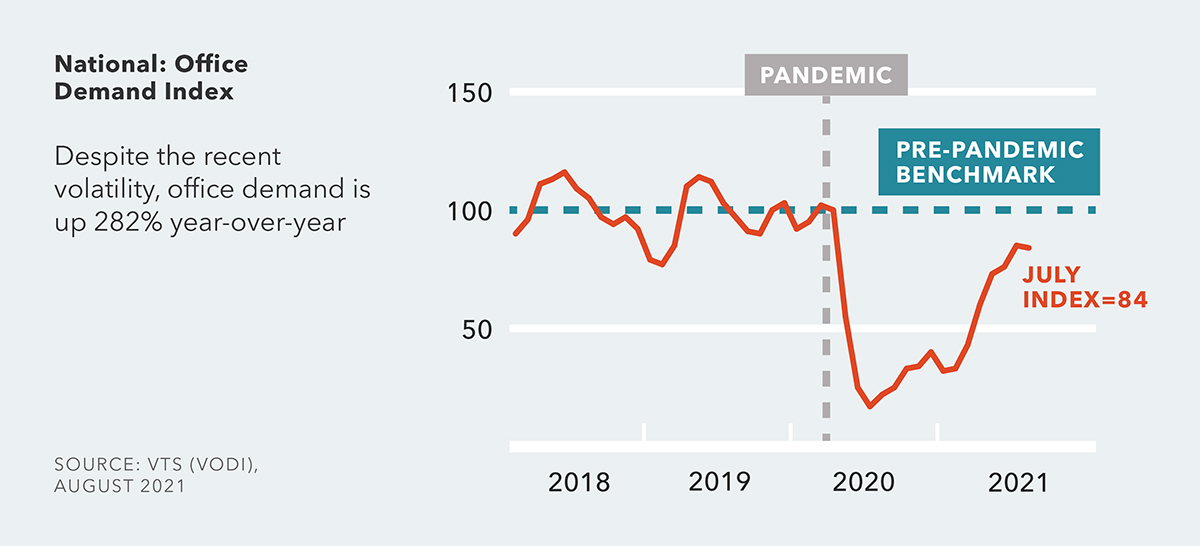

Technology, Life Science, and Healthcare Industries Driving Office Market Growth

Traditional office tenants are currently evaluating how much space they will need in the future as work from home and flexible work options continue to impact their overall footprint. This trend is expected to remain during the near term as firms continue to implement various return-to-work policies. Most tenants are still paying rent even though the workplace utilization rate for many office buildings remains low at an estimated 20% to 25% as employees continue to take advantage of more flexible work arrangements. While there has been a temporary and brief slowdown in market tours recently due to the delta variant, there has also been a noticeable increase in overall office demand compared to last year with the largest movers coming from technology firms, life science companies, and healthcare institutions.

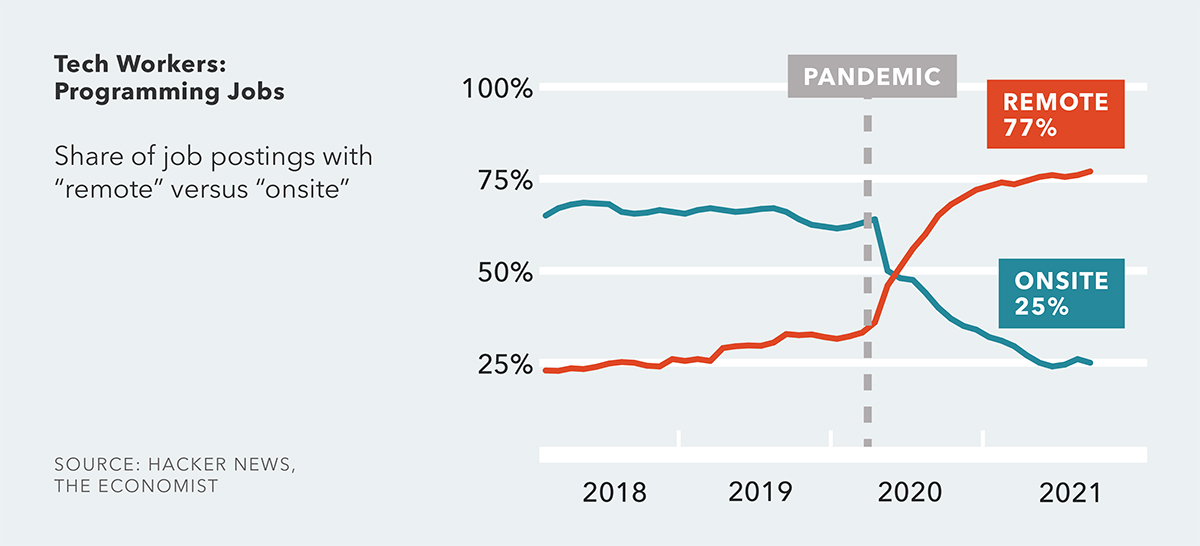

Firms Searching for the Optimal Balance Between On-Site, Remote, and Hybrid Work

According to a recent article by The Economist, approximately 75% of programming jobs posted in 2021 included the term “remote work” compared to only 13% in 2011. The referenced study also illustrated how the pandemic only accelerated a shift that already started in 2018/2019. It’s not just tech jobs either as a handful of recent articles describe remote work as becoming “the hottest city in America for jobs.” The recent shift to remote work has also prompted some firms to offer lower wages for remote positions to account for the lower cost of working from home. Google recently rolled out a cost of living pay calculator explaining work-from-home salary cuts. However, a high number of companies are still pushing for a full return to the office according to a recent study by Robert Half, but the emerging delta variant of Covid-19 and a weaker-than-anticipated vaccination rate are delaying plans for many firms.

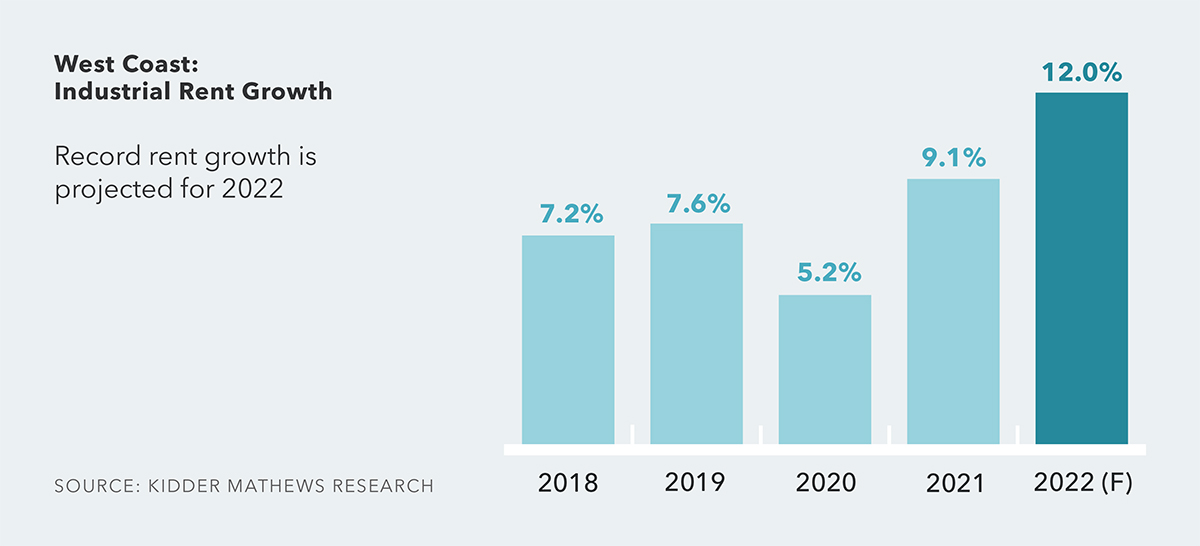

Industrial Demand and Rent Growth Continue to Increase at a Record Pace

Driven by e-commerce demand and recent economic growth, the industrial sector is still incredibly strong across West Coast markets with high levels of tenant activity, very low vacancy rates and extremely strong rent growth. In fact, many institutional owners are projecting 12% rent increases across their industrial portfolio over the next 12 months. Additionally, development activity continues to expand while industrial land prices are at a premium, especially in well-located distribution corridors and transportation hubs.

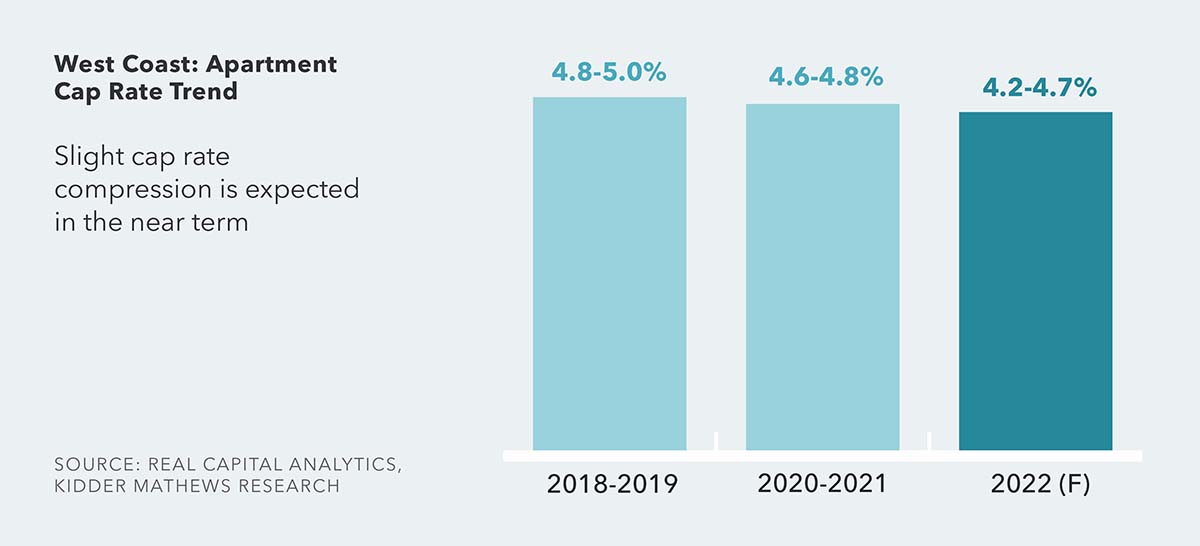

Apartment Market Fundamentals Continue to Strengthen Across the Country

Apartment investment has quickly become one of the safest bets in commercial real estate. Most West Coast markets are experiencing strong overall transaction volume with extremely aggressive pricing on both a price per unit and price per square foot basis, and with cap rates. A recent forecast by the Mortgage Bankers Association project a 31% year-over-year increase in total U.S. apartment loan volume by the end of 2021. Many institutional investors that don’t typically focus on apartment assets are beginning to invest and being very aggressive at the opportunity to expand their portfolios. Additionally, recent rent growth has pushed rent levels beyond pre-pandemic levels in

most markets.

Regional Market Highlights

SEATTLE

Industrial leasing activity has slowed “a bit” but remains strong overall and is expected to stay that way. Downtown Bellevue office is hot with increasing market activity and rising rents, while Downtown Seattle continues to struggle in its recovery from the impact of Covid-19. Retail leases and sales are beginning to pick up all over the region while multifamily continues to be red hot in Seattle.

PORTLAND

While the downtown office market is still struggling to recover from Covid-19, the suburban office, industrial and apartment markets are all showing positive signs of renewed growth heading into 2022.

BAY AREA

Covid-19 impact on property values has been inconsistent. In general, value for Class A institutional quality real estate has held up well as FAANG and other large well capitalized companies continue to make strategic real estate decisions, while Class B&C and non-institutional are showing signs of stress. We are seeing a continued acceleration of more municipalities and planning departments proactively looking at how they can satisfy California State mandated housing goals.

SOUTHERN CALIFORNIA

The industrial market is very tight with strong demand driving up building and land prices to levels that would have been unheard of just two years ago. It has become a good time for contrarian buyers as investors are putting more money into safe harbors of industrial and multifamily (good luck finding product though), but limited product is available and bid up quickly. It is currently a seller’s market in all product types and

a tenant’s market for all product types

except industrial.

SAN DIEGO

The regional Life Science market is experiencing overwhelming demand, no existing space is available for lease in established markets, pushing developers to expand into downtown and up to Carlsbad. San Diego home prices have appreciated dramatically in recent months, pushing up apartment demand and asking rents.

PHOENIX

Phoenix apartment rents are up and continuing to rise, while cap rates are down causing property values to skyrocket! Healthcare and medical office real estate has been surging in Phoenix, largely influenced by regional demographics and population growth dynamics. The industrial market is also on fire in Phoenix, especially in the

West Valley.

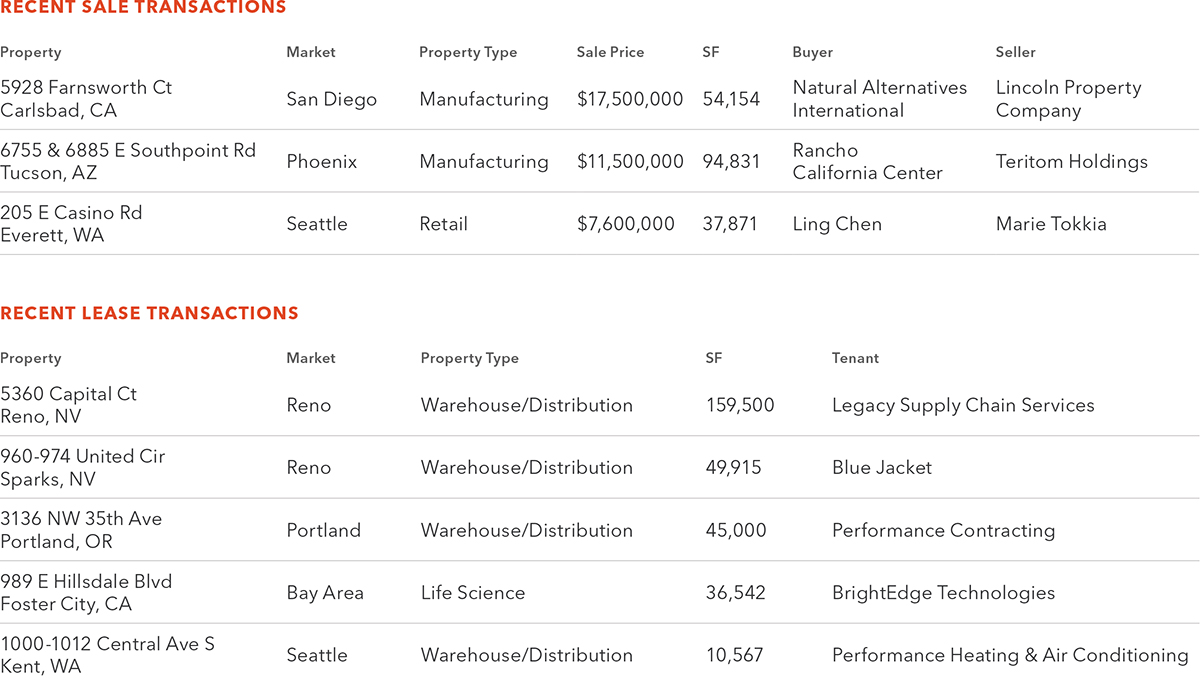

Notable Kidder Mathews Transactions

Contact

The information in this report was composed by the Kidder Mathews Research Group.

GARY BARAGONA

Director of Research

415.229.8925

gary.baragona@kidder.com