New Sheriff in Town –

The 2021 Mayoral election brought Bruce Harrell and Sara Nelson into office, both running as strong supporters of business with an interest in making Seattle an easier place to build housing. Time will tell if they plan to move the ball forward, but at least there is hope the pendulum may swing back to a more builder-friendly environment in Seattle.

Pod Micros are Back

In 2014, the city council passed legislation that killed off pod micro-housing development. The legislation was largely understood to make it impossible to build the kind of 8br/8ba townhouse pods we call “Micros”, because complications were created with the land use code, essentially starving Micros of a land base where they could be built. However, in most instances, Micros can now be permitted again as they were prior to 2014. There are a few new projects underway using this pod model, which can now be used in most urban villages in any zone where multi-family development is allowed in Seattle.

New Energy Code

The new 2018 Energy Code went into effect March 2021. While most architects and engineers are still going through their first round of projects designed under the new code, the profession is struggling with the difficulty and expense of complying with the new code. The effects are felt most acutely in the design of building systems for HVAC and hot water. The changes are adding a minimum of $10,000-$15,000 per unit to meet the requirements for balanced ventilation systems, no fossil fuels combustion, heat pump based hot water and HVAC systems, more renewable energy, and tighter envelopes. Developments with smaller sized units are most negatively affected by these changes as many of these extra costs are accrued on a per-unit basis, not on a per square foot basis.

2021 Seattle Fundamentals

A Macro Recovery for Micros

Some buildings have lagged, but as a whole, the microhousing market established resiliency in 2021.

While only a handful of investors currently develop, own and operate microhousing in the Puget Sound, thousands have watched the microhousing boom with equal parts intrigue and skepticism. The most common question and objection investors have about microhousing developments and buildings we’ve sold is, “how will these small units perform in a market recession?” Now we have the answer. 2020 and the COVID 19 pandemic presented the ultimate test for microhousing.

Nearly every apartment property in our region was challenged by the impacts of the pandemic and social unrest in 2020. Urban located apartments were impacted much more severely than suburban ones, and within the urban core, properties that were heavily dependent on students and service level workers were impacted greatest. Microhousing specifically serves those exact demographics in exactly those locations, so if microhousing was going to fail as a long-term investment thesis, 2020-2021 would have proven the doubters correct.

Microhousing rents & vacancy both improved year over year, and while they have not topped 2019 numbers, they are poised for a surge. The return to in-person classes at most universities had a robust impact on the microhousing, and as COVID and the strict regulations surrounding it subside in 2022, we expect an even more robust recovery as thousands of service jobs and workers return.

Rent & Vacancy

How has Microhousing Recovered Compared to Market Rate Apartments?

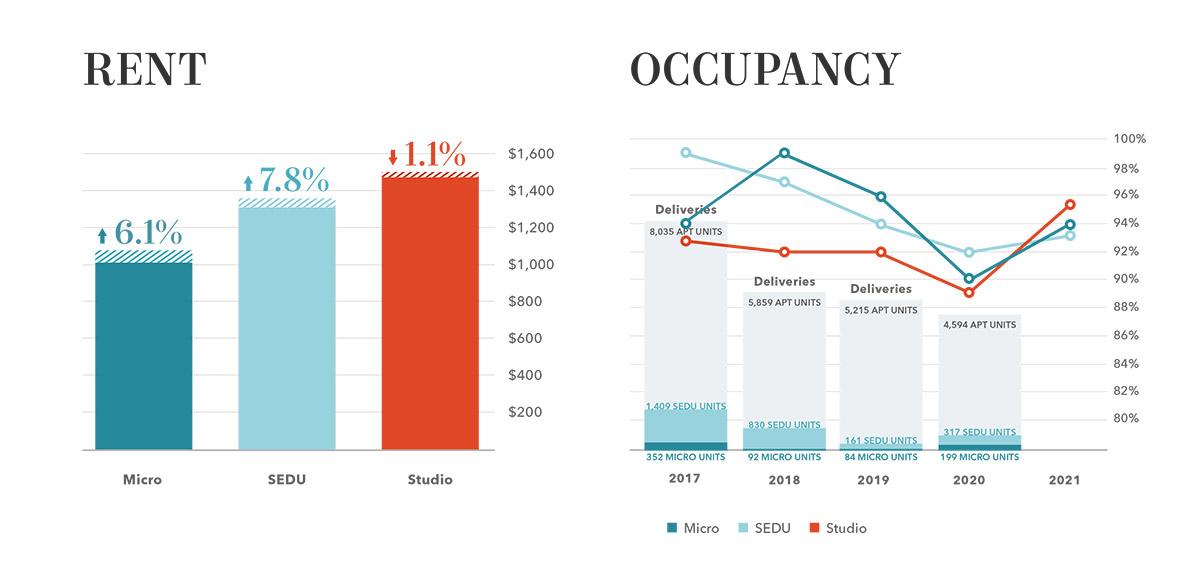

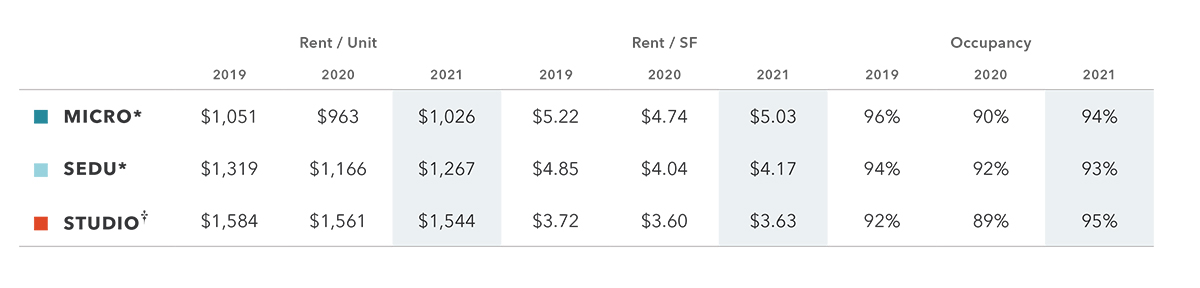

MICRO True Micros have proven to be more volatile than both SEDUs and Studios when comparing rent and vacancy; however, as of November 2021 they have a higher occupancy rate than SEDUs and have outpaced market rate apartments in rent growth by a wide margin. Owners of these properties understand it’s a hands-on business with higher-than-average turnover and those that watch over their investment closely have done substantially better than owners that have taken a more passive approach.

SEDU SEDU apartments have been less volatile than Micros and studios from an occupancy perspective, but still have the lowest occupancy rate. SEDUs also experienced the largest percentage decline in rents during 2020 (11.6%) and the largest percentage increase in 2021 (7.8%). The primary cause for lower occupancy and greater rent growth in SEDUs year over year was the limited number of deliveries of new SEDUs in 2020. That was followed by a flood of new units which are still being absorbed, but at higher rates than older vintage SEDUs as the developers continue to push the envelope of building and unit fit & finish.

Data Sources

1 Asking rents and surveyed vacancy

2 CoStar – Asking Rent, studios built 2010+; Costar – Q2 Gross Vacancy, Studios Built 2010+

Note: Vacancy impacted by properties in Lease-Up

Rent & Vacancy by Neighborhood

Last year we excluded Micro and SEDU occupancy levels in the University District & Roosevelt from our averages because of the severe impact they had on the remainder of the market. Fast forward 12 months and those two markets have the highest occupancy levels of all Seattle markets, bested only by the few microhousing buildings located in East King County.

The jury is still out on whether 2020 or 2021 occupancy levels are the anomaly in the University District & Roosevelt. Looking more broadly we’ve recognized three themes for demand.

Sales & Development

While micro and SEDU price per unit and price per square foot metrics have seen only moderate growth and decline over the last few years that will soon change.

- City and affordable housing groups will close several sales in the near future well above market pricing – this will severely impact comparables but is not indictive of market value (they are being purchased vacant and pricing is not based on current operations).

- Operations are still recovering – once net income at micro and SEDU properties exceed pre pandemic levels, we anticipate cap rate compression given the resiliency of the investments.

Development

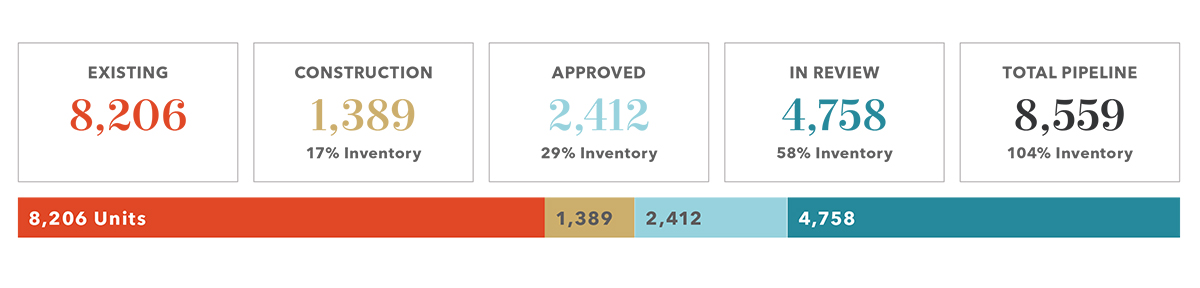

Nearly 50% of the microhousing development pipeline under construction in 2020 was completed in 2021. That doubles 2020’s deliveries, but the two most common delays still plaguing developers are utility providers and supply chain issues.

2021 marks the first year of a decline in permits for microhousing since their inception. While an 8% pipeline decrease seems nominal, it’s worth noting that the number of projects with permits approved that are on hold grew by 41%. Speaking with Developers, COVID concerns and hard costs are the main reasons many projects have been shelved or put on hold.

Most importantly, if the permitting, development, and energy code challenges posed by Seattle cause microhousing to fall out of favor with developers, the city will continue to get less and less affordable as the Puget Sound grows.

Read the full study at the link below.

Contact

Simon | Anderson Multifamily Investments Team

Dylan Simon, Executive Vice President

Jerrid Anderson, Executive Vice President

Matt Laird, Senior Associate

Brandon Lawler, Associate Vice President

Winslow Lee, Associate

Max Frame, Associate

Jack Counihan, Associate | Financial Analyst