As your lease expiration is approaching, you are faced with many key decisions. The main one being, Should you relocate to a separate facility or begin the renewal process?

Why not begin both at the same time?

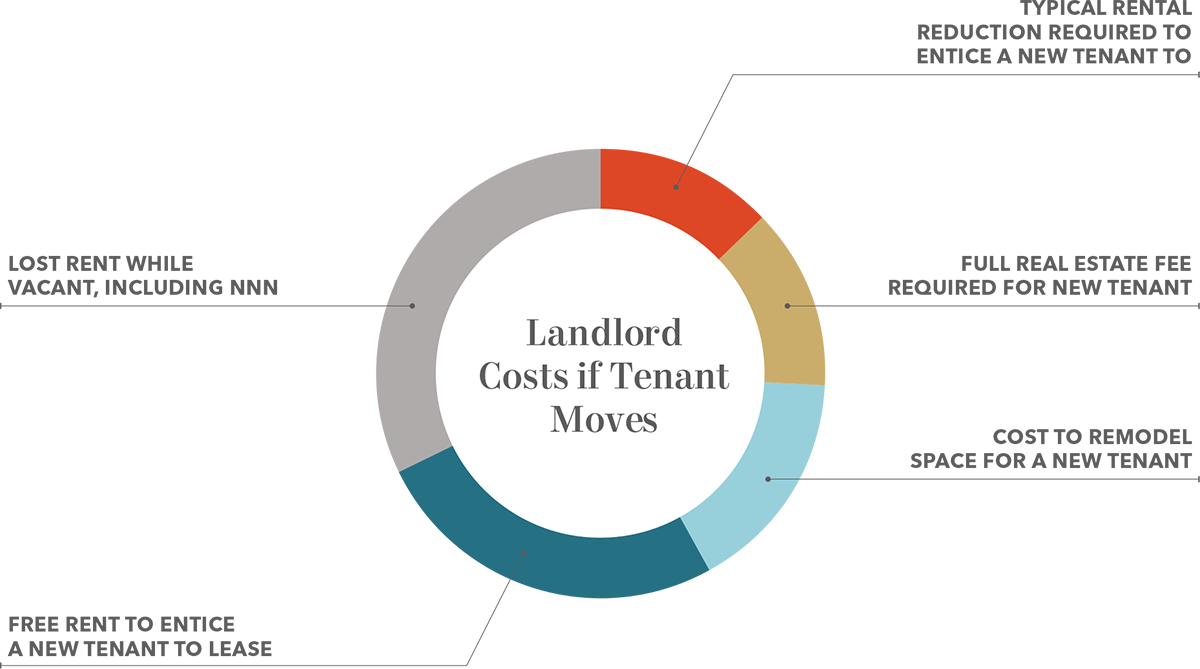

We take a two-sided approach to lease negotiations, initiating the renewal process while simultaneously exploring relocation options. This strategy allows us to maintain both an external and internal strategy. Externally, we express a genuine interest in renewing—emphasizing that staying put avoids the hassle and expense of moving—while noting that attractive alternatives exist that may better suit operational needs. This position helps build leverage, ultimately pushing the renewal rate down. Internally, whether we’re committed to staying or seriously considering a move, we’re setting up favorable terms for either scenario, ensuring a lower renewal rate for both Plan A and Plan B.

Advantages to Renegotiating your lease

- Below market lease rate

- Improvement allowance

- Less disruption with more time focused on your business

- Save on moving costs

- Employee retention

- Use of a third party creates an arm’s length relationship between tenant and landlord, protecting your landlord/tenant relationship