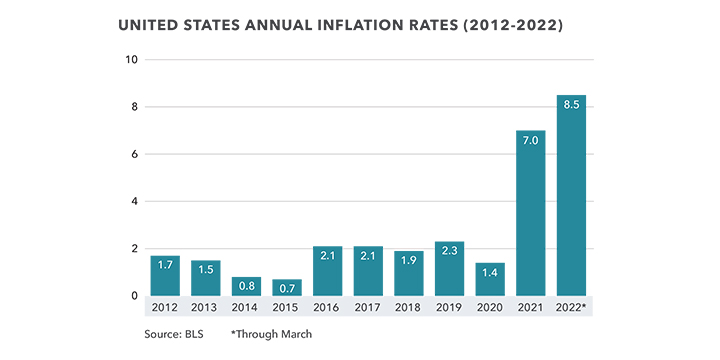

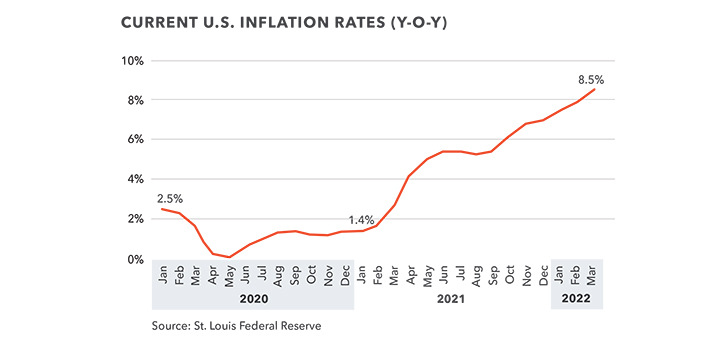

Coming out of a difficult 2020, the commercial real estate market lit up 2021 with record sales of $809 billion, including more than $300 billion in sales across all property types during the fourth quarter alone, according to research from Real Capital Analytics. Interestingly, this flurry of sales activity took place during a 12-month period when rapidly accelerating inflation multiplied over five times to 7%, the highest rate since 1982. There is no sign of slowing as sales volume in the first quarter of this year came in at $123 billion, 17.7% higher than the $104.5 billion transacted in 1Q 2021, despite inflation jumping another 146 basis points to 8.5% through the end of March.

Inflation

The solid performance of commercial real estate over the last five quarters of accelerating inflation demonstrates the resilience and stability of the industry. Historically, commercial real estate has been considered a strong inflation hedge and generally performs well in rising rate environments.1 More specifically, income-generating real property and multifamily have shown the ability to grow greater net income during inflationary periods than other asset types, such as stocks or bonds. In fact, one of the driving forces behind the strong 2021 investment activity was the money coming into commercial real estate from other investment sectors seeking a safe haven as the economy moved into an inflationary period.

There are many benefits that owners of commercial real estate enjoy during periods of high inflation. First, as inflation grows, property values appreciate to keep pace. Appreciation also increases as the result of decreased competition from development projects that are delayed or scrapped altogether due to rising entitlement, labor, materials, and other costs. Next, inflation accelerates rent growth. Properties with short rental terms such as hotels and self-storage can raise rental rates quickly (daily, weekly, or monthly) to match inflation growth. Many office and multi-tenant retail properties have inflation escalators built into lease agreements that adjust rental rates to inflation rates. As demand for multifamily continues to far outpace supply, landlords continue to raise rents, which increases revenue and property value. According to Rent.com, as of February, rents for a one-bedroom apartment had grown 24.4% and rents for a two-bedroom unit increased 21.8% year-over-year.2

The properties likely to perform the best in an inflationary environment generally have four characteristics: good location, strong fundamentals and functionality, sufficient cash flow, and modest capital needs.3 Property types that provide a service whose demand is either unaffected by the economy or is increased during inflationary periods will perform well. Examples of such properties include:

- Medical office space/single-tenant medical offices

- Multifamily

- Industrial

- Self-storage properties

Commercial real estate’s performance through past inflationary periods confirms its value as a hedge against inflation. And when compared to the long-term hold times normally associated with commercial real estate investment, the relatively temporary nature of inflation — usually a few years or less — should be looked at as a short-term risk factor at most.

Interest Rate Hikes

On March 16th, the U.S. Federal Reserve (the Fed) raised interest rates 0.25% for the first time since 2018 in response to accelerating inflation. The move was no surprise as the Fed had communicated its intent well in advance. As part of the Fed’s announced policy to tighten its monetary policy, it signaled another six rate hikes this year and up to four more next year.

History has shown that too much monetary tightening by the Fed in response to high inflation has, more often than not, ended in a recession. Overly aggressive tightening pushes the cost of capital up too fast, reducing access to capital and depressing borrowing and spending. This, in turn, slows demand and reduces revenue needed for capital expenditures. Economic growth slows or, worse yet, stalls leading to a domino effect of business reduction, layoffs and, ultimately, recession.

On the flip side, too little monetary tightening will fail to sufficiently curb the rate of inflationary growth driven by outsized demand. In that scenario, inflation would continue to suppress revenue growth to the point that it will be outpaced by expense growth, earnings would decline, and production would fall. Business activity would shrink, overburdened by inflation-driven expenses, layoffs would follow and, eventually, a recession.

So, what does this mean for commercial real estate? Initially, probably very little. The recent 0.25% rate increase is coming at a time when commercial real estate fundamentals and demand drivers are exceptionally strong, and investors, developers and brokers are overwhelmingly optimistic about the industry.4 As mentioned above, the Fed communicated the beginning of interest rate hikes well in advance, so industry stakeholders have been factoring them into their underwriting for the remainder of 2022 and into 2023. According to Trepp, financial markets are already pricing in rate increases of as much as 300 basis points over the next two years.5

As the Fed enacts more rate increases over the next two years, commercial real estate price growth will likely slow from the 12.4% price growth seen last year. Strong economic and employment growth coupled with low interest rates propelled the market last year. But market fundamentals remain solid, demand still outstrips supply in most commercial sectors, and the momentum built last year has commercial real estate investors flush with cash and planning on more real estate investment this year. Favored asset classes include industrial, multifamily, data centers, self-storage, and medical office buildings.6

At this point, the periodic rate increases of 0.25% contemplated by the Fed over the next two years should not have as big an impact on commercial real estate sales and investment activity as some might fear. Such modest rate increases over a two-year period will likely result in only moderate increases in financing costs that, to some extent, have already been “baked into” investment underwriting.

What must be closely watched is whether the Fed will decide to move more aggressively against inflation at the expense of the economy. A series of larger rate increases could slow economic growth too much, making recession a greater possibility.

The Ukraine War

Emerging from the pandemic, the nation went into a painfully high inflationary cycle where we saw the inflation rate skyrocket 6.5% — from 1.4% in January 2021, to 8.5% in March 2022 — the highest rate of inflation in nearly 40 years. Pent up demand, fiscal stimulus, supply chain issues, labor shortages, and monetary policy all contributed to the runaway inflation that, without the impact of the Ukraine war, would have probably taken a couple of years to bring into check.

Russia’s invasion of Ukraine on February 24 amplified the onus of inflation even further as rising oil and commodity prices caused by the war have contributed to increasing current inflation and the expectations that inflation will be a longer-term challenge. Just as pandemic-driven supply chain disruptions started to abate, the Ukraine war has sparked another global supply chain crisis as trade with Russia, Belarus, and Ukraine has come to a near halt due to sanctions and severely disrupted production and exports in Ukraine. These trade disruptions increase the already existing shortages of commodities, including oil, wheat, rye, nickel, and other metals, further driving up pricing.

The added upward pressure on global commodity prices and inflation coming from the Ukraine war has market experts cutting their forecasts for economic growth in the U.S. while increasing the risk of recession. Goldman Sachs economists, led by Jan Hatzius, recently cut their forecast for U.S. economic growth this year from 2.0% to 1.75% and, at the same time, increased their outlook for a U.S. recession to 20% to 35%.7 Persistent growing inflation over the past 15 months has driven the Index of Consumer Sentiment down over 25% from April 2021 to 65.7 this April, a warning sign for reduced consumer and business spending, the precursor for a recession.

It is still too early in the conflict to predict an outcome or the long-term ramifications of the war on the U.S. economy, but it seems certain that the risks of a recession grow the longer the conflict continues.

Outlook

On the whole, the commercial real estate sector is in a strong position to weather the current inflationary environment as well as a potential recession. Last year’s record-breaking performance created solid momentum and investor confidence that has, thus far, carried over into 2022. Market fundamentals remain favorable as demand for various types of commercial space such as industrial/logistics, apartment buildings, and self-storage continues to outpace supply. Still, prolonged economic and geopolitical uncertainty could drive capital and investors to the sidelines until a clearer picture emerges. Only time will tell.

Contact

GARY BARAGONA

Director of Research

415.229.8925

gary.baragona@kidder.com

Written by John Fioramonti

Senior Business Writer

Kidder Mathews Research

Sources

1 Forbes, How Rising Interest Rates and Inflation Impact Real Estate Investments

2 Rent.com, Research: Average Rent Price Report

3 Bisnow, There’s No Recession-Proof CRE, But Some Property Types Will Slog Through Better Than Others

4 2022 RCM Lightbox Investor Sentiment Report

5 Trepp, Interest Rates and Commercial Real Estate-What to Expect? March 2022, Interest Rates and Commercial Real Estate – What to Expect? Part 1

6 Realtybiznews.com, Commercial Property Sales Hit New Record in 2022

7 FOX Business News, Goldman says Ukraine-Russia war could trigger US economic recession

Stay in the know and subscribe to our monthly West Coast Market Trends report and our quarterly market research.