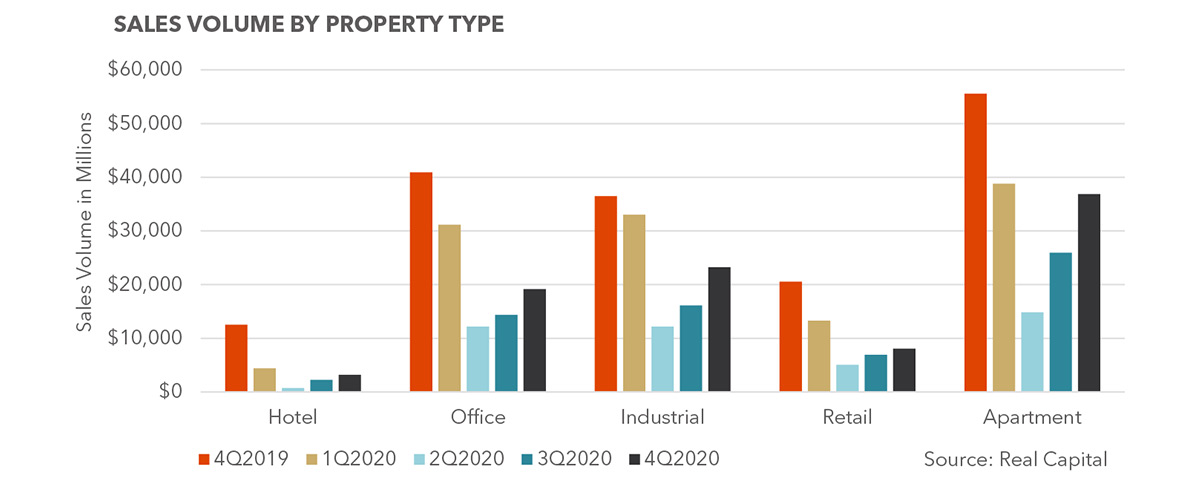

The commercial real estate market ended 2020 much stronger than feared early in the year. While sales volume was down 32% year-over-year, overall pricing for the $405.4 billion in sales that did occur was up 7.3% over 2019 pricing.1 And most of the carnage in the market happened in the second quarter, at the height of the COVID-19 pandemic panic when deal volume plummeted 64% year-over-year. But investors quickly learned how to navigate the logistic challenges to closing deals in a lockdown environment. As a result, sales volume jumped 45.7% in the third quarter over the second quarter and another 37.9% in the fourth quarter.

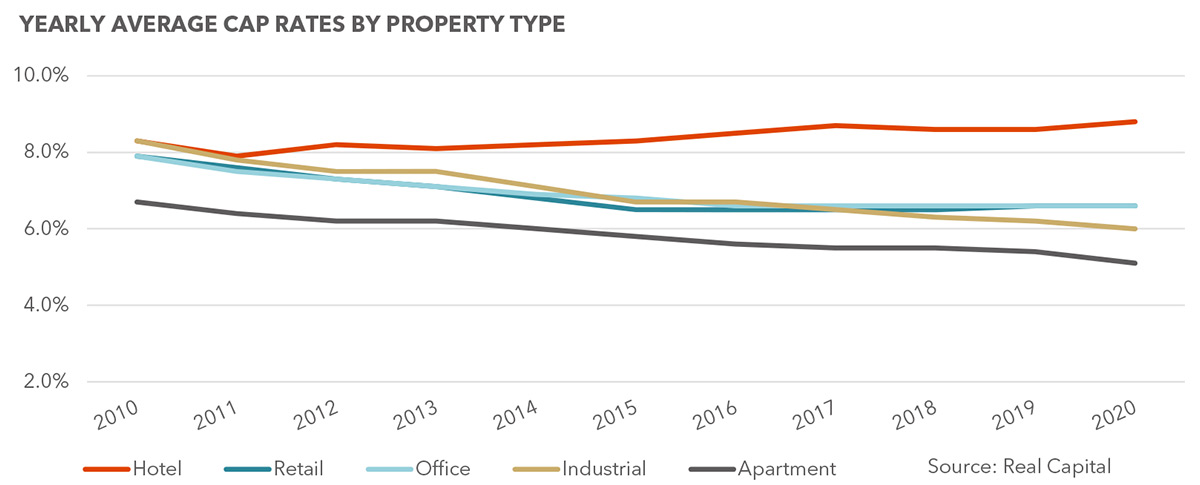

Surprisingly, instead of rising as might be expected in a severe recession, cap rates stayed steady or declined slightly, depending on the product line, despite the shock to the economy. Also noteworthy, according to the Green Street Commercial Property Price Index, overall commercial property pricing was down only 8%, far less than some had predicted.

Distressed Properties

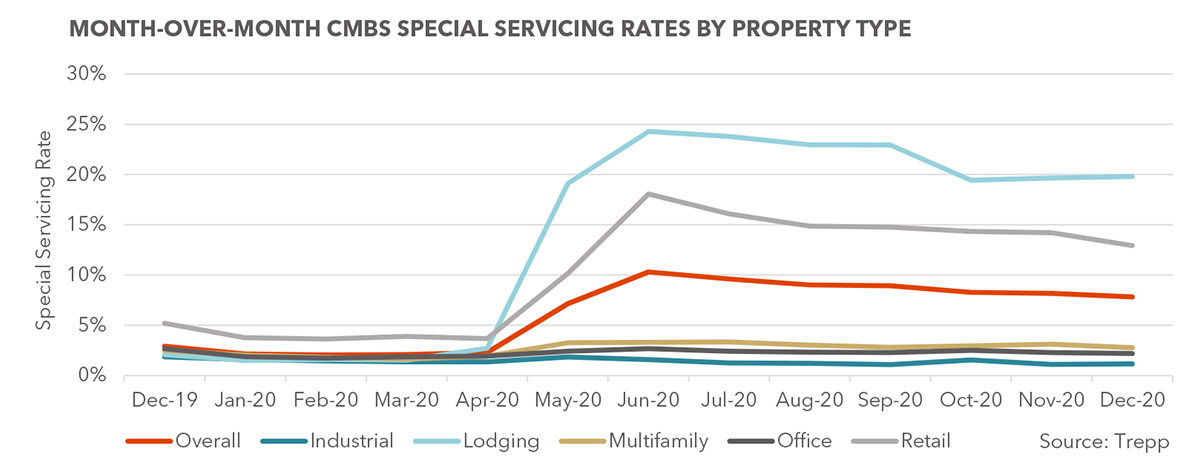

The sudden national economic shutdown’s overwhelming effects drove overall CRE delinquencies up 825 basis points in the chaotic second quarter to end June at 10.32%, the highest point of the year. A closer look at the data reveals that the rapid acceleration of the second quarter’s delinquency rates was driven almost exclusively by the lodging and retail sectors. In fact, between March and June of last year, retail delinquencies jumped over 1,400 basis points to 18.07%, while lodging delinquencies exploded a whopping 2,277 basis points to 24.30%. By contrast, in that same time frame, office delinquencies rose only 80 basis points to 2.66%, while industrial delinquencies increased 22 basis points to 1.57%, and multifamily delinquencies rose 166 basis points to 3.29%.

As the pandemic dragged on, lodging and retail properties continued to suffer the brunt of the continuing lockdown orders. Over the remainder of the year, retail and lodging delinquencies gradually improved as special servicers stepped up and processed workout, forbearance, and other types of modification requests, ending the year at 12.94% and 19.80%, respectively. Industrial, office, and multifamily all ended the year with sub-3% delinquencies. Industrial ending the year at 1.14%, 43 basis points less than in January 2020.

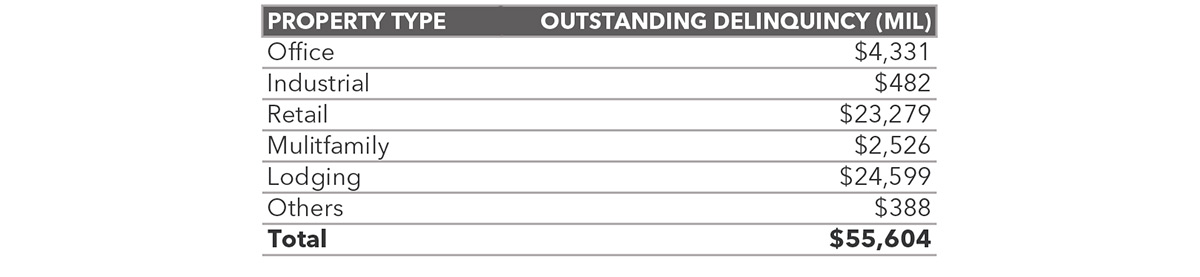

To better understand the composition of the CRE distressed asset market at the end of 2020, Real Capital Analytics broke down the 2,312 properties in distress by property type and total delinquency amounts in the following table:

Remarkably, $47.8 billion, or 86%, of the $55.6 billion total outstanding delinquencies at the end of 2020 is attributable to retail and lodging properties.

Looking Forward: 2021 Distressed Properties

Tracking the monthly CMBS delinquency rates for 2020 (Trepp graph above) shows a CRE market stunned in the second quarter followed by six months of falling delinquency rates in all five major property types. Trepp recently released the January delinquency rates showing the seventh consecutive month of declining rates in all five property categories and an overall rate of 7.58%, down 23 basis points from December’s 7.81% and 274 basis points from June’s high of 10.32%. The trend seems to show an improving distressed asset market moving in tandem with the improving U.S. economy.

Industrial and Logistics

The necessary resort to e-commerce resulting from the nationwide lockdown order put industrial and logistic assets, already expanding at an unprecedented pace, on an accelerated growth path. By all recognized commercial real estate metrics–rent growth, vacancy, absorption, starts, and deliveries—last year the industrial market easily outperformed 2019. Only 1.57% of industrial loans were delinquent going into 2020, and by year’s end, that number dropped to 1.14%. January of this year saw another 88-basis point drop in industrial delinquent loans to 0.26%. Adding to the sector’s overall strength, the data storage, cold storage, life sciences, self-storage, and last-mile warehousing subsectors all saw accelerated expansion driven by the pandemic. Even as the economy continues to open, the high demand for industrial space will outpace supply this year and beyond. By all industry metrics, there will probably be little, if any, opportunity to acquire distressed industrial or logistic properties resulting from the pandemic recession of 2020.

Multifamily

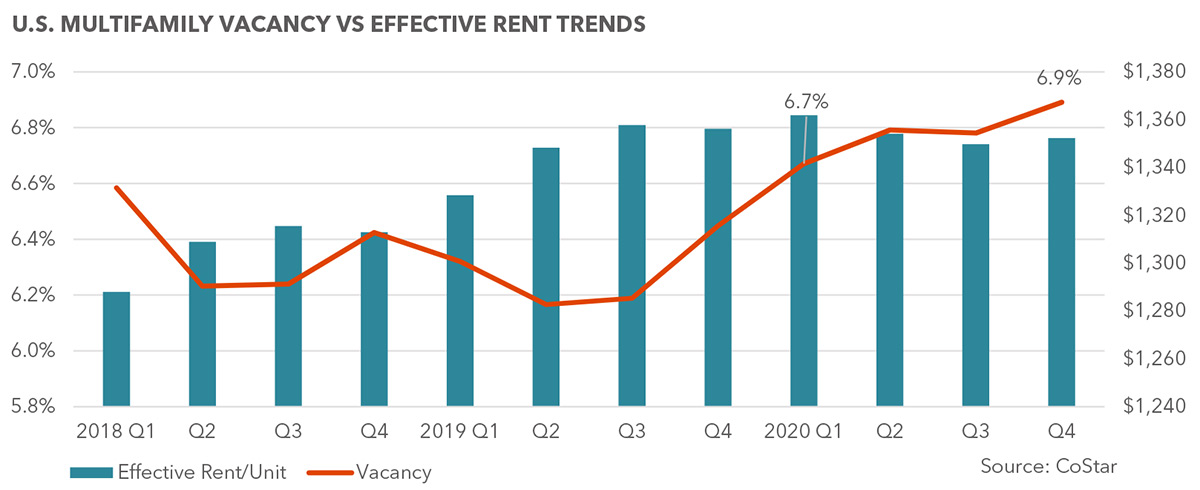

The multifamily sector withstood the COVID-19 recession better than the other major CRE sectors except industrial. Going into January of last year, the sector had 2.49% of its mortgage loans in special servicing. Twelve months later, there were 2.75% of multifamily mortgage loans in special servicing. In January of this year, the delinquency rate dropped 40 basis points to 2.35%. Operating metrics throughout 2020 remained stable, with rent dropping only.73% from $1,362 per month in the first quarter to $1,352 per month in the fourth quarter. Vacancy increased in that same time period only 20 basis points to 6.9%. This was possible because the CARES Act passed in March provided direct stimulus payments and enhanced unemployment benefits to tenants and the GSEs Fannie Mae and Freddie Mac, the major lenders for multifamily mortgages, moved swiftly to establish forbearance programs for the payment of mortgage loans for borrowers and moratoria on rent payments for tenants. As the pandemic dragged on, additional stimulus bills distributed more funds to tenants, the enhanced unemployment benefits got extended, and both the forbearance programs and the moratoria were extended several times to keep the sector stable.

Going into 2021, there is little risk of a significant increase in distressed multifamily assets going to sale. The stability of the sector in 2020 should strengthen this year with the rollout of the COVID vaccines and the economy’s continued opening. And given the high priority that the government puts on housing, it is much more likely that the GSEs, lenders, and servicers will pursue workouts, modifications, and forbearance over a distressed sale.

Office

Despite deteriorating performance metrics, the office sector managed to keep delinquencies low throughout 2020. The sector went into 2020 carrying a 2.66% delinquency rate and ended the year at 2.71%. In January, that number dropped to 2.52%. Longer-term leases with staggered expirations helped owners cover debt service payments to keep their loans current. 2020 sales volume dropped 20.7% when compared to 2019. A sharp increase in negative absorption coupled with a dramatic slowdown in leasing activity drove vacancies up while per square foot market rent fell. The year ended with office vacancy at 15.5%. Interestingly, lease renewals accounted for 70% of office leasing activity last year, with occupiers negotiating for shorter lease terms and smaller footprints.

The office sector goes into 2021 facing many uncertainties. The pandemic demonstrated to occupiers that a “return to business as usual” may not be the best strategy. What was initially thought to be a necessary temporary move, employees working remotely from home (WFH), became an overwhelming success. In a recent survey performed by PwC2, 83% of employers responded that remote work has been a success for their companies. Less than 20% of company executives expressed their desire to return to the office as it was pre-pandemic. With 64% of companies planning on keeping remote work policies in place after the pandemic, according to a survey conducted by S & P Global Market Intelligence, it is safe to assume that WFH will continue to be a major factor depressing office demand for 2021 and beyond.

The success of WFH and the demands of employees for more flexible work options have occupiers re-evaluating their office needs. In that PwC Remote Work Survey mentioned above, 87% of the respondents reported that they expect to make changes to their real estate strategies over the next 12 months, including consolidating office space and opening smaller satellite locations. A recent Green Street analysis suggests that WFH and the COVID social distancing mandates resulting in less square feet per employee will decrease office demand by 15% moving forward.

The path forward of the office sector is unclear. While occupiers are downsizing and demanding shorter terms, more flexible leases, they are also demanding expensive building upgrades such as touchless door and elevator controls, ventilation and air filtration systems, and lobby redesigns to accommodate social distancing. The current employment slowdown in office-dominant industries such as advertising, media, and information services has further decreased office space demand. But recent distressed office sales have only resulted in losses to lenders as Moody reports that while 78.91% of the 121+ days delinquent office loans that were removed from special servicing since November were either modified or placed in forbearance, the remaining 21.09% were all liquidated with losses. Given that performance, it seems the better course of action is to work with borrowers to modify loans and wait to see how the sector adjusts to the post-COVID market demands.

Retail

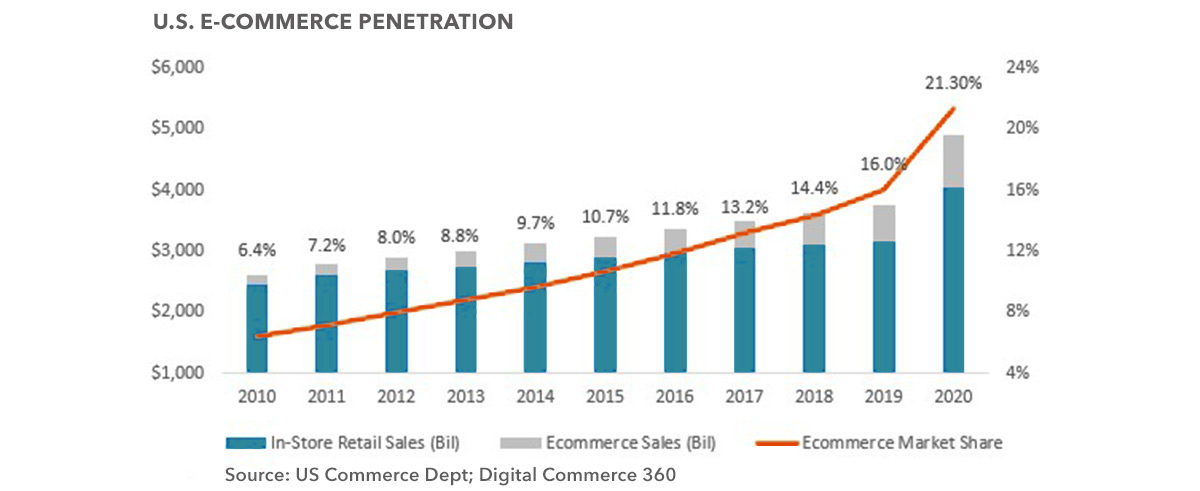

The retail sector was already in a weakened position going into 2020. Shoppers were moving to e-commerce in greater numbers every year, and serious competition from mega-stores such as Target and Walmart cut into sales and profit margins for the traditional brick-and-mortar retailers. 2019 saw 9,500 retail store closures, many being established brands. At 5.19%, the sector already had the highest special servicing rate of the five major property types at the end of 2019. The pandemic mandated closures of “non-essential” retail stores and shopping centers for what turned out to be extended periods of time only accelerated the sector’s decline. E-commerce captured another 5.3% of the retail market share, ending 2020 at 21.3%.

By June, retail delinquencies topped out at 18.07%. As the lockdowns across the country eased and retail malls and stores were allowed to reopen, albeit at limited capacities, retail loans in special servicing steadily declined to end 2020 at 12.94%. Retail real estate sales volume in 2020 fell by more than 30% year-over-year, totaling $205.6 billion. Because market fundamentals for the sector such as rent growth, rent collections, net absorption, and vacancy all worsened in 2020, servicers likely recognize that liquidation of these properties at this time would be difficult and result in large realized losses, so they are opting for various types of workout agreements. A recent report from Moody’s Analytics confirms this assumption reporting that of the delinquent retail loans that were 121 or more days delinquent removed from special servicing since November, 96.37% were either modified, placed into forbearance, or were cured, while only 1.56% were moved into foreclosure. Unless the widespread distribution of the vaccine allows the economy to fully open by mid-year, retail vacancies will probably continue to increase while rents continue to decline, making distressed liquidation sales more likely in the last half of 2021 and into 2022.

Hotel/Lodging

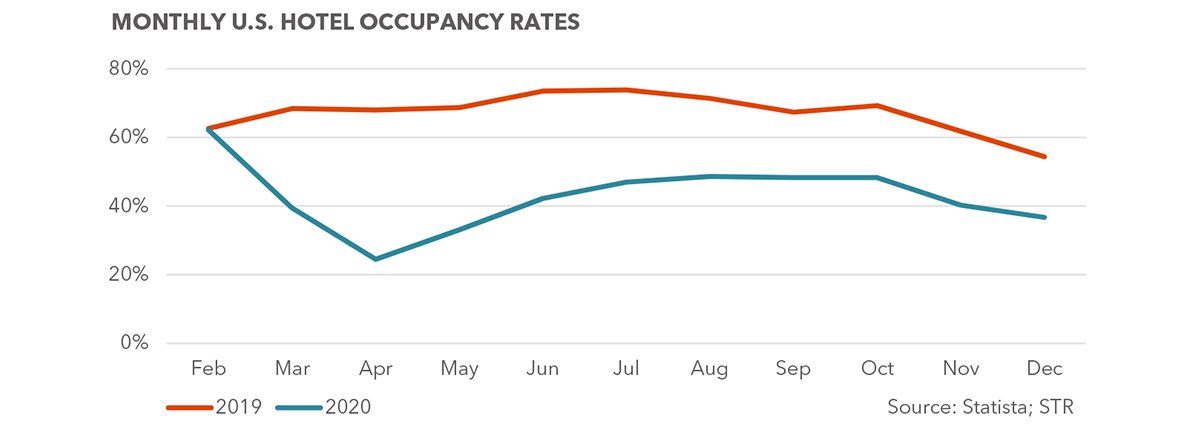

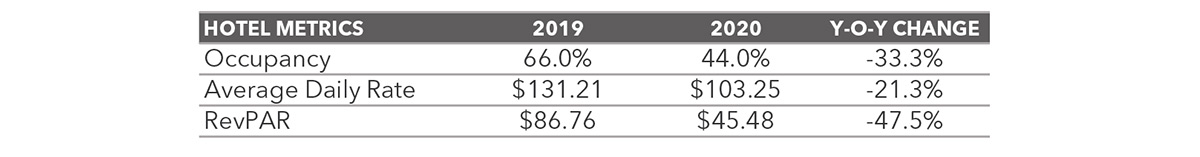

After turning in a record year in 2019, the pandemic lockdowns alone caused an unprecedented decline in hotel operations in 2020. The total cessation of international, business, and vacation travel early in the year made 2020 the worst year on record for the hotel industry. In December 2019, the hotel sector had a special servicing rate of only 2.08%, the second-lowest only to the industrial sector. Immediately after the World Health Organization declared the COVID-19 outbreak a global pandemic in March, monthly hotel occupancy rates dropped 42.4% year-over-year and then 64% year-over-year in April. Revenue per available room (RevPAR) fell 80% year-over-year in April.

The all-time performance lows set in 2020 produced another grim industry milestone-more than one billion unsold room nights, surpassing the previous high-water mark of 786 million unsold room nights during the Great Recession in 2009.

It should be no wonder why hotel delinquencies jumped over 600% from April to May, going from 2.71% to 19.13%. In special servicing, hotel mortgages hit 24.3% in June, before beginning a gradual decline to end the year at 19.8%.

Given the solid performance of this sector pre-pandemic, the anemic 2020 hotel sales numbers (down 40% from 2019 at $95.4 billion), and the widespread distribution of the COVID vaccine currently underway, it seems reasonable that servicers of hotel debt may believe that the light is appearing at the end of the tunnel and the more prudent course of action at this time is to modify loans, monitor the market and, if necessary, move to liquidation later when the market is stronger. Data from Moody’s Analytics seems to support this conclusion as 92.36% of the 121+ days delinquent hotel/lodging loans that were removed from special servicing since November were either modified, placed in forbearance, or cured, while only 1.03% were moved into foreclosure.

Conclusion

Commercial real estate performed better through the pandemic than expected. The precipitous drop in sales volume was as much due to the obstacles to completing transactions stemming from the lockdown as it was the effects of the recession. And when 2020 ended, overall pricing was up year-over-year, and delinquency rates for all five asset classes were down. It looked like the market was heading in the right direction despite the struggling retail and hotel/lodging sectors.

To be sure, extreme stress remains in the retail and lodging sectors, and uncertainty about what office use will look like post-COVID will keep office demand soft. But the rollout of the COVID-19 vaccines, the continued opening of the economy, the projected 2021GDP growth of 4.2%3, and expected employment growth all bode well for a CRE recovery in 2021. So, investors that are keeping their powder dry planning to scoop up deals on distressed asset sales in 2021 may be disappointed.

Provided By

GARY BARAGONA

Director of Research

415.229.8925

gary.baragona@kidder.com

Written by John Fioramonti

Senior Market Analyst

Kidder Mathews Research

Sources

1 For all product types. Real Capital Analytics

2 PwC Remote Work Survey, January 12, 2021

3 December 16, 2020 meeting of the Federal open Market Committee