Today’s unprecedented disruption of the global supply chain has strained every facet of the economy. The root causes of this crisis go back nearly two years to when mitigation strategies were enacted worldwide to curb the impact of COVID-19. Today, the lingering effects of those strategies continue to suppress the production, transportation, and delivery of goods and services — causing the extreme supply-demand imbalance and inflation now occurring as the economy struggles to return to pre-pandemic levels. While resolving supply chain issues may take well into 2022 and possibly 2023, how will the U.S. industrial sector adapt and respond?

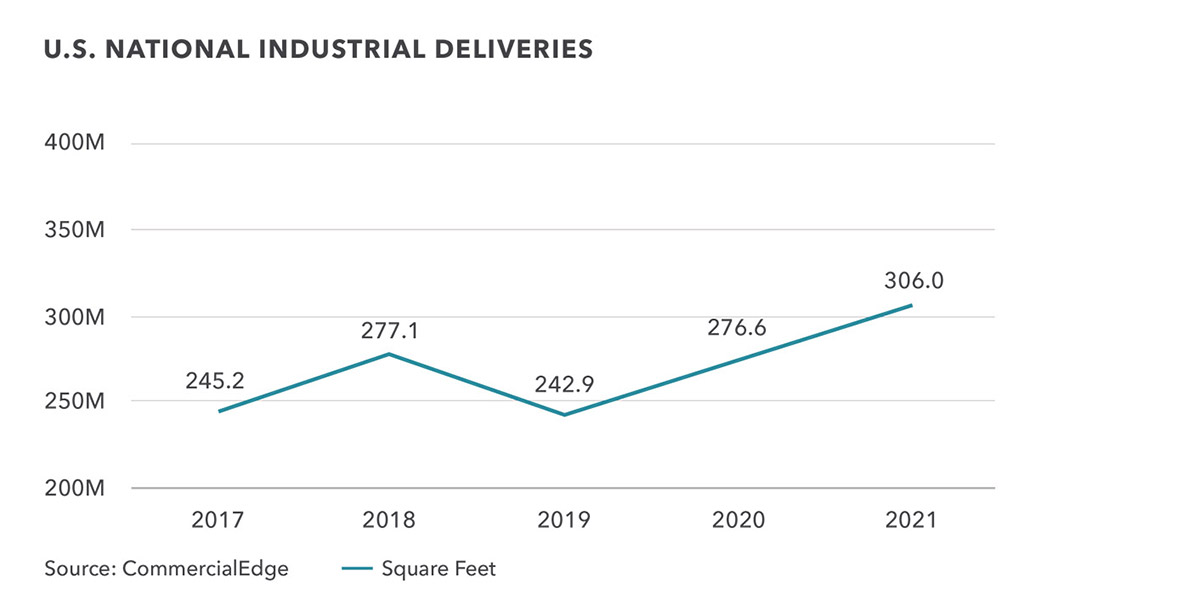

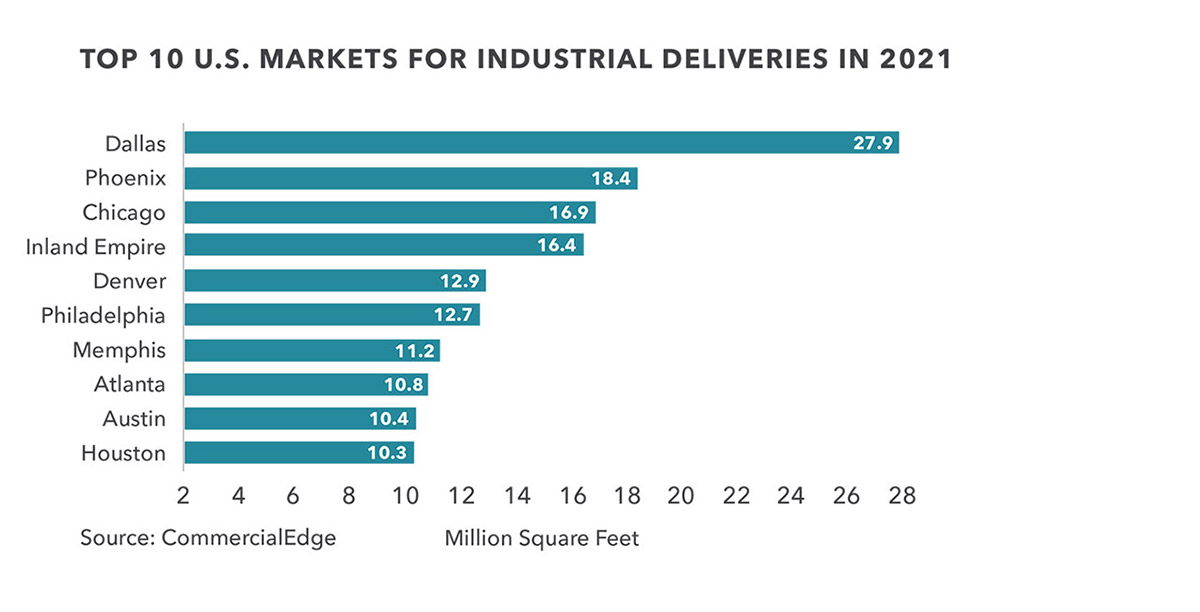

Expansion of the industrial footprint across the country took off last year before the supply chain crisis became acute, driven by the explosive growth of e-commerce accentuated by the COVID-19 pandemic. Consumers spent $791.70 billion online with U.S. merchants in 2020, up 32.4% year-over-year, according to U.S. Department of Commerce. That’s the highest annual U.S. e-commerce growth in at least two decades. It’s also more than double the 15.1% jump in 2019. The industrial sector was the direct beneficiary of that phenomenal growth in 2020, with vacancy dropping by the end of the year to near its historic low of 4.8% and rent growth coming in at a healthy 4.7% across all U.S. markets. In calendar year 2020, developers delivered 276.6 million square feet of industrial space in 454 new buildings, most of which was pre-leased. That rapid expansion continued into 2021 as exploding consumer demand drove an accelerated need for industrial space. By the end of 2021, the national average vacancy dropped another 60 basis points to 4.2% while rents increased 8.5% to $9.77/SF. Developers upped their game, delivering 306 million square feet. West Coast markets saw even more dramatic demand. By the end of last year, vacancy fell in the Inland Empire to 1%, in Los Angeles to 1.1%, and in Orange County to 1.3%. In response to such demand, rents jumped to $11.50/SF, $15.60/SF, and $14.70/SF, respectively.

Today, U.S. companies are reevaluating their inventory strategies. Shaken by the substantial shortages of available product and materials caused by unexpected levels of demand and the supply chain issues, companies are now moving to what Jim Connor, Duke Realty Chairman and CEO, calls the “safety stock” model: keeping 30 to 45 days of inventory in warehouses and readily accessible, compared to the previous strategy of keeping a 14-day inventory.1 This shift alone could push inventories up by more than 5 to 10% in U.S. warehouses, according to Prologis CFO Thomas Olinger, the world’s largest industrial real estate owner and developer.2

The global shipping gridlock has also prompted many companies to consider bringing manufacturing operations back to the U.S. to reduce reliance on overseas suppliers and establish greater local inventory control. Lessons learned during the pandemic exposed the dangers of being 100% reliant on overseas suppliers for such essentials as medical equipment and supplies. Moving manufacturing back to the U.S. will increase demand for the construction of more industrial, warehouse, manufacturing, and logistics space, as well as expansion of rail and air distribution hubs across the country. Connor estimates that the combination of e-commerce, employing the “safety stock” inventory model, and the move to return manufacturing to the U.S. could add 750 million to more than one billion square feet of demand for new industrial warehouse space over the next five years. That’s two to three times the normal demand for warehouse space in the U.S.

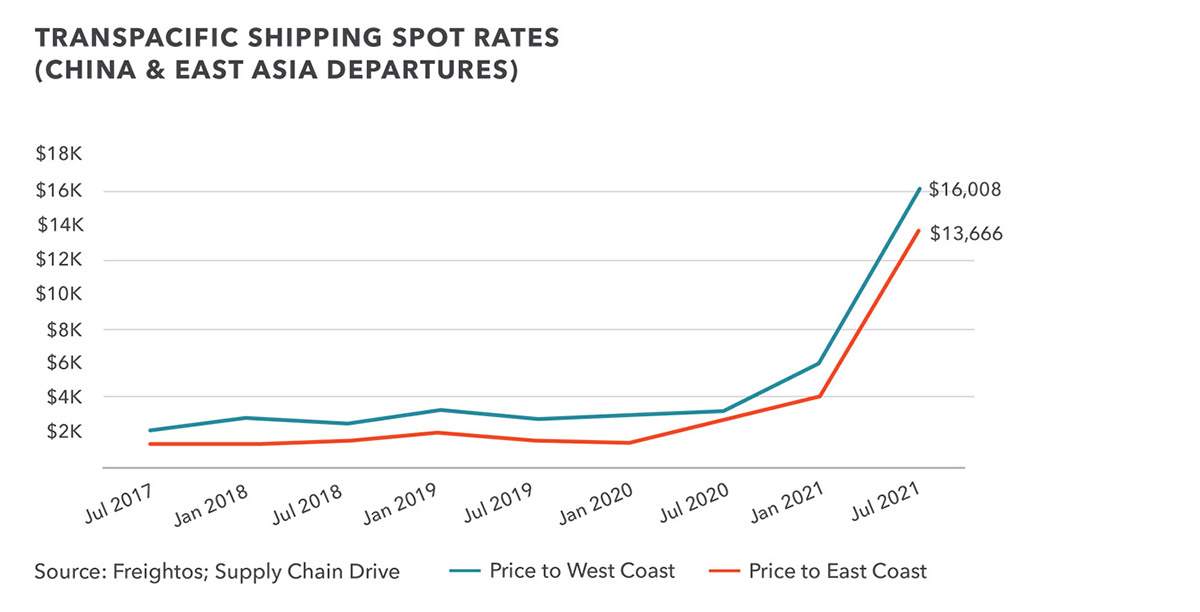

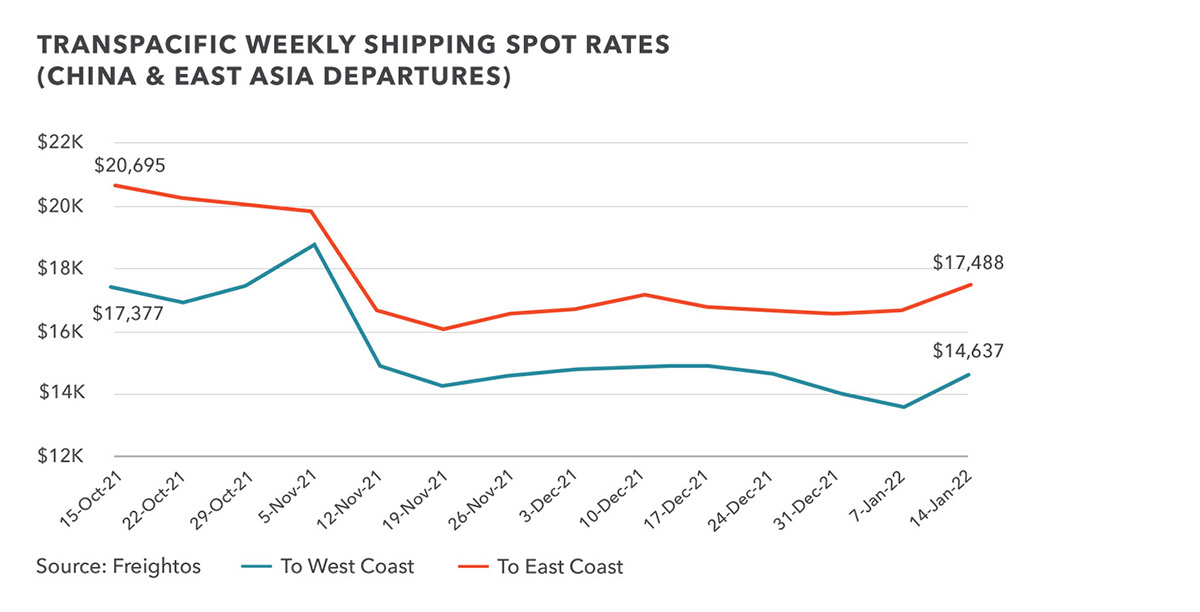

The skyrocketing cost of shipping is another incentive for U.S. companies to either change inventory strategies to longer-term structures like the “safety stock” model or reshore their manufacturing activities — or both. 2020’s pandemic-driven demand quickly outpaced the weakened supply chain, pushing shipping costs to never-before-seen heights. Between January 2020 and January 2021, transpacific shipping costs from China and East Asia to the West Coast jumped 170.9% while shipping to the East Coast increased 120.4%.3 Pricing worsened further once the economy began to reopen, and demand accelerated last year. Through July 31, shipping costs to the West Coast grew another 220.7% to $13,666 per container, and shipping to the East Coast rose another 167.6% to $16,008 per container. In early October there was a short-lived reduction in shipping rates, but according to Freightos, on November 5, the Asia-West-Coast spot rate was $18,730.

Following a fall in rates in November when peak shipping season ended, transpacific ocean rates have been more stable. Despite this stabilizing trend, rates remain extremely elevated at eight to nine times the pre-pandemic norm.4

Deploying the “safety stock” or similar inventory strategies, U.S. companies can order larger quantities of product at current shipping rates and stockpile that inventory for later disbursement. Reshoring manufacturing would completely eliminate their vulnerability to unpredictable swings in shipping costs.

Even when products arrive in port, challenges getting the product to the store shelves further strain the situation. A nationwide shortage of trucks, truck drivers, and other logistics workers combined with the rising cost of fuel creates further expense and delay. Middle- and last-mile distribution hubs are being created to reduce costs and have ready access to inventory. This is another demand driver for additional industrial real estate development.

The consensus is clear that despite record-setting performance in 2021, the production of more warehouse, manufacturing, and logistics space is needed to meet growing e-commerce demand and alleviate, in part, the supply chain bottleneck we are experiencing. As recently as January 11, there were 103 container ships waiting to dock at Southern California ports, according to the Marine Exchange of Southern California. Robust demand has driven industrial vacancy down to a historic low of 4.2% through November 2021 while asking rents have grown 8.5% on a year-ago basis. Developers are using all their resources to deliver as many square feet as possible. Through the end of the year, over 306 million square feet were delivered, and another 512.1 million square feet were under construction.

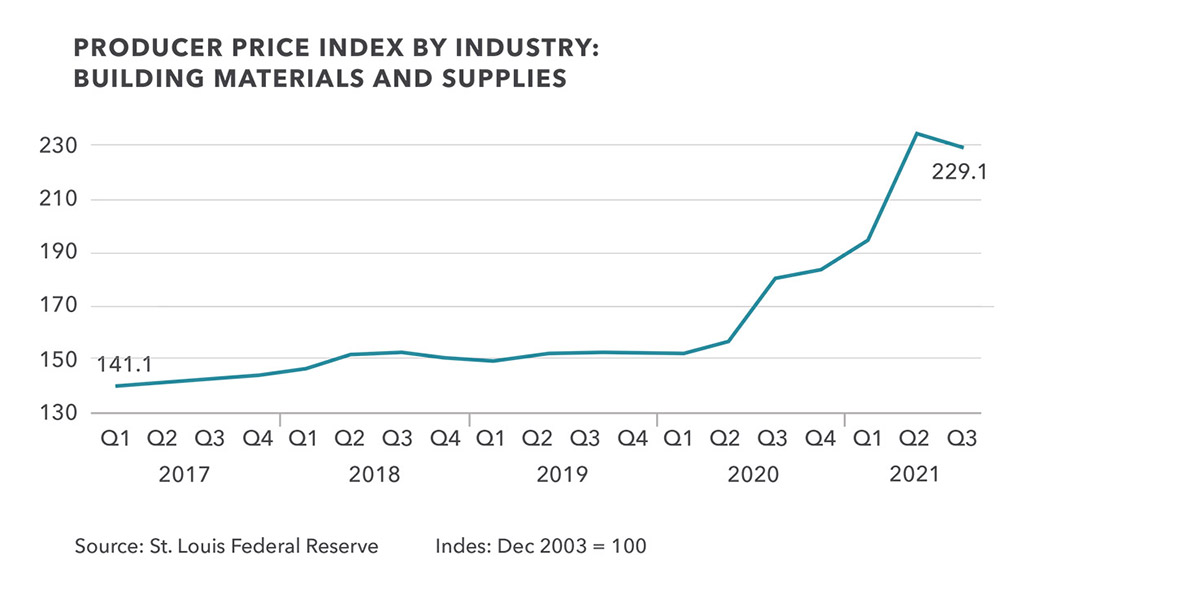

Developers are now facing a myriad of challenges to future development. Available land for development is becoming difficult to find, especially near ports and urban markets. Parcels of land that are available come with a much higher price tag than just a year ago. In many jurisdictions, the entitlement process has grown longer and more expensive. Finding qualified skilled labor to build the properties is another challenge. According to a recent U.S. Chamber of Commerce survey, 92% of contractors report difficulty finding qualified, skilled labor for open positions. Supply chain delays in receiving material and supplies slow — and sometimes halt — construction, and when materials and supplies are received, they are substantially more expensive. For example, The Association of General Contractors recently reported that steel prices have risen 67%, brass and copper are up 49% and the price of aluminum jumped 20.5%. Plastic construction materials — PVC piping, moisture barriers, paints, and adhesives — have gone up more than 12%. Lumber had a wild rollercoaster ride last year, jumping to an all-time high in May 2021 to $1,686 per thousand board feet, then dropping to $454.20 per thousand board feet in August, still 5% higher than its pre-pandemic price of $435.50 per thousand board feet.5 This drop was short-lived, however, as lumber prices have steadily increased since August to the current $1,224 per thousand board feet.6 In October, the cost of copper wire skyrocketed 156% on a year-ago basis. A good snapshot of how building materials and supplies have been affected by the current cost inflation is shown in this graph:

With no end in sight to the demand for warehouse, manufacturing, and logistics facilities driven by e-commerce and supply chain issues, the challenge now is how developers can meet that demand. Land shortages, lengthy and expensive entitlement processes, permitting difficulties, and increased costs related to labor and material shortages are some of the hurdles developers must negotiate to get product out of the ground. What is certain is that, so long as such intense demand persists, vacancies remain at or near historic lows, and strong rent growth continues, industrial developers will find their way to keep production flowing.

Contact

GARY BARAGONA

Director of Research

415.229.8925

gary.baragona@kidder.com

Written by John Fioramonti

Senior Business Writer

Kidder Mathews Research

Sources

1 Commercial Property Executive, “ICYMI: How the Supply Chain Crisis Impacts Industrial Real Estate,” October, 2021

2 Id.

3 Freightos; Supply Chain Drive

4 Freightos, January 7, 2022 update

5 Trading Economics

6 Id.

Stay in the know and subscribe to our monthly West Coast Market Trends report and our quarterly market research.