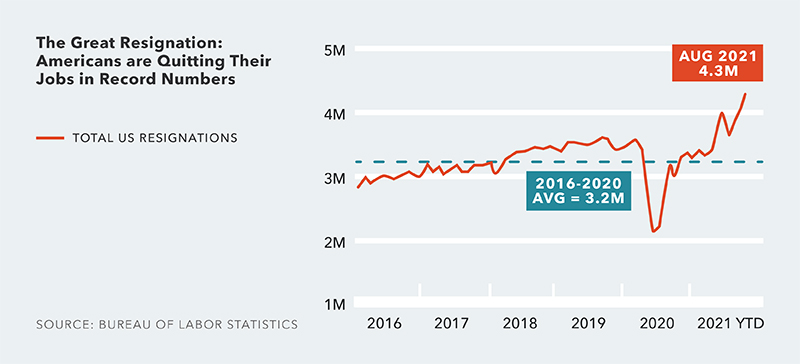

The Great Resignation and Its Impact on the Future of Commercial Real Estate

A pandemic-induced surge in quit rates led to a record-breaking 4.3 million Americans leaving their jobs in August 2021, roughly 3% of the US workforce and the fifth straight month of nearly 4 million resignations. This trend is impacting nearly every industry and every state. Experts say that people are quitting their jobs in search of better employment conditions, critical support in their daily lives, remote opportunities, and higher pay. The recent exodus is also creating numerous hiring challenges, leaving millions of jobs unfilled. ZipRecruiter estimates that there are approximately 50% more job openings now than before the pandemic. In response to this workforce realignment, many companies are revamping employee incentive packages and finding a healthy balance between in-office, remote, and hybrid work models. While the long-term impacts remain uncertain, the movement dubbed as “The Great Resignation” should be closely monitored going forward.

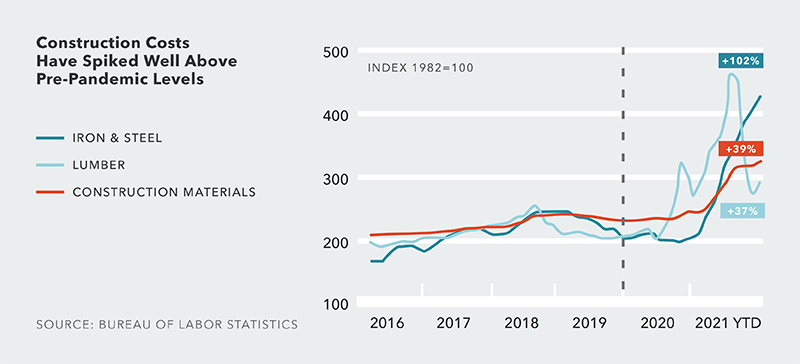

Rising Construction Costs Causing Development Challenges

Although development activity is approaching record levels and robust across most real estate sectors, a recent shortage in construction materials coupled with significant supply chain disruptions have contributed to an alarming rise in construction costs. The recent increases are producing many challenges for developers — causing excessive lead times, prompting project delays, and sometimes halting projects altogether. Additionally, a shortage of skilled labor has been a constant struggle for the construction industry, creating significant challenges. Overall, construction material pricing is well above pre-pandemic levels, up 39% compared to December 2019. Key building materials have increased, including steel (+102%), lumber (+37%), and copper (+43%). Even though construction pricing is projected to further escalate in the near-term, long-term expectations are that pricing will diminish as the economic landscape improves, supply chain bottlenecks ease, and material shortages normalize.

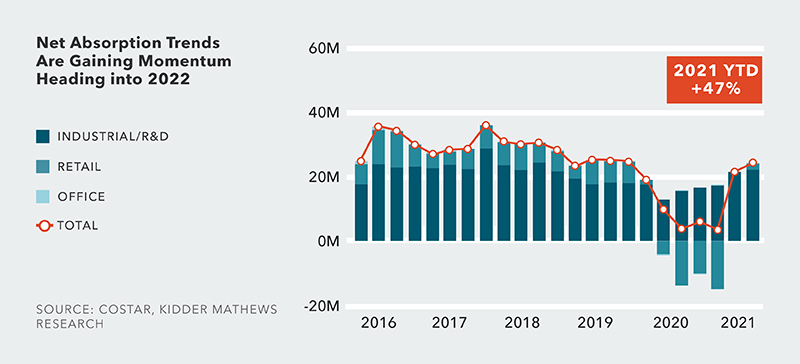

Economic Recovery Forecasts Point to a Potentially Strong Year in 2022

Many are optimistic that the momentum gained during the past couple quarters will continue into next year. Positive economic forecasts and pent-up demand is expected to fuel continued growth during the next 12-18 months. Year-to-date net absorption has already started to swing back towards pre-pandemic levels, collectively growing 47% in 2021 compared to 2020. Technology is driving office growth in addition to regional drivers from life science, media/entertainment, and healthcare. While many companies are still determining what their future footprint will look like, much of the workforce is scheduled to return in some capacity in early 2022, prompting a slow and steady wave of new activity, especially in and around downtown cores. While office leasing is expected to have a longer runway, the industrial market is projected to benefit from its already strong fundamentals, rising rents, and persistent demand, despite the recent supply chain challenges and a supply-demand imbalance in many markets.

Regional Market Highlights

SEATTLE

The Urban Land Institute recently tagged Seattle as a top 10 growth market in 2022. The only other West Coast market on the list was Phoenix. The ranking was based on survey responses from real estate experts across the country. The report cites Seattle’s growing population, regional diversity, talent base, active development, and world-class companies — many of which are continuing to increase their real estate footprint. Amazon is a perfect example of this — not only growing across many Puget Sound markets, but also investing and expanding across the US with no signs of slowing down. Two key situations to monitor going forward, especially in the office, retail, and hospitality sectors, will be impacts from evolving remote work trends and the recent worker exodus.

PORTLAND

While Portland struggled to recover early after the pandemic, the regional economy is gaining momentum. Office tenants are beginning to adjust to the new normal with increased remote and hybrid work models. The investment market is out of equilibrium, with more interested buyers than active sellers.

BAY AREA

The office/tech thaw continues. Not just FAANG, but mid-size companies are beginning to make plans for 2022. Given the current economic uncertainty, many are still looking at short-term leases. However, some are also thinking longer term and looking to take advantage of suppressed market conditions before it strengthens. Office sublease space is still elevated, especially in San Francisco, but decreasing as deals are getting done, and tenants are taking back space previously placed on the market. The life science, industrial, and multifamily markets remain incredibly strong, while the retail market continues to gain momentum heading toward the end of the year.

SACRAMENTO

Apartment pricing and cap rates have returned to pre-COVID levels. Rents are strong in that sector with few, if any, concessions offered. Pricing has come down on existing office buildings with vacancy over the last 6-12 months. This looks to be a trend that could continue throughout 2022. Industrial land and investment properties continue to increase in price due to low vacancy and a lack of available buildings and land throughout the region.

RENO

The Reno industrial market continues to thrive, with strong demand and tremendous rent growth (28% YOY). However, it is starting to experience a significant imbalance between supply and demand, with a sub 3% vacancy rate. Existing supply chain issues with construction materials are delaying new projects to late 2022 or early 2023. The office market has performed better than most other markets on the West Coast, with low vacancy and a dwindling supply of available space.

SOUTHERN CALIFORNIA

Tenants and landlords alike are experimenting with hybrid/flex offices to help aid in luring employees to return to the office. The gaming sector is creating strong demand for commercial real estate across asset classes, especially in Los Angeles and Orange County. Multifamily and industrial are still the strongest performing asset classes in Southern CA, although industrial markets are becoming so tight that even land for development is becoming a rare commodity. There is also an ongoing debate on the real cause of the supply chain disruption. Buyers of existing shopping centers are assessing how to incorporate housing into the project by rezoning or allowing municipalities to rezone commercial sites to mixed-use. In certain markets, sites are more valuable as an apartment project, townhome development, or mixed-use as opposed to “only retail.” Short-term anchor tenant leases are now desirable as it acts as a covered land play until zoning is finalized.

SAN DIEGO

Life science continues to surge as overall demand and record funding remains strong, but supply chain delays in building materials and recent chip shortages may stifle near-term growth. Industrial is growing at a record pace, especially in Otay Mesa. Tech and life science are driving the office market to recover at a modest pace, illustrated with Amazon adding 200-300 new jobs at its tech hub in University City.

PHOENIX

The Phoenix market has been on fire recently as all sectors of CRE continue to thrive. Industrial demand is at an all-time high from e-commerce, logistics, and service-based companies. Multifamily investments are also thriving, largely due to robust population growth and a recent lack of single-family inventory. Land values continue to rise, and the supply of buildable land is starting to dwindle, causing additional growth to occur outside of the immediate metro area.

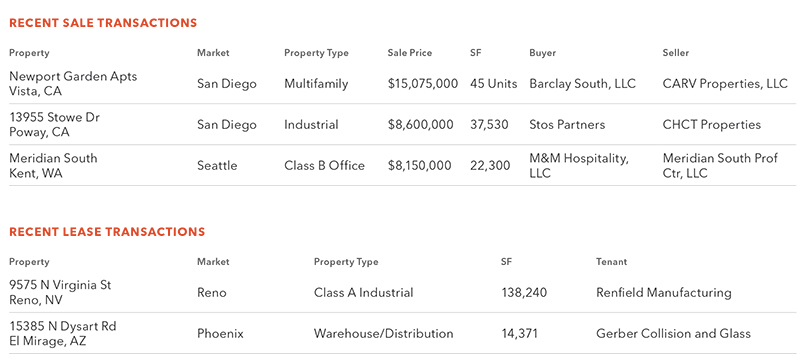

Notable Kidder Mathews Transactions

Contact

The information in this report was composed by the Kidder Mathews Research Group.

GARY BARAGONA

Director of Research

415.229.8925

gary.baragona@kidder.com