decisions.

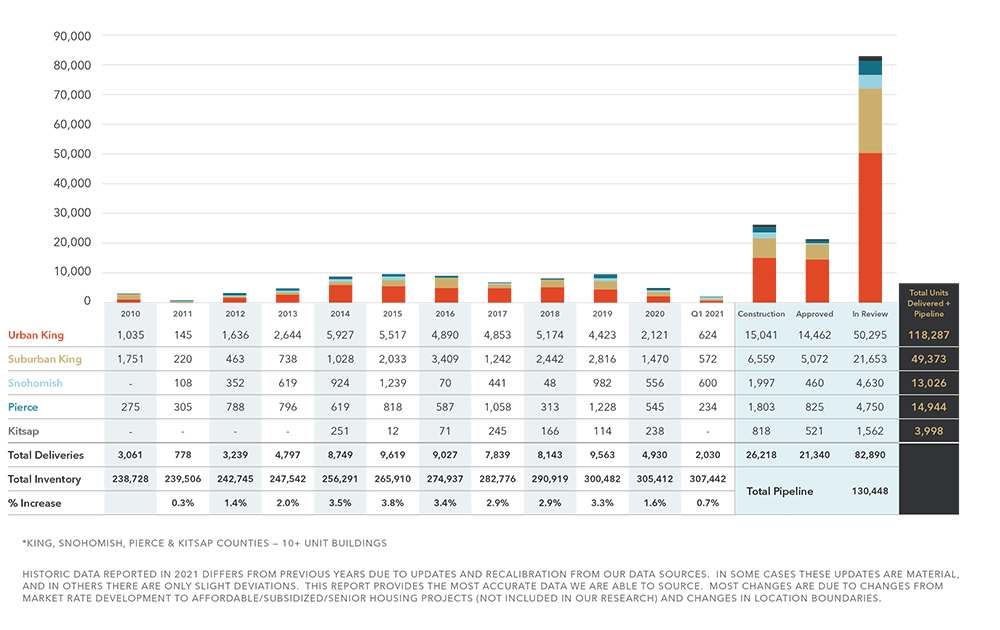

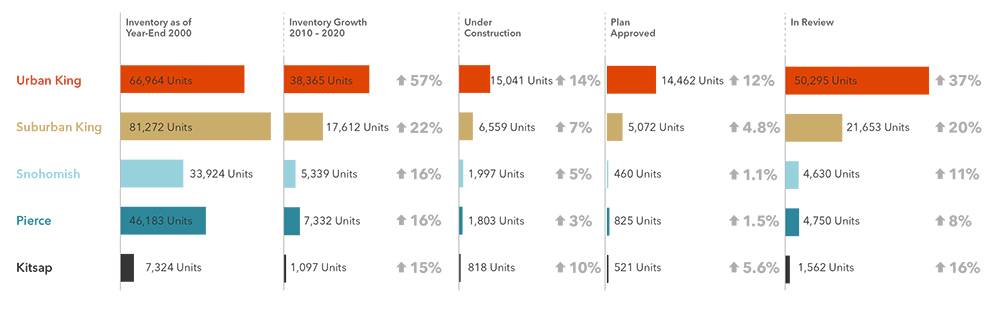

For this study, we traced apartment development deliveries back 10 years and analyzed three distinct phases of the current development pipeline, as outlined below. Our research and data cover the quad-county region (King, Snohomish, Pierce, and Kitsap counties), encompassing more than 6,400 square miles, 130,000+ planned apartment units, and nearly 1,000 individual apartment developments.

Pipeline Definitions

UNDER CONSTRUCTION

Developments labeled “Under Construction” have broken ground. Anticipated delivery is within the next 36 months for Type I projects or the next 24 months for Type III and Type V projects.

PLAN APPROVED

These units have entitlements from their respective cities and could break ground at any time. Given current market dynamics, it is important to note projects that might be on hold. Concerns over the economy, rising construction costs, and tighter lending restrictions have led some developers to rethink permitted projects. Some permitted sites will trade hands and construction will commence, while many others will be held by developers until a later date.

IN REVIEW

Projects “In Review” are currently pending city approvals. In Seattle, the entitlement process can take over two years, so in many cases, projects in this category are three or more years away from delivery.

Development Deliveries & Pipeline by Year / Status

Pipeline Snapshot

A SLOWDOWN – SORT OF …

In last year’s Apartment Development Pipeline Report, we forecast a slowdown. Less apartment units delivered and less developments receiving permitting. In 2021, we are experiencing some of the effects of that slowdown, with less units delivered year-over-year than in previous years, and less construction starts. Where the market has not slowed is in delivering permitted development sites.

Part of what the market is experiencing is a bottleneck at the stage of groundbreakings. Apartment developers are much busier entitling development sites than they are in starting to construct them. And given demand drivers, constructions costs, and availability of capital – this all makes sense.

A PATH FORWARD

Expect 2021 to serve as a year of regrouping – centering, if you will – and focusing on which developments make the most sense. Is no surprise that apartment developers are focusing more on Eastside and suburban markets, and we expect this trend to continue for the long-term.

In the short term, we expect a slowdown in the construction and delivery of urban-located, small unit-sized developments. Expect continued vibrancy in urban markets with high entrance barriers– Queen Anne, Green Lake – and slowdowns in markets hardest hit in the last year – South Lake Union, West Seattle, University District.

Development History & Pipeline by Region

King County

In each successive year of the market cycle that spanned from 2010 to 2020, the question of urbanism came more into focus. For the first half of the last decade, apartment developers focused on dense, urban neighborhoods – with nearly 90% of all development planned in urban cores. That number shifted closer to 60% by the time the decade closed.

A QUESTION OF URBANISM

Yet, 2020 – and the ravaging impacts of COVID-19 – caused the apartment industry to second-guess urbanism altogether. Its early innings of this next decade; however, the next few years will prove crucial in determining the direction of renter demand, and how apartment developers will respond to it.

A TALE OF TWO CITIES

Seattle’s recent ascendancy as one of the most desirable cities for renters and apartment developers alike met an abrupt halting over the course of the last year. As both renters and investors second-guessed their interest in Seattle, it didn’t take either long to make their way across Lake Washington to settle on Bellevue as the next-best alternative.

Nationwide, in 2020 most all urban centers felt the impacts of COVID-19 in the form of lessened demand, yet somehow Bellevue defied the odds. Renters chose it over Seattle – as did employers, leading the apartment development community to flock en masse to Bellevue.

Urban King Development Overview

Over the course of the last year, apartment development in Urban King County shifted from a gold rush to plugging holes in a dam. Its challenging – and fruitless – the cease work on projects under construction and a current pipeline of over 15,000 units under construction (compared to 16,000 at this time last year) proves that point.

The biggest change year-over-year are the number of projects halted. As of Q1 2020, plans for approximately 2,500 units were approved, yet construction had not commenced. Rollforward to 2021, and the number of permitted units skyrocket to nearly 15,000 units. Due to slowed-demand, high construction costs, and a challenging capital markets environment, apartment developers are waiting out the storm.

Despite a slowdown in construction starts, the overall pipeline of units in review (applications submitted, yet not issued) is as high as it’s ever been – representing 50% of all apartment inventory in King County’s urban neighborhoods.

Suburban King Development Overview

2020 was unsurprisingly a very tough year for apartment investors and developers alike across Puget Sound. Predominantly, apartment investors and developers fled from Seattle to pursue opportunities in suburban King County. There were two main factors that led to this suburban flight: renter demand and light rail.

With working from home becoming the new norm and, in some cases, the only choice, residents searched for larger units and (slightly) lower rent outside of the city. Along with occupancy rates rising higher outside the city, light rail continues to bring with it developer demand and new development sites popping up along light rail line throughout suburban King.

East King continues to lead suburban markets when it comes to demand for development sites from apartment developers. Yet, with light rail lines providing the roadmap for new development north, south, and east – all markets will benefit from the push towards more transient oriented development (TOD).

Read the full study at the link below.

Contact

Simon | Anderson Multifamily Investment Team

Dylan Simon, Executive Vice President

Jerrid Anderson, Executive Vice President

Alex Mundy, Debt & Equity Finance

Matt Laird, Senior Associate

Brandon Lawler, Associate Vice President

Winslow Lee, Associate

Greyson Elmes, Associate

Max Frame, Associate