The arrival of COVID-19 has brought widespread disruption to American’s lives and the U.S. economy in 2020. Stay-home orders and uncertainty about managing the spread of the disease continue to cloud commercial real estate markets and make it difficult for investors and owners to make decisions.

Yet, underneath the upheaval, savvy investors are frequently writing their 2020 CRE playbooks on the foundation of a triple-net (NNN) asset strategy, and in many cases, it involves a 1031 Exchange. The fact that NNN deals have risen in favor this year reflects the realities facing investors that need to execute agreements amidst a market without clarity.

“Net leased investments are a safer place to invest in this tumultuous environment,” said Kidder Mathews’ Paula Danker, CCIM, a senior vice president in San Diego. “That’s because they typically feature long term leases, which will work to bridge the current disruption period to one that is more stable. Absolute NNN deals involving a tenant with excellent credit in an outstanding real estate location look to be a safer strategy than alternative investment options.”

There has been a newfound interest in net lease properties from people who weren’t interested before the pandemic because of the solid fundamentals NNN assets provide, which became even more valued in an uncertain time. Kidder Mathews’ Erik Swanson, a senior vice president who specializes in the sale of single and multi-tenant retail assets throughout the Pacific Northwest, explained, “The increase in NNN sector activity was primarily driven by a 1031 Exchange deadline that expired on July 15th. But knowing everything else is virtually stopped, we kept seeing activity in net lease side of things as the deadline approached.”

Swanson adds even after the deadline passed, they are “still seeing interest in NNN assets from buyers,” he says. “But in the deals after the 1031 deadline, investors are increasingly seeking a solid investment backed by a credit tenant, as well as reliable cash flow.”

Danker agrees that transaction volumes slowed down considerably since COVID 19 reared its ugly head. She closed a large pipeline of business in the first quarter of 2020, and all of the transactions were with 1031 exchange buyers that needed to close to avoid capital gains taxes. “Once COVID hit, I had approximately $20 million worth of “all cash buyer” deals fall out due to investor uncertainty and fear,” she notes.

NNN Delivers Solid Options

Danker explained, “My clients gravitate towards tax-free states, and at this point, again due to COVID-19, my current clients are looking at COVID resistant uses such as grocery stores, pharmacy, convenience stores – with or without a fuel component, fast food, tire stores, auto repair, auto collision repair, and dollar stores.”

Swanson adds, asset types of most interest are single-tenant net lease deals or perhaps one with a 60-40 to multi-tenant composition, followed by strip centers, malls, and net lease with a Walgreens or grocery store NNN deal in place. He said, “Investors are seeking these essential centers with a grocery component or a drug store or hardware retailer that brings a solid name and is a credit tenant.”

Swanson cites a recently closed 40,000-square-foot Smart Foodservice portfolio deal as reflective of the types of assets investors seek in a coronavirus era. The $10.95-million deal involved a two-property portfolio with stores in Tumwater, WA and Portland, OR that was executed by Swanson and partner Mike King.

He also reports they recently closed a deal involving Dollar General for a buyer seeking an essential business with a credit tenant that delivered reliable income for what is expected to be a long-term hold.

But Swanson notes not every single-tenant NNN deal works. Harder sells for investors are retail properties with fitness, gas stations, restaurant, or casual dining, though convenience stores could still work.

Swanson points out that it is difficult to secure financing for multi-tenant investment real estate, but that isn’t the case for NNN single-tenant assets because they are typically less levered and have less debt on them. “Without the ability to place debt on an asst or secure financing, it effectively locks up the market,” concludes Swanson.

Finally, primary markets are where clients look to invest because they offer better locations, higher household incomes, larger population numbers, and just “better real estate,” compared to secondary and tertiary markets, notes Danker.

Investors Seek NNN Assets with Solid Tenants, Reliable Cash Flow

The reason behind the renewed interest in triple-net leased assets is that investors seek investments with solid tenants and reliable cash flow. Swanson notes NNN deals help deliver “bondable income” when other options are considered riskier. Given the volatility in the stock market, NNN deals are a good alternative and because the predictable cash flow is attractive.

“Volatility in the stock market and uncertainty in other investment types is pulling investors with available cash waiting to be deployed toward NNN assets,” said Swanson. Another factor weighing in favor of NNN assets is that market uncertainty, and unstable future demand makes it a challenge to price assets. But in the case of net lease assets, essential properties are open, so they are viewed as stable and hedges against inflation.

NNN assets are expected to maintain value and offer the potential of increased value in a turbulent time when others might not, adds Swanson, who points out there’s no predictability in other asset types right now. That’s one reason he says they continue to see steady interest in net lease deals involving quality assets and with essential tenants.

Strong private or corporate credit tenants are seen as the “safe” alternative, adds Danker. That makes it easy to see why high net worth private investors seek security through investing in absolute, triple net leased properties with the attributes previously mentioned.

Danker says, “As 2020 evolves, I do not see things changing much until after the November election. And until that shakes out, the CDC gets an effective vaccination in place or gets a handle on how COVID is impacting our nation, cash buyers are probably going to sit on cash due to fear of the unknown. Conversely, for 1031 Exchange investors, the option to remain on the sidelines may not be an option if they want to avoid paying taxes.”

Effective 1031 Exchange Strategies

The common strategies being deployed via 1031 Exchanges include both the traditional exchange as well as reverse exchanges. 1031 Exchange transactions offer many advantages or benefits. They start with the fact that investors can save on paying capital gains taxes by deploying equity into another asset. A 1031 Exchange can be highly beneficial to an overall investment strategic plan and to an estate plan.

Swanson says most of the transactions he does are 1031 Exchanges involving both single- and multi-tenant assets. They are typically private equity deals in a trade to defer capital gains. He notes, “we see a lot of 1031 money in single-tenant retail net lease deals because they are passive, “mailbox money” investment vehicles. When there is one tenant, there’s not a lot of management or owner responsibilities.” He adds that retirees may have sold a multifamily asset and are simply weary of having management responsibilities. NNN deals deliver passive cash flow, so they seek out a Walgreens or properties with a credit tenant.

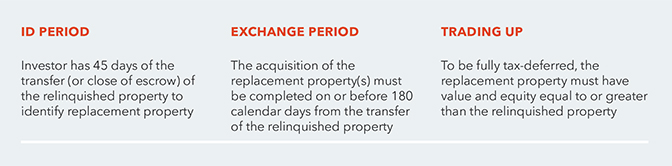

Danker adds the challenges facing 1031 Exchange investors today include finding quality products to exchange into, resulting in decreased deal volumes. The extension of the 45-day deadline gives investors extra time to identify a quality replacement property that will provide more comfort to investors. But Danker says, “Even in a good market, 45 days is a short window to execute a deal.”

1031 Exchange Guidelines

The main considerations of 1031 Exchange deals investors need to know about include:

As the COVID-19 outbreak continues to span through the summer, it is clear NNN lease deals remain a steady strategy in a 2020 CRE playbook. Investors are expected to count on these types of assets to deliver certainty in an uncertain time while helping them achieve their investment objectives.