In November 2020, California voters will decide whether to approve Proposition 15. If voters approve it, the current property tax system will be amended to increase the tax burden for many commercial and industrial property owners, creating the largest property tax increase in California’s history.

Current Tax Law – Proposition 13

Since 1978, Proposition 13 has been the foundation of California’s property tax system. The proposition passed in response to the dramatic increase in property taxes seen throughout the state. The intent was to limit property tax rates and annual increases. Proposition 13 limits property tax rates to 1% based on the 1975 fair market value with annual increases at either 2% or the inflation rate, whichever is lower. A property would only be reappraised if new construction occurs or if there was a change in ownership. At which point, the new sales price is presumed to be the property’s fair market value and used as the base year for the property’s tax requirement and subsequent annual increases.

Proposed Tax Law – Proposition 15 1

Proposition 15 would amend Proposition 13 and raise property taxes for commercial and industrial properties to reflect the current market value rather than the previous sales price. The market value of all properties will be re-assessed every three years, beginning in the fiscal cycle of 2022. However, multifamily, residential, and agriculture properties would be exempt from this change and continue to be taxed under the current structure. This is called a split roll tax structure that applies different tax methods to different types of properties.

There are a couple of additional exemptions. Some properties, lower in value, will not be included as the proposed tax law change will not apply if an owner has $3 million or less worth of commercial land and buildings in California. These properties will continue to be taxed based on the original purchase price. Additionally, the measure reduces the each business’s equipment’s taxable value by $500,000, starting in 2024. Companies with less than $500,000 of equipment pay no taxes on those items. All property taxes would be eliminated on business equipment for California companies that meet criteria and have 50 or fewer employees.2

State analysts believe the initiative could generate between $8.5 billion and $12.5 billion in additional tax revenue per year by 2025-2026. Several hundred million dollars would be allocated from the new taxes and pay for costs associated with property value reassessments. Then 60% of the remaining funds would be given to counties, cities and special districts 40% will go to schools and community colleges through the Local School and Community College Property Tax Fund.

Intended Purpose

Currently, property tax on commercial and industrial properties is based on the purchase price (regardless of how long ago it was purchased. Many Californians feel that long-time property owners have not paid their fair share. This disparity has created inequities in the amount of property taxes paid by private owners, small businesses, and large corporations because long-term owners pay disproportionately less than those who have recently purchased properties. The intended purpose of Proposition 15 is to rebalance and reallocate the tax burden to capture billions of dollars in lost tax revenue each year.

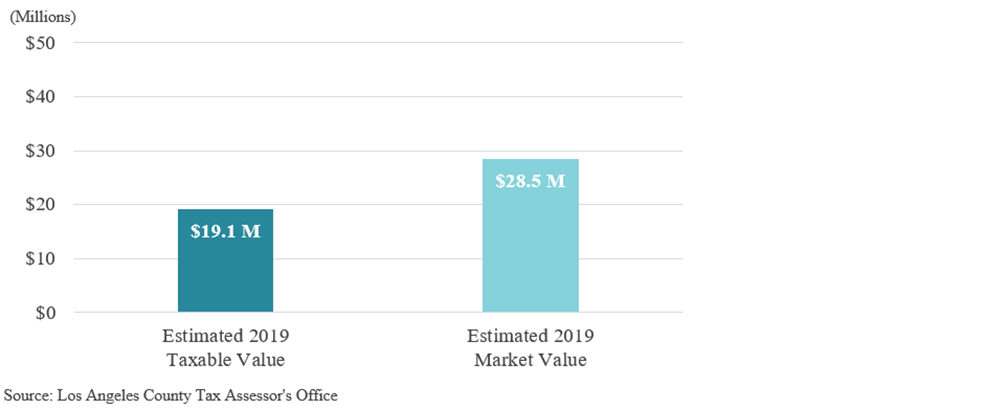

FIGURE 1: SAMPLE OFFICE BUILDING SOLD IN 2006 FOR $14.7 MILLION

To illustrate this change’s impact, we pulled information from a 2006 property sale in Los Angeles County. The sample office building was sold to an owner-user for $14.7 million. After applying 2% annual increases to the purchase price since 2006, the estimated 2019 taxable value of the property would be approximately $19.1 million, with the total tax liability of $191,000. However, the same property has an estimated 2019 market value of $28.5 million. If Proposition 15 guidelines were applied, the new total tax liability would be $285,000, nearly 50% more than using the current system.

Unintended Consequences

However, Proposition 15 has many unintended consequences that would impact small businesses and individuals. Most companies, especially small businesses, lease the space they occupy. Almost every one of those leases requires the tenant to pay their proportionate share of property taxes and their base rent. Suppose a building experiences a significant property tax increase. In that case, those additional costs will be passed through to every tenant that leases space in the building – increasing the overall cost for them to occupy the same space. Soaring property taxes could cripple many small businesses already struggling to survive the negative effects of Coronavirus shutdowns, ongoing recession, mass layoffs, and high unemployment rates. Many of these existing companies will have a difficult time absorbing a sudden rent increase.

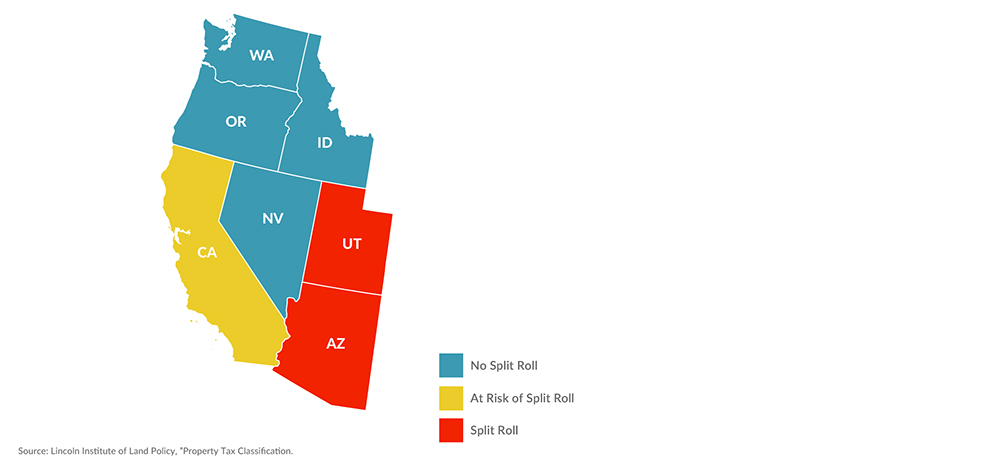

A split roll tax will make it increasingly more difficult for businesses to compete. California already has one of the nation’s least business-friendly tax environments ranking 48th on the Tax Foundation’s State Business Tax Climate Index. However, the state’s current property tax code is a relatively bright spot, with the state ranks 14th on that component of the Index. Under the existing tax structure, companies in California have enjoyed stability and predictability with property taxes. If Proposition 15 is approved, that would disappear. Imposing a split roll system in California could encourage businesses to relocate to lower-taxed jurisdictions or invest out-of-state, accelerating an existing trend. Of the nearby states in the West, only Utah and Arizona currently have a split roll property tax system between residential and commercial properties. 3

FIGURE 2: WESTERN STATES WITH & WITHOUT A SPLIT ROLL TAX SYSTEM

Additionally, these property tax increases would likely trickle down to consumers and harm the already high cost of living in California – ranked the second-highest state in a recent study by US News and World Report. Since both individuals and families are heavily reliant on tenant’s goods and services in commercial buildings, if the cost of doing business increases, so will the cost of the goods and services those companies provide as they attempt to offset higher rent expenses. Examples of the types of companies that could be impacted include daycare centers, medical clinics, retailers, restaurants, and grocery stores, to name a few. Even though the split roll tax is not directly aimed at individuals, much of the cost will be picked up by consumers through higher prices on everyday goods and services.

Conclusion

While many agree that California’s property tax system needs to be revised, passing the largest property tax increase in the state’s history during a pandemic and economic downturn will only weaken the struggling state economy. The unprecedented tax increase would represent an increase of approximately 10-15% in total property taxes. Such an increased tax burden would further hamper many commercial real estate owners’ ability to remain competitive and operational. Additionally, the overall cost of doing business would increase for most tenants, creating additional challenges for many small businesses already fighting to survive. Given the current economic climate and the business challenges associated with the pandemic, introducing higher property taxes becomes a precarious proposition for the State of California.

Written By

Gary Baragona

Director of Research

415.229.8925

gary.baragona@kidder.com

Sources

1 Prop 15: https://voterguide.sos.ca.gov/propositions/15

2 California Legislative Analyst Office – Proposition 15

3 Tax Foundation – Split Roll Initiative in California Threatens Property Tax Limitations