The COVID pandemic has dramatically changed how people navigate their daily lives. Lockdowns and ongoing restrictions have caused dramatic lifestyle changes in how people work, shop, dine and play. As we transition into 2021, the overriding question is when the country will return to normal, or is this the new normal?

The pandemic and the sudden national response to the disease upended commercial real estate. Stay-at-home orders, social distancing, and the many restrictive protocols enacted on the local, state, and federal levels fundamentally impacted all real estate sectors. The uncertainty caused by the resultant economic disruption forced investors to pause, assess the new investment landscape, and recalibrate investment strategies to include a wider array of investment opportunities.

With the lodging, retail, and office sectors severely impacted by the pandemic, the industry targeted in the last half of 2020 by many commercial investors was multifamily. Multifamily remained resilient throughout the year, with average vacancy slightly lower than 2019 and monthly rent collections never dropping below 91.7%1.

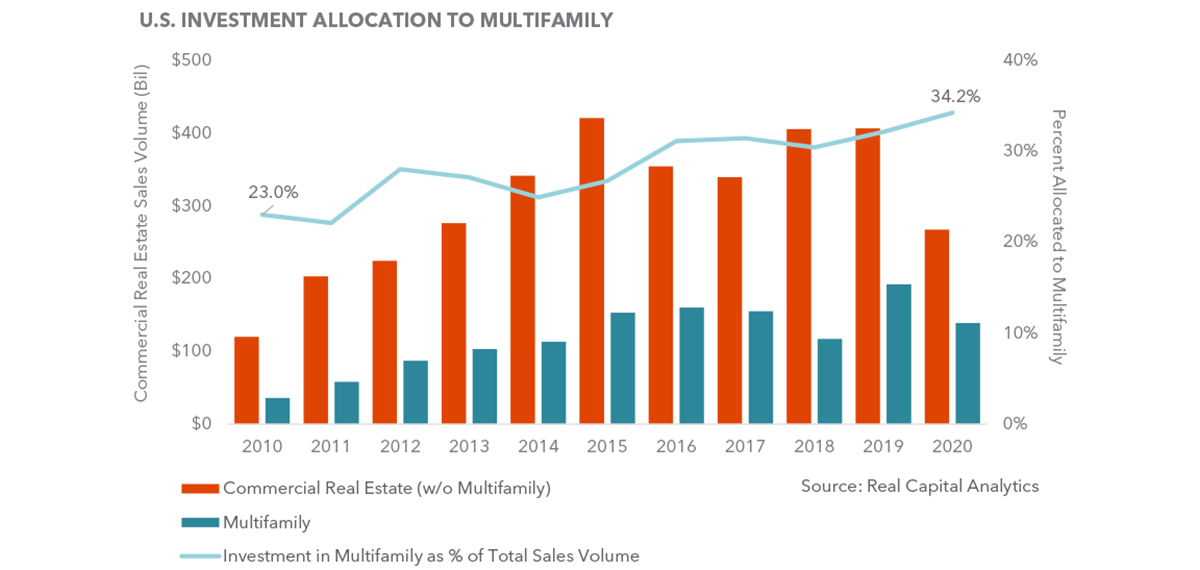

After a strong third quarter, multifamily investment set a new record in the fourth quarter, coming in at $56.7 billion, up 115.6% over the previous quarter. The year ended with multifamily investment totaling 34.2% of all commercial real estate investments, up 8.1% over the long-term average of 26.1% and reaching an all-time high.

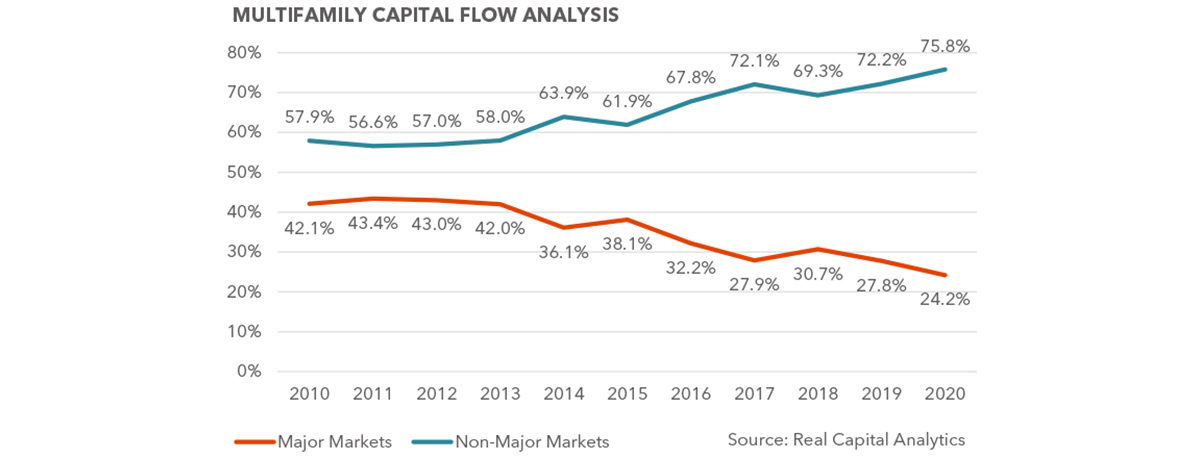

In tandem with the overall increases in multifamily investment as a share of total commercial real estate investment reflected in the above graph, multifamily investors have been slowly increasing investment allocation to smaller markets and suburbs following migration patterns. Before the pandemic, out-migration from major metro urban cores was driven primarily by the escalating costs of living in those areas. The pandemic’s cumulative effects accelerated that migration as the ability to work from home enabled tenants to move to the suburbs or different cities and escape higher rents and densities. Multifamily investors followed the accelerated migration pattern, placing 75.8% of their investment dollars in smaller metro areas and the suburbs, the highest percentage on record.

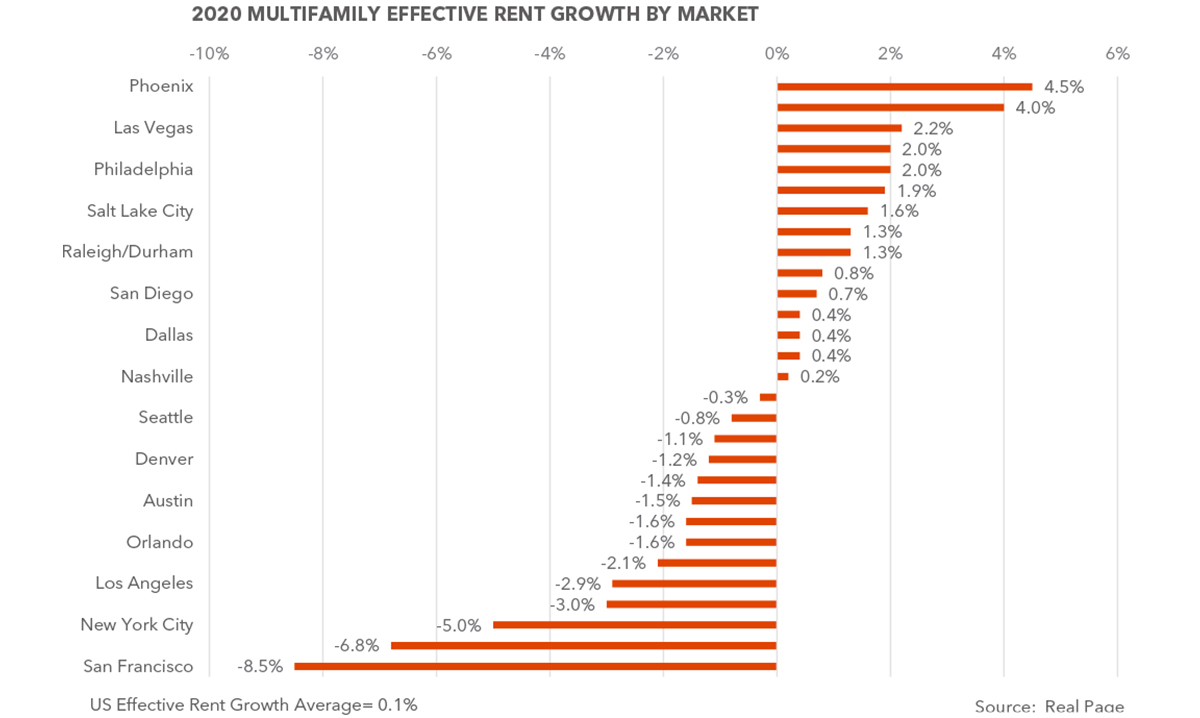

The increased demand for apartment units, especially in the Sun Belt region, has kept fundamentals strong in the smaller markets and suburbs. For example, the Phoenix, Arizona metro area added 8,193 units to its inventory in 2020, while 9,645 units were absorbed, ending the year with a stabilized vacancy rate of 4.8%, 210 basis points less than the U.S. vacancy rate. That strong occupancy rate supported solid rent growth in the Phoenix market, ending 2020 with 5.1% asking rent growth and 4.5% effective rent growth. Similar mid-market cities also saw positive effective rent growth.

But perhaps the most compelling motivation for the large increase in multifamily investments in the smaller secondary and tertiary markets and their suburbs are the annualized returns produced in those markets. Over the past 12 months, smaller markets like Salt Lake City and Phoenix, with strong fundamentals driven by positive demographic trends, had the highest total returns, while major urban areas that experienced the highest out-migration, like San Francisco and New York, suffered negative total returns.

The work-from-home policies enacted in response to the pandemic have directly impacted the increased exodus out of the larger, more dense urban areas to smaller metros and the suburbs. The ability to work from anywhere allowed renters to seek out more affordable, larger rental units away from the expensive urban centers without any negative impact on their employment. And to some degree, it looks like remote work policies will remain after the pandemic ends. In a recent survey performed by PwC2, 83% of employers and 71% of employees responded that remote work has been a success for their companies. Less than 20% of company executives expressed their desire to return to the office as it was pre-pandemic. And 67% of respondent companies to a survey conducted by 451 Research, the emerging technology research unit of S & P Global Market Intelligence, indicated that they expect their remote work policies to remain in place either permanently or for the long-term3.

The remote work policies’ success coupled with growing demands from employees for more flexible working options bodes well for the multifamily markets in smaller metros and suburbs. The continuing in-migration of urban renters will keep demand high and strengthen operational fundamentals, all to benefit the growing numbers of investors capitalizing this space.

Provided By

GARY BARAGONA

Director of Research

415.229.8925

gary.baragona@kidder.com

Written by John Fioramonti

Senior Market Analyst

Kidder Mathews Research

Sources

1 National Council of Real Estate Investment Fiduciaries (NCREIF)

2 PriceWaterhouseCooper, Remote Work Survey, January 12, 2021, https://www.pwc.com/us/en/library/covid-19/us-remote-work-survey.html

3 S&P Global Market Intelligence, “COVID-19 Shakes Up the Future of Work” https://www.spglobal.com/marketintelligence/en/media-center/press-release/covid-19-shakes-up-the-future-of-work