After a long period of a rising tide, the economy has felt like a slack tide; we find ourselves mulling over the implications of a softening market that may move into a recession. Will the federal reserve’s policies guide the economy into a soft landing, or is the economic tide dropping to painful lows?

In general, market participants in the Northwest are pondering shifts in the economy and the potential upcoming changes in real estate prices. Amid this change, Portland and Seattle face challenges similar to other west coast metro areas, including high taxes, rising crime, homelessness, and an increase in remote work compared to historical norms. The federal reserve’s stance on increasing interest rates and quantitative tightening to slow the economy substantially adds to this mix. Additionally, banks are tightening lending standards amid liquidity concerns, a potential decline in collateral value, and a move to avoid and reduce risk.

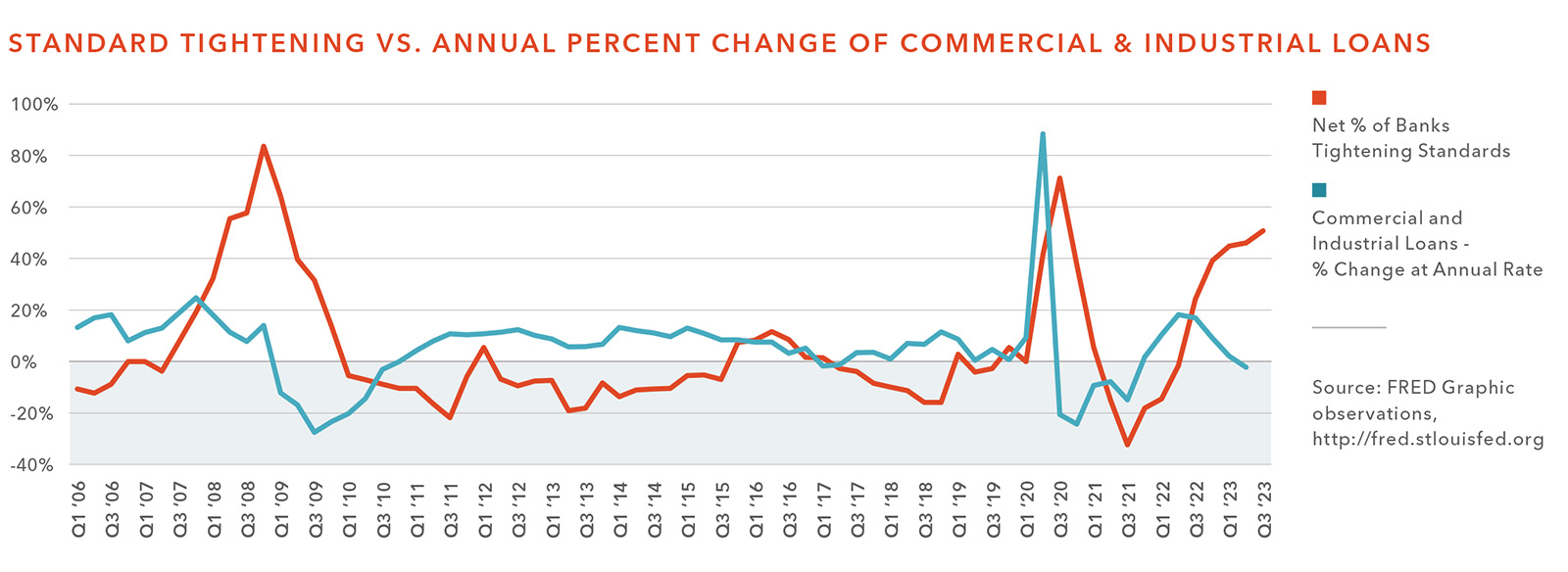

The below chart is based on a survey conducted quarterly by the Board of Governors of the Federal Reserve System. The survey includes, “up to eighty large domestic banks and twenty-four U.S. branches and agencies of foreign banks.” This survey is juxtaposed with the quarterly measurement of the percentage change in commercial and industrial loans at an annual rate. For the survey on bank tightening standards, data above 0% indicates a greater tightening of lending standards. Alternatively, the annual percent change of commercial and industrial loans shows growth when this measurement is above 0%.

Even during times of increasing uncertainty, there are opportunities and reasons to be optimistic for those investors that stay well informed, are willing to adjust investment strategies while embracing creative solutions to problems, and tackle possible investments with a well-thought-out strategic vision.

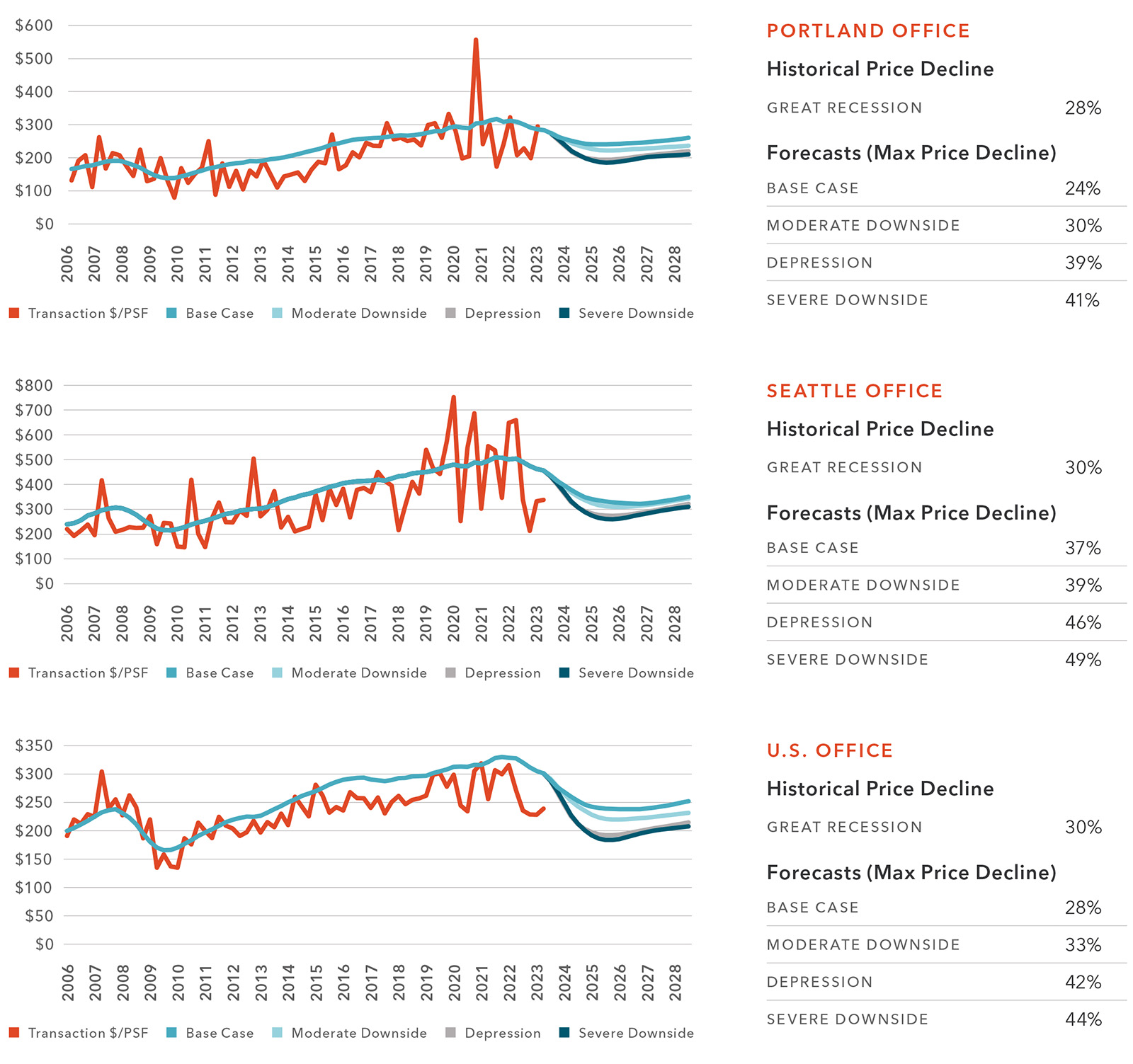

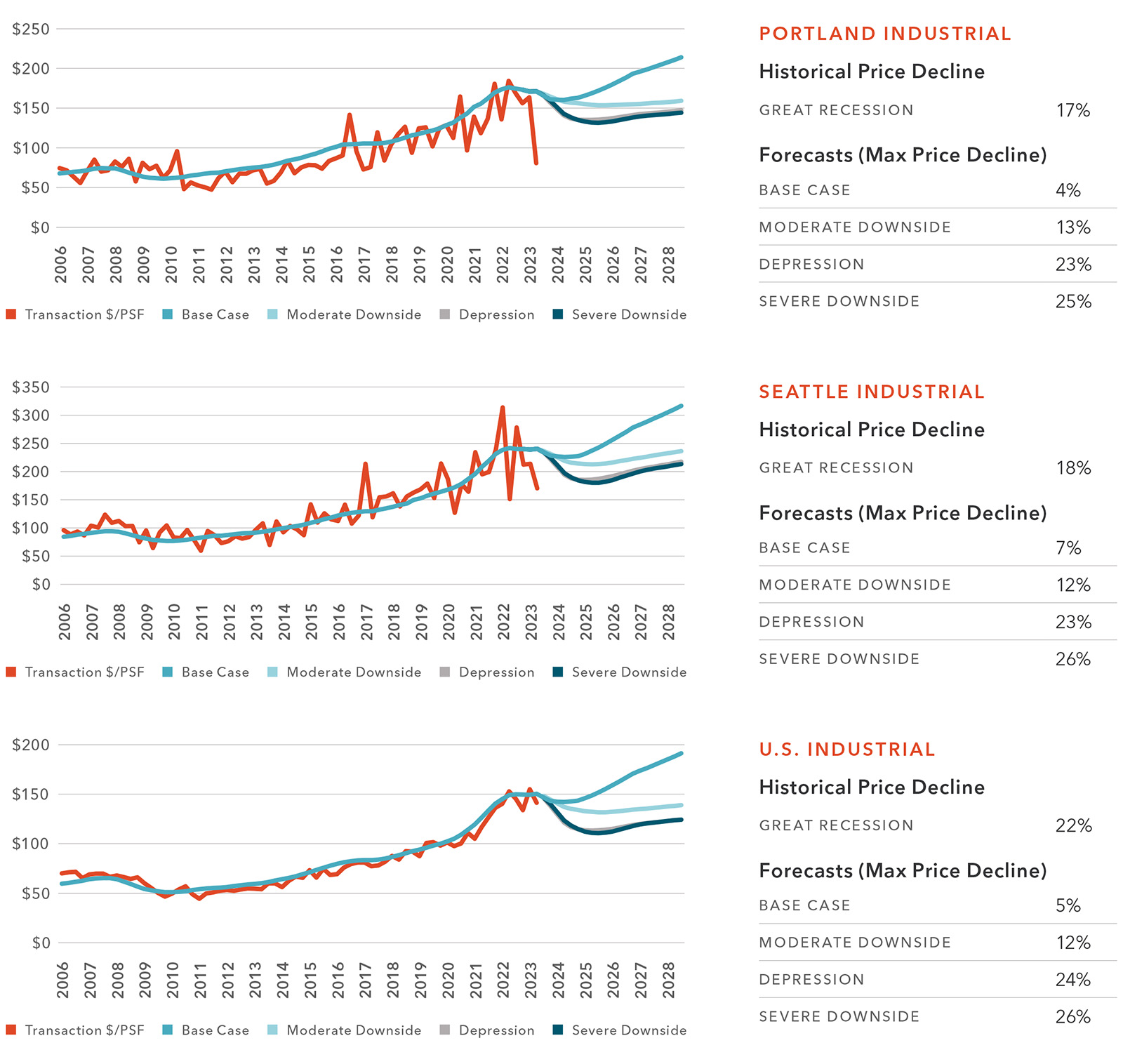

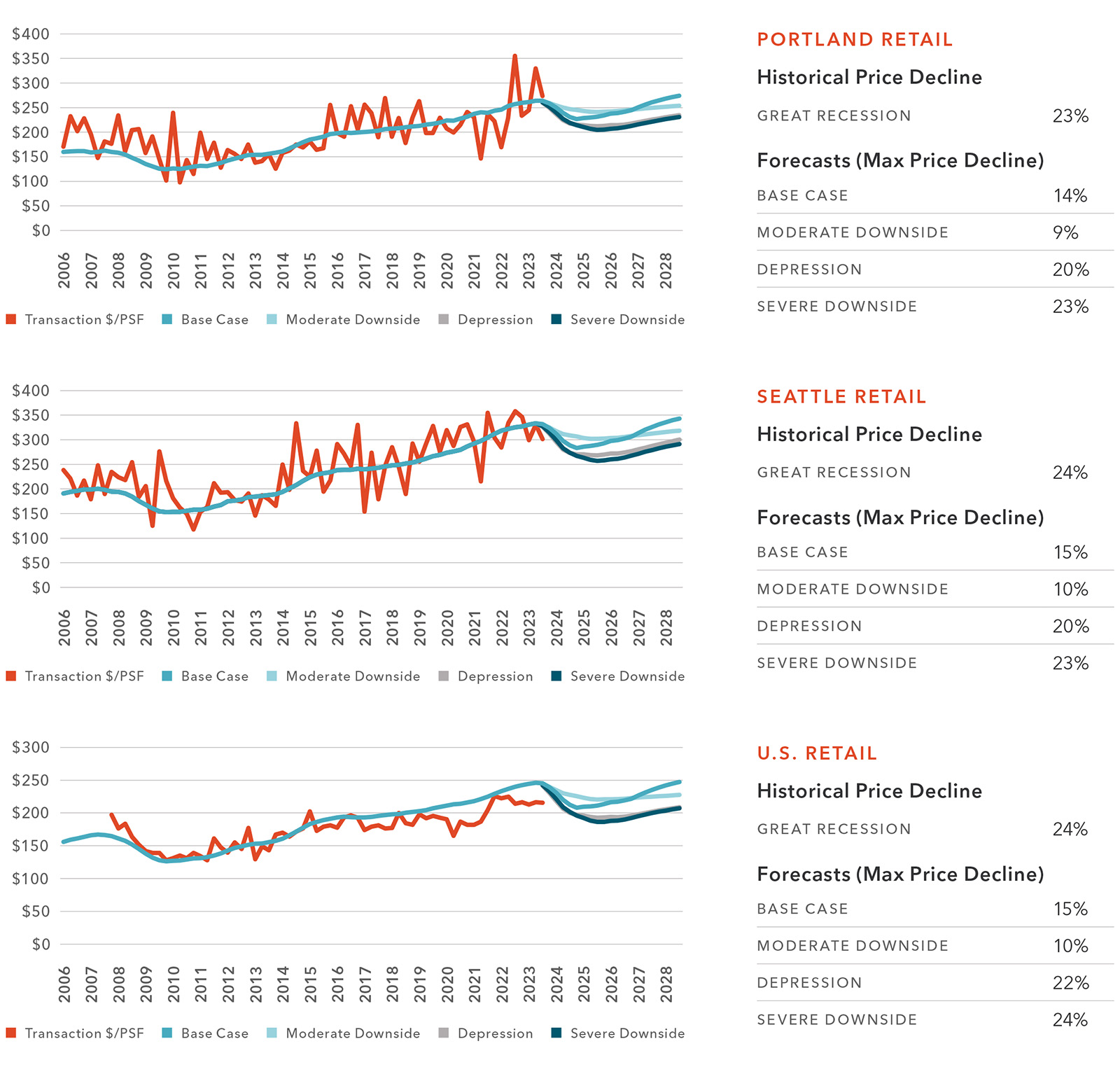

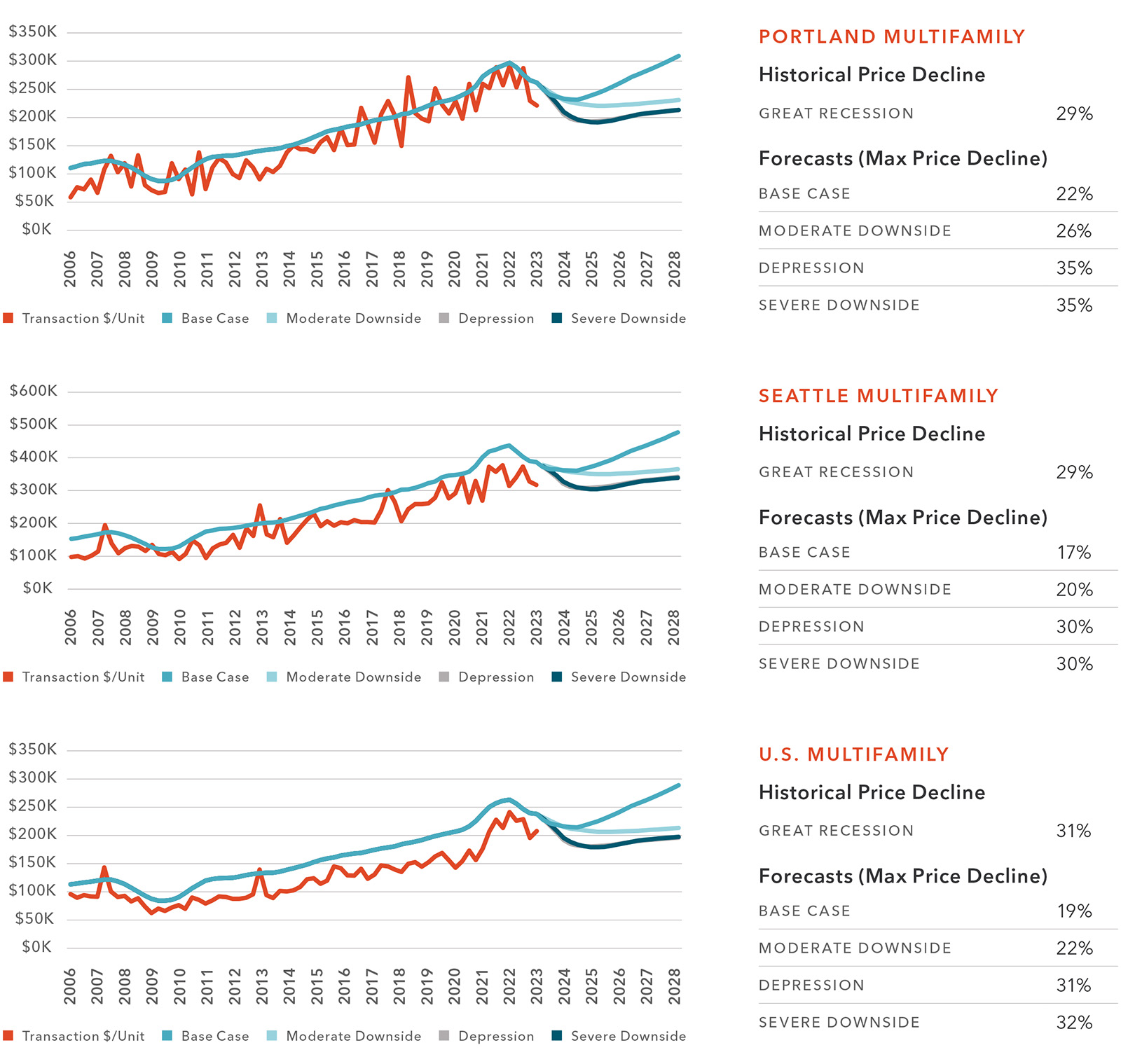

There are myriad elements to consider for each real estate sector, with market participants trying to understand and rationalize the impact of the changing economic environment. An abbreviated discussion from Kidder Mathews (focused on the Portland and Seattle areas), as well as a forecast of market prices for the inventory related to industrial, retail, office, and multifamily real estate sectors as provided by CoStar through their collaboration with Oxford Economics for Portland, Seattle and the US, is as follows. The charts display the estimated market prices from Q1 2006 through Q3 2028. Actual average transaction prices by quarter, as collected by CoStar, are also provided from Q1 2006 through Q2 2023.

Office Price Forecast

Hybrid work, crime, homelessness, and high taxes have weakened CBD demand, intensifying the downtown-suburb contrast. High vacancies, costly renovations, prolonged regulation processes, elevated development expenses, rising interest rates, and falling rents will collectively suppress the office market in Portland and Seattle’s CBD. These factors will persist, influencing future office sector pricing in both cities.

Industrial Price Forecast

Limited sales inventory, minimal new construction, but a slight bump in available space to lease and a somewhat eroding rent growth have resulted in forecasts that are mild to the downside for the industrial sector compared to other product types.

Retail Price Forecast

Prior to current economic concerns, e-commerce and re-purposing of space had already affected retail in Portland and Seattle. Reduced competition aids both existing and new supply, while embracing experiential retail and eco-friendly business practices should support retail investors against consumption slowdown from inflation and unemployment. Retail is expected to fare relatively well compared to other real estate sectors in the near term.

Multifamily Price Forecast

Leasing has slowed even as Portland and Seattle’s downtown area expect additional high-quality/luxury units to be developed, putting downward pressure on rent growth, particularly for the higher-end units. At the same time, Seattle’s apartment rent growth has already been feeling the effects of new inventory coming online. Additionally, the continued development of multifamily units in the suburbs, even while tenants struggle with inflation and the potential for increased unemployment, has dampened the appetite for multifamily acquisitions.

Summary

Any expected downturn in the economy is currently anticipated to have a range from minimal to relatively strong impacts on real estate prices, depending on the real estate sector’s existing characteristics and anticipated changes.

The effects of increasing interest rates, quantitative tightening, and stricter lending standards will affect all sectors. However, even within sectors that are potentially expected to experience large declines, there are opportunities for sound investments, especially where buyers and sellers have reasonable expectations of current economic conditions and future expectations about pricing, capitalization rates, and rent growth. As always, seek professional guidance and contact your broker to understand how your property or a potential acquisition competes and compares to the market in general and the market conditions in your property’s immediate area, given its characteristics and specific facts and circumstances. This material is provided for informational purposes only; events and market conditions can unexpectedly change. The material in this article should not be considered financial advice.

NOTES ABOUT FRED (FEDERAL RESERVE ECONOMIC DATA)

Net Percentage of Domestic Banks Tightening Standards for Commercial and Industrial Loans to Large and Middle-Market Firms (DRTSCILM)

Survey of up to eighty large domestic banks and twenty-four U.S. branches and agencies of foreign banks. The Federal Reserve generally conducts the survey quarterly, timing it so that results are available for the January/February, April/May, August, and October/November meetings of the Federal Open Market Committee. The Federal Reserve occasionally conducts one or two additional surveys during the year. Questions cover changes in the standards and terms of the banks’ lending and the state of business and household demand for loans. The survey often includes questions on one or two other topics of current interest.

Commercial and Industrial Loans, All Commercial Banks (CILACBQ158SBOG)

These series are break adjusted. The percent changes are at a simple annual rate and have been adjusted to remove:

– The effects of non-bank structure activity of $5 billion or more

– The estimated effects of the initial consolidation of certain variable interest entities (FIN 46) and off-balance-sheet vehicles (FAS 166/167).

Information about these adjustments is documented in the H.8 Notes in the Data section (http://www. federalreserve.gov/releases/h8/h8notes.htm) of the H.8 Assets and Liabilities of Commercial Banks in the United States release from the Board of Governors.

To make the current and past levels comparable, a ratio procedure is used to adjust past levels. For example, if on December 31, 2008, real estate loans at large banks increased by 1% because a large bank acquired a non-bank during that week, the levels for real estate loans at large banks for all weeks prior to December 31, 2008, would be increased by 1% and then the percent changes would be calculated using those adjusted levels. These quarterly percent changes are calculated from quarterly levels, rounded to the nearest $100 million, based on the average of the three monthly levels in each quarter.

Contact

| AARON TAYLOR, MAI , ASA SVP, Manager, Valuation Advisory aaron.taylor@kidder.com View Bio |

BRIAN HATCHER President & COO brian.hatcher@kidder.com View Bio |