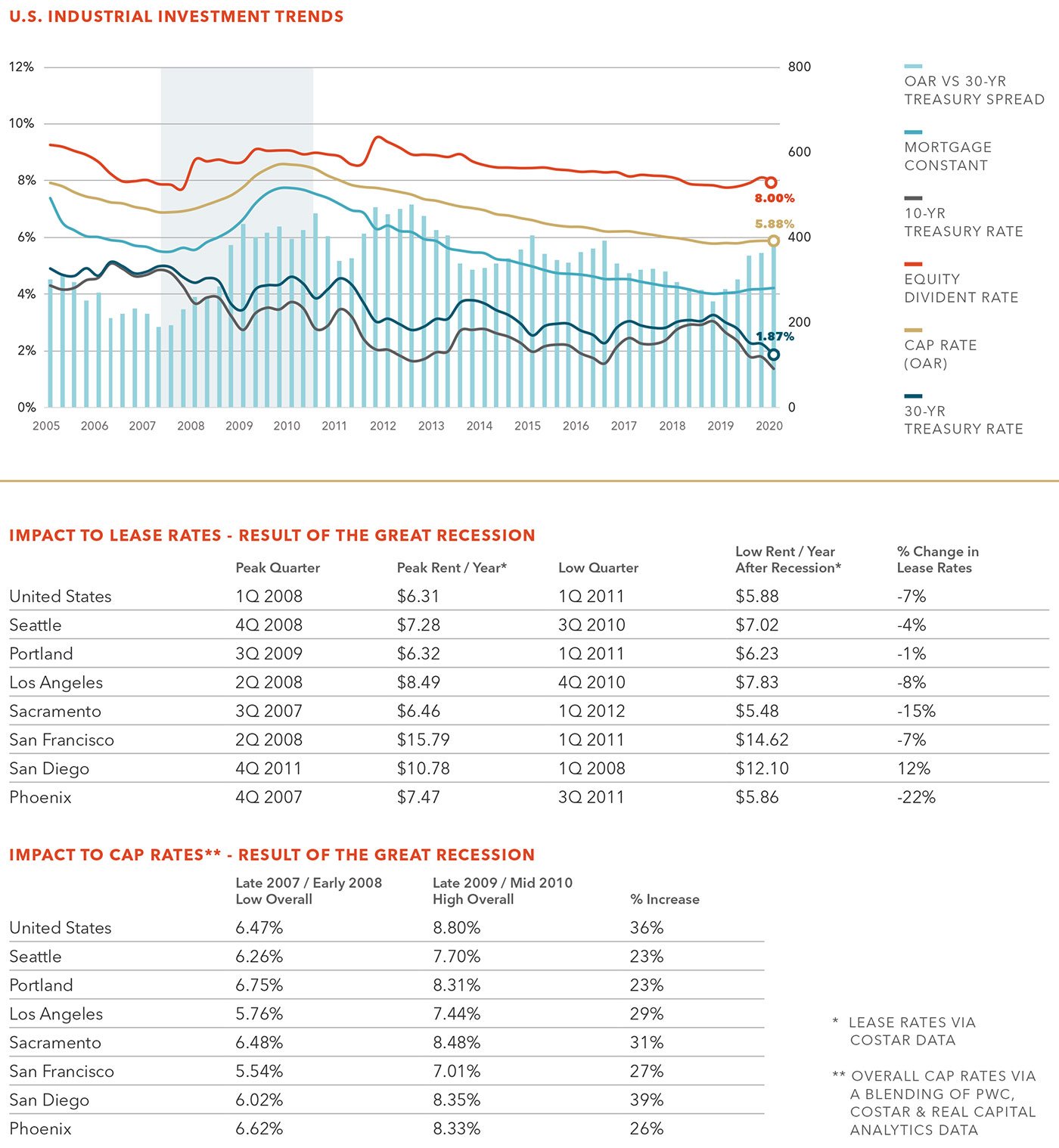

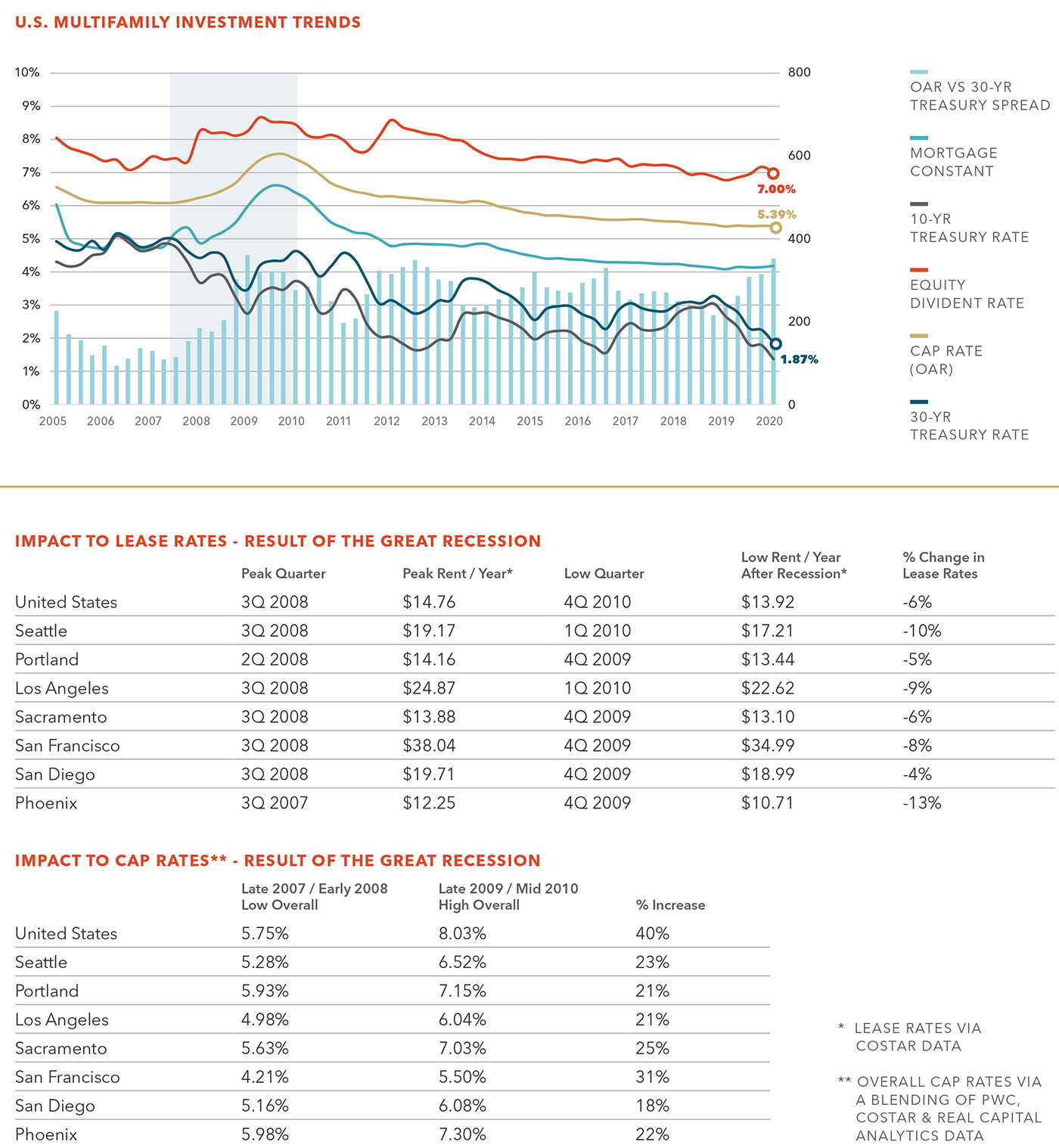

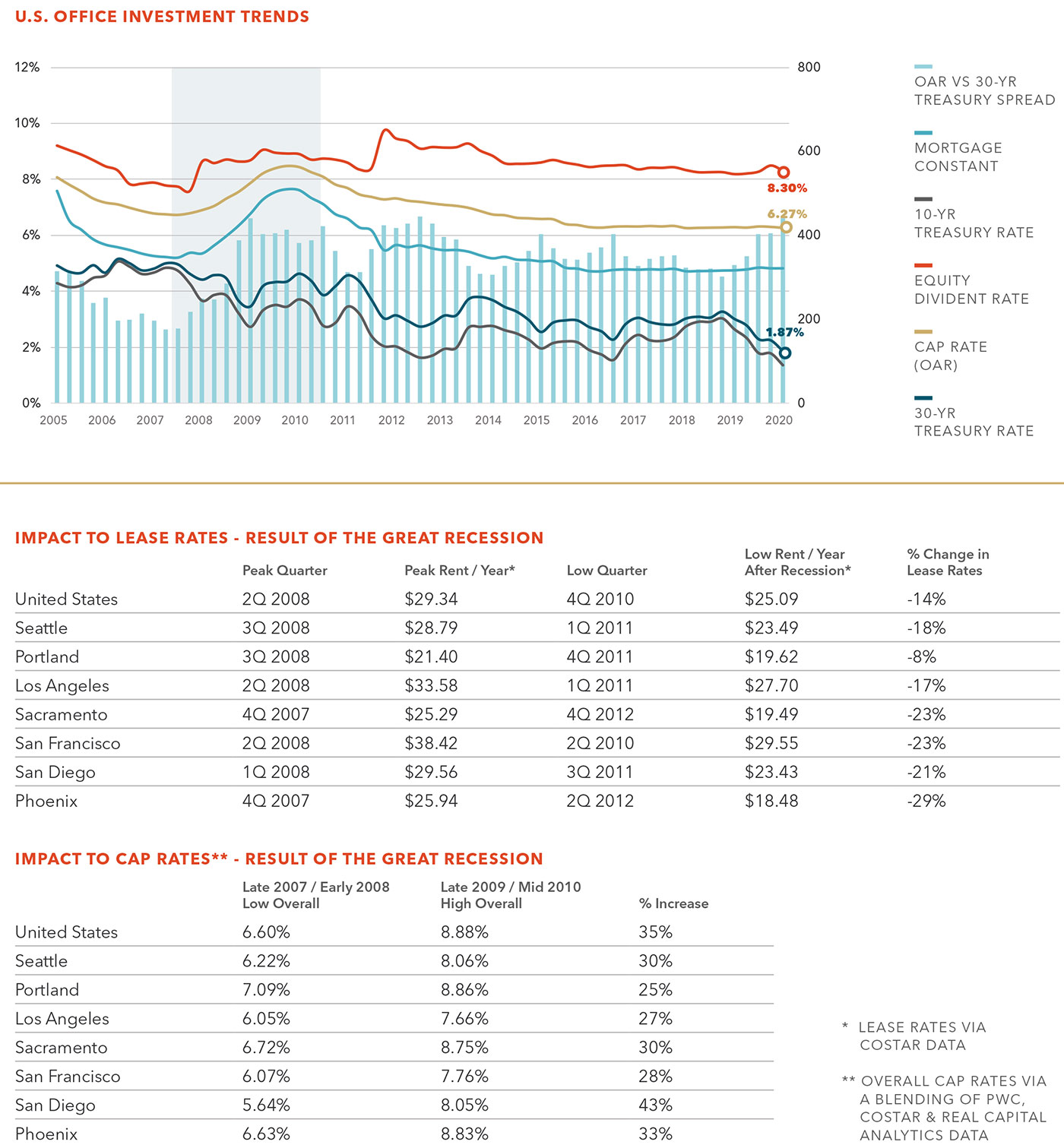

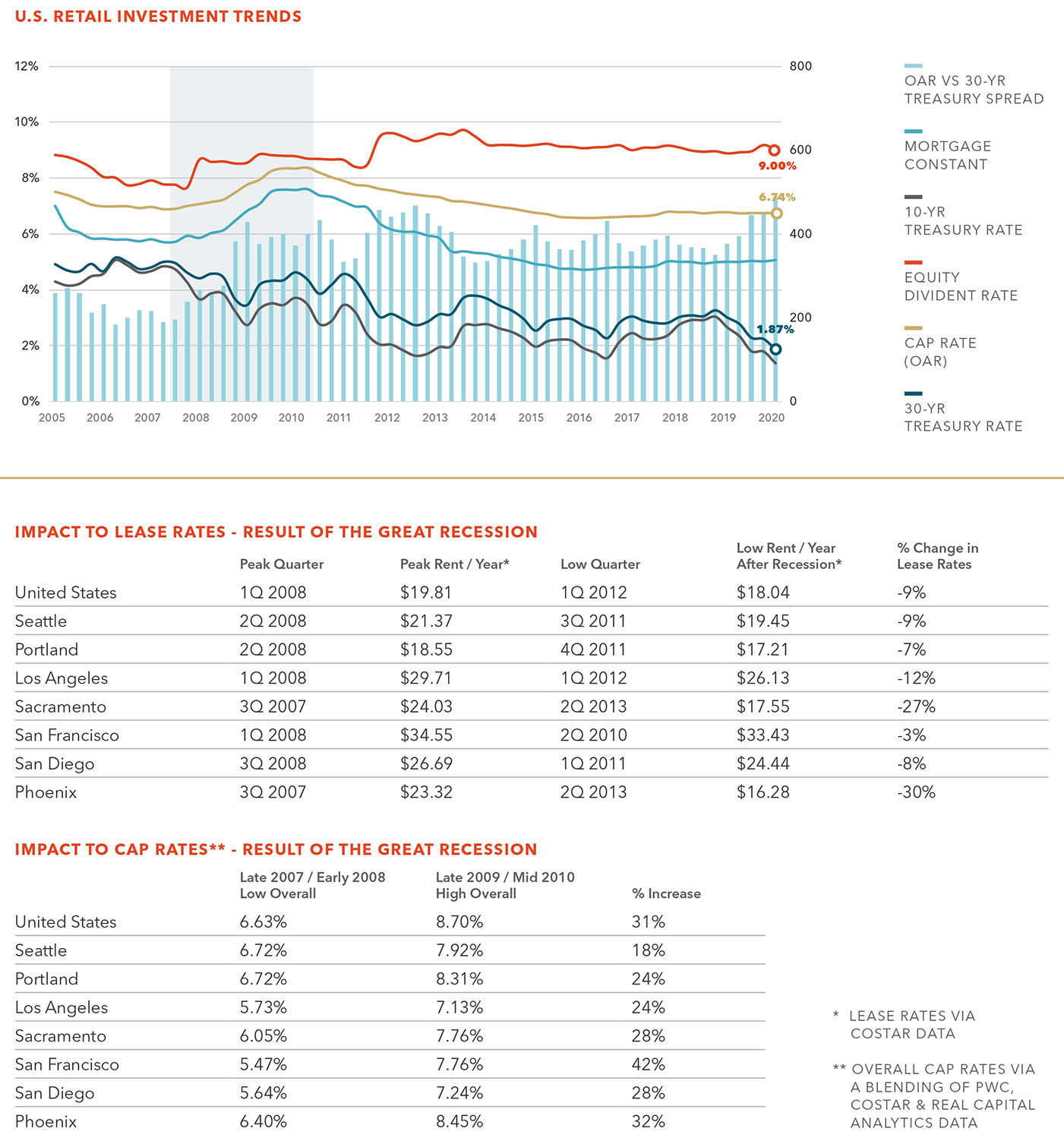

The following illustrates various measurements of commercial real estate investment from the beginning of 2005 through the first quarter of 2020, including an overall capitalization rate, equity dividend rate, mortgage constant etc. Data was estimated and blended from sources including PWC, Real Capital Analytics, CoStar, Realty Rates and the Federal Reserve Bank of St. Louis.

Real Capital Analytics, CoStar, Realty Rates and the Federal Reserve Bank of St. Louis.

The highlighted portion of timelines focuses on the final period of economic expansion prior to the Great Recession to the period where capitalization rates for industrial were at their peak. The Great Recession is considered by many to have been the largest financial crisis since the Great Depression of the 1930s. The cause of the Great Recession (lax lending standards / real-estate bubble) is different from the non-market pressures of the existing COVID-19 economy; the result, however, is similar in terms of downward pressure on real estate values. Therefore it’s important to consider these historical changes in market conditions as measured by capitalization rates, lease rates etc. when considering how and to what degree market conditions of real estate might change in the near future.

The tables on the following pages indicate the U.S. and other select markets’ overall capitalization rates and lease rates from the peak of the economic expansion to the point where these investment parameters made their greatest change. Historically, the capitalization rate changes occurred most quickly while lease rates took much longer; this is likely due to the extended drop off from the peak of the market and the lag that naturally occurred as the market adjusted to the new economic situation.

It is important to note that the time frame of declining lease rates relative to the rise in capitalization rates (to the extent that they occur) will likely be less than during the Great Recession as a result of the nearly immediate and transparent drop in economic activity particularly when coupled with the recent memory of the last recession.

Summary

Overall, there is and will be strong downward pressure on market conditions as a result of various ‘Stay at Home’ and ‘Social Distancing’ orders that have been in place since March 2020. The information provides important benchmarks when assessing the magnitude of these changes to the industrial, multifamily, office, and retail real estate sectors for the U.S. and other select markets in the near future.

Industrial

Multifamily

Office

Retail

Provided By

Aaron Taylor, MAI, ASA

Sr Vice President, Manager

Valuation Advisory Services

503.721.2707

aaron.taylor@kidder.com