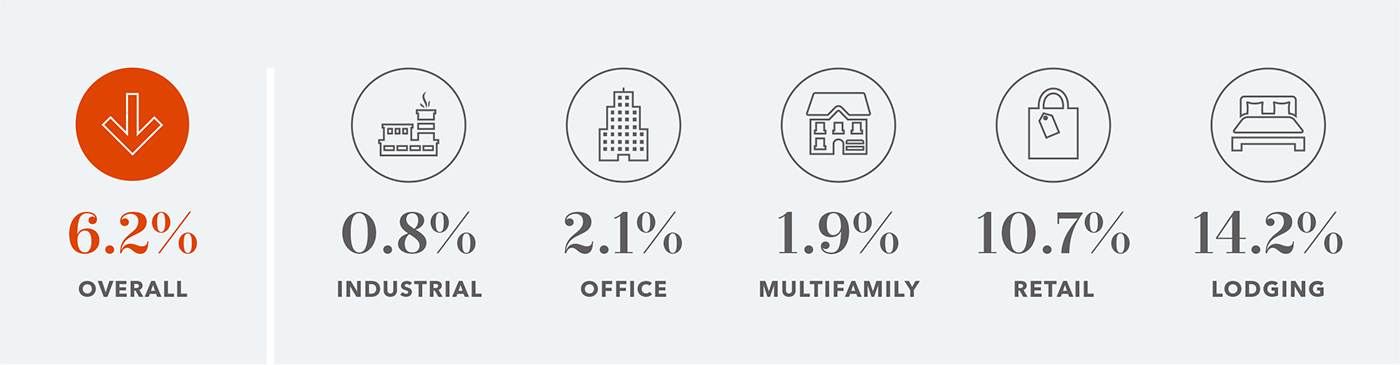

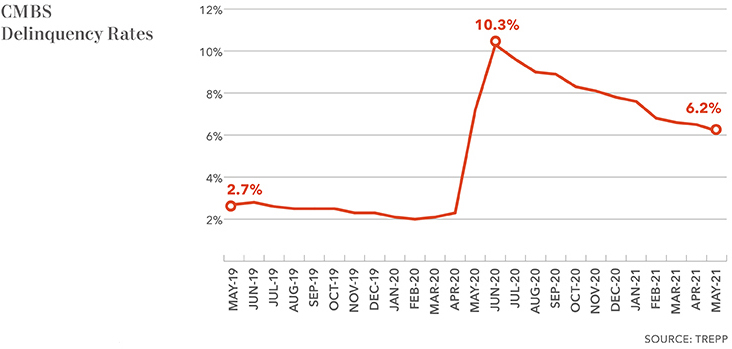

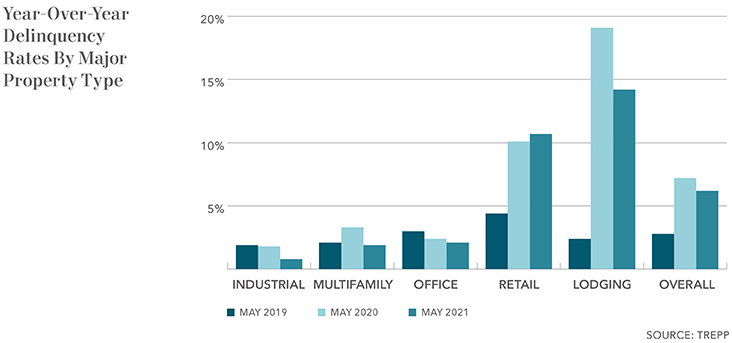

May saw the eleventh straight monthly decline in the rate of commercial mortgage delinquencies. According to Trepp, after two unprecedented increases in May and June of 2020, driven by the sudden shutdown of the economy to combat the COVID-19 pandemic, the commercial real estate market began to slowly recover. As the states opened their economies, the overall mortgage delinquency rate dropped over 400 basis points from a high of 10.3% in June of 2020 to 6.2% last month.

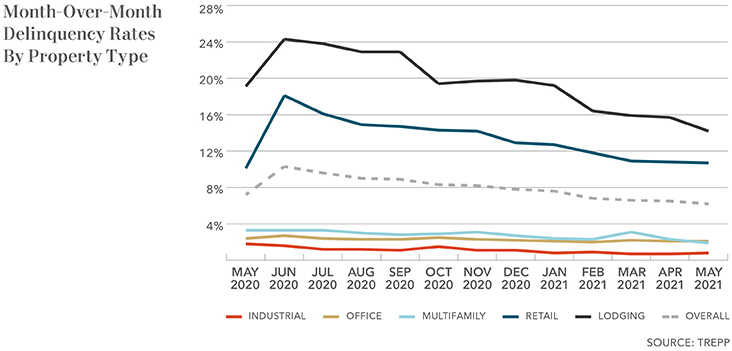

The hardest hit property sectors—lodging and retail—have seen impressive improvement in performance since the economy started re-opening. Hotel delinquencies have dropped just over 10% between June 2020 and May 2021 while retail delinquencies have improved by just under 8% in that same time. As the economy continues to recover, expect delinquencies to continue to decline.

While the retail and lodging sectors struggled through the lockdowns, the other major property types avoided escalating delinquencies. With many industrial sub-sectors deemed “essential” through the pandemic (e.g., grocery stores, life science facilities and big box stores) the industrial sector turned in the best performance with fewer delinquencies during the lockdown and after than in 2019. Bolstered by federal intervention such as foreclosure moratoriums, multifamily managed to keep delinquencies low throughout the past 12 months. And the office sector has benefited from forbearance agreements with lenders driven by the need to protect their property portfolios through the pandemic.

Contact

GARY BARAGONA

Director of Research

415.229.8925

gary.baragona@kidder.com

John Fioramonti

Senior Business Writer

Kidder Mathews Research