Office Market Recovery Is Continuing to See Solid Progress

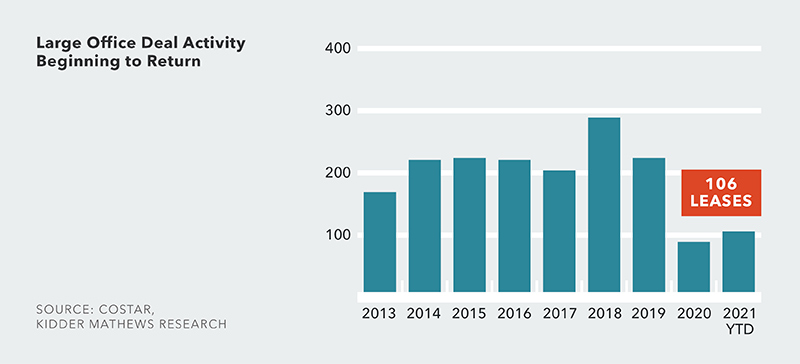

Emerging office market fundamentals suggest that a sustained recovery period could be just around the corner. Illustrating the recent shift, total leasing activity on the West Coast increased by 42% during the past two quarters (averaging 22.2 MSF of activity per quarter), compared to the low levels immediately following the start of the pandemic in early 2020 (averaging only 15.7 MSF of activity per quarter). Despite the growth, total volume is still considerably lower than the pre-pandemic peak in late 2017 and early 2018 when leasing activity averaged more than 34.6 MSF per quarter. Another positive sign is the recent increase of large deal activity, primarily driven by the tech sector. Since the beginning of the year, 106 new office leases over 50,000 SF have already been signed in West Coast markets, compared to only 89 during the entirety of 2020.

Life Science Sector is Experiencing Unprecedented Growth

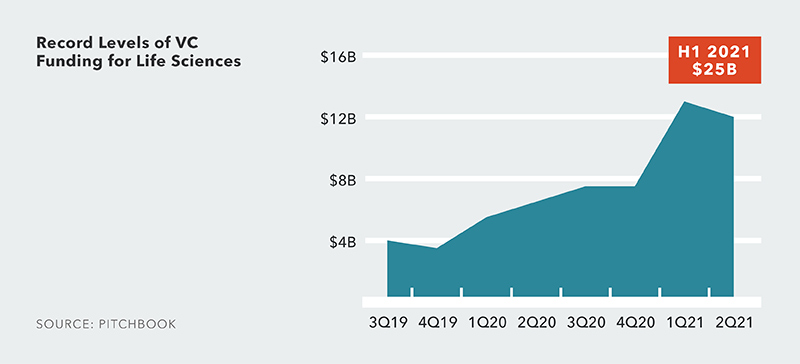

The life science sector continues to expand at a record pace, with quicker and more consequential product development leading to substantial real estate development. Considerable increases in both funding and employment are also helping drive an increase in demand for lab space, leading to an expanding development pipeline and increased conversion opportunities. In some ways, the pandemic helped transform the industry by creating opportunities for institutions and investors to drive healthcare through innovation. One key driver on the West Coast has been a combination of leading research institutions that are turning out world-class scientific discovery and the access to capital. Illustrating the strength of the market, current sector availability is below 3% across most West Coast markets and approaching 0% in many submarkets. Additionally, life science footprints are expanding, rents are climbing and the cost of building new life science facilities has doubled over the past five years.

Development Activity is Fast Approaching Record Levels

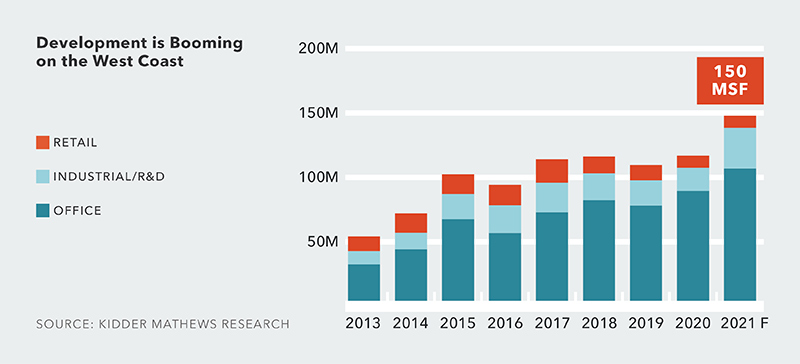

With an estimated 150 MSF of new deliveries across all product types by year-end, 2021 is on pace to become the most productive year since the construction boom in the mid-2000’s when deliveries averaged 185 MSF per year between 2006 to 2008. Southern California leads the way with 39 MSF of total product followed by Phoenix with 28 MSF, the Bay Area with 20 MSF and Seattle/Puget Sound with 14 MSF. The industrial market continues to be the strongest segment of commercial real estate. Of the annual total of scheduled deliveries by year-end 2021, 71% is from the industrial sector, the fourth straight year representing more than 70% of the total and the highest ever annual total with more than 100 MSF. The industrial sector is also showing no signs of slowing down with an additional 75 MSF of projects under construction scheduled for completion between 2022 and 2024.

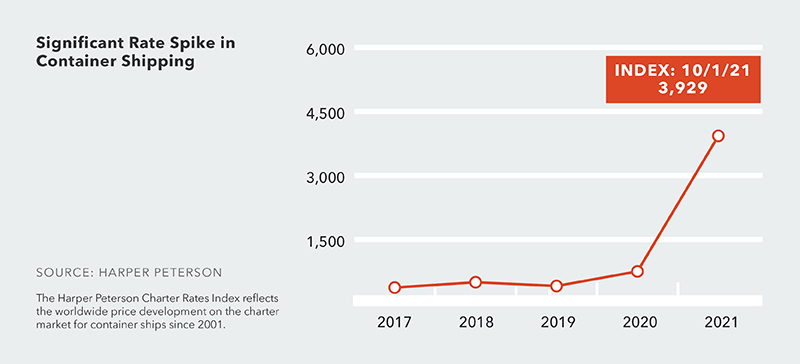

Congestion at the Ports is Disrupting the Supply Chain

While the numbers vary day to day, there are currently more than 70 container ships stuck outside the Ports of Los Angeles and Long Beach. Combined, these two California facilities account for about 40% of containers entering the U.S. The ships are carrying clothing, furniture and electronics worth billions of dollars and the backup is causing substantial delays in the supply chain as retailers are desperate to restock their depleted shelves before the holidays. As a result, some of the nation’s largest retailers began chartering private cargo ships to combat the delays. Additionally, the average shipping price per container from Asia to the U.S. has increased substantially during the past year. This recent spike in shipping costs is expected to be passed through to consumers in the form of higher prices and an extended period of high inflation rates. In an effort to ease these supply chain bottlenecks; President Biden recently announced the approval to allow key West Coast ports to stay open 24/7.

Regional Market Highlights

SEATTLE

Developers are still developing! Major sites are either under contract or have been purchased specifically in Snohomish County and Pierce County. There are sizable projects moving north and south, all industrial. Bellevue is still growing faster than any other city in the Northwest, mainly driven by Amazon, resulting in more multifamily projects being built. Retail space is also moving quickly in Bellevue, especially food services. Retail activity is slower in Portland and Seattle but gaining momentum in both of those cities. Companies continue to struggle with hiring and finding strong talent.

PORTLAND

While the downtown office market continues to struggle, there are positive indicators in suburban office markets including solid leasing activity and low vacancy rates. Industrial land remains competitive with demand expected to outpace supply in the near term. Developers are actively pursuing opportunities in second tier markets outside of Portland’s core markets.

BAY AREA

Investor activity is firing on all cylinders in the Bay Area. The pandemic and economic slowdown does not seem to have impacted institutional investor appetites as pricing for core quality assets continues to tighten. However, sub institutional buyers are becoming frustrated by the current lack of supply and options to purchase. Multi-tenant office is on the verge of coming out of the post-pandemic slump, but the waters are still choppy as many owners are looking at 2022 as the year for a rebound. Demand for life science space continues to outpace supply, leading to low vacancy, a growing development pipeline and increased conversion opportunities.

SOUTHERN CALIFORNIA

There is a tremendous amount of capital on the sidelines to acquire CRE. Multifamily and industrial sales are strong with cap rates in the low 3% range for some assets. The industrial market is as strong as ever with sub 2% vacancy across most submarkets in LA, OC and IE. Demand continues to be robust, although the container ship back-up at the ports is disrupting the supply chain. Office users are beginning to trickle back to work, with full return dates being pushed to “maybe next month or the holidays.” Retail is still struggling to find staff from line chefs to waiters and while hospitality picked up over the summer months, they are also struggling to find employees.

SAN DIEGO

San Diego is experiencing record levels of industrial absorption and leasing activity. Overall, cap rates are continuing to fall, currently reaching the low mid-3% range. Life Science demand is incredibly strong, and conversions are abundant – changing the overall landscape of the region and key submarkets.

PHOENIX

Investor and developer activity has been gaining momentum in Phoenix, contributing to a notable increase of sales activity during the past few months. The office market is showing signs of growth, while the industrial market is on pace for a record year as net absorption, rental rates and sales volume are all at historic highs and vacancies tightened to an all-time low.

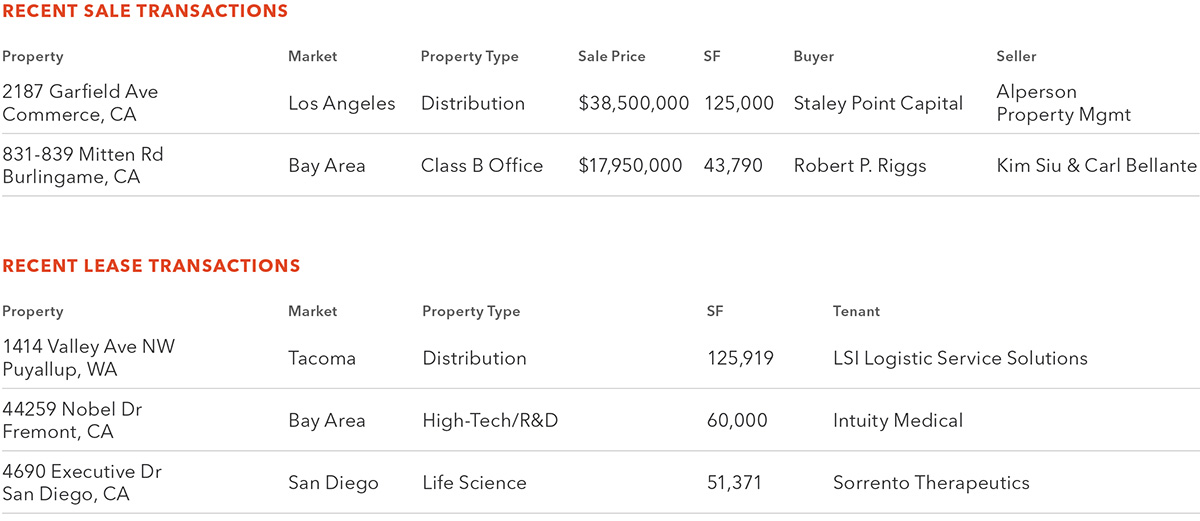

Notable Kidder Mathews Transactions

Contact

The information in this report was composed by the Kidder Mathews Research Group.

GARY BARAGONA

Director of Research

415.229.8925

gary.baragona@kidder.com