CMBS delinquencies accelerate due to COVID-19

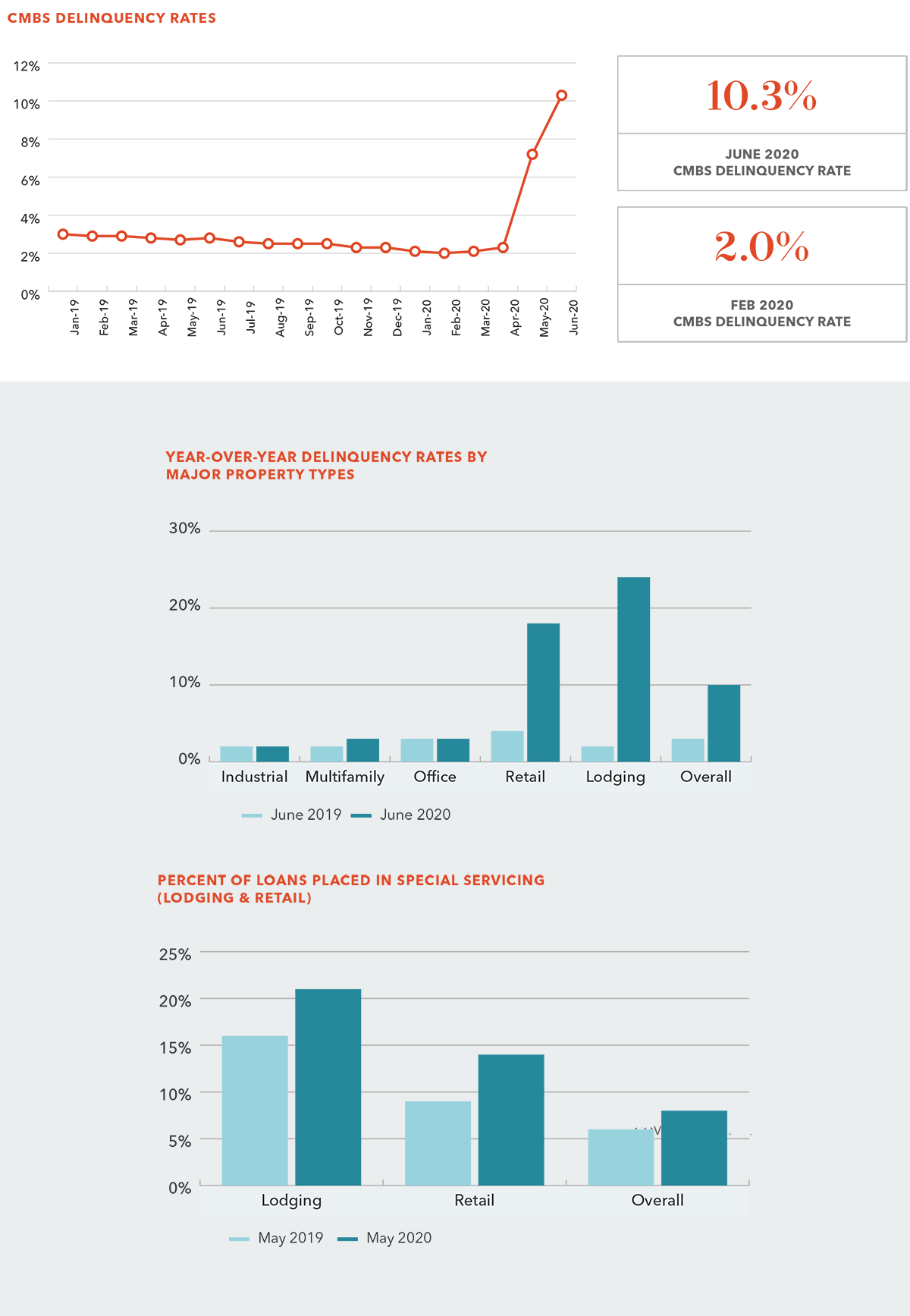

Bolstered by the strong economy, the overall Commercial Mortgage-Backed Securities (CMBS) Delinquency Rate started on a record-setting pace of strong performance after June 2017 when delinquencies totaled 5.8%. Between July 2017 and February 2020, delinquencies fell 27 of the 32 months to the post Great Recession low of 2.0%. Delinquencies were unphased in March, ticking up only 10 basis points, as the magnitude of the pandemic’s disruption to businesses had not yet been fully realized.

While the increase in April was again modest, growing just 20 basis points to 2.3%, the percentage of loans transferred to special servicing forewarned of the pain to come. Overall, loans placed with special servicers grew 160 basis points from 2.8% in March to 4.4% in April. Lodging loans sent to special servicing ballooned from 2.3% to 11.4%.

CMBS DELINQUENCY ACCELERATION

The anticipated surge in CMBS delinquencies hit in May with the largest single-month jump since Trepp started tracking monthly delinquency rates in 2009. At 7.2% the delinquency rate grew by 490 basis points in May, signaling the extreme consequences of the economic shutdown. The lodging sector continued to bleed, with 16.2% of all loans with special servicing, an increase of 480 basis points over April’s count. The retail industry also experienced significant delinquencies in May as 9.3% of all retail loans were placed with special servicing.

Recently released June data from Trepp shows the continued slide of the CMBS market as overall delinquencies expanded by more than 300 basis points to 10.32%, nearly equaling the all-time record high of 10.34% set in July 2012. Remarkably, the pandemic drove the overall CMBS delinquency rates up 830 basis points from the all-time low in February of 2.0% to the second-highest rate of 10.32% in the span of five months. (See, graph 1)

But a deeper dive into the data reveals that the rapid escalation of the delinquency rates is driven almost exclusively by the lodging and retail sectors. As demonstrated in the graph below, on a year-over-year basis, the industrial and office sector delinquencies improved slightly while multifamily delinquencies ticked up marginally to 3.3%. (See, graph 2 below) Understandably, the escalated delinquencies in lodging and retail translate to higher percentages of those loans being placed in special servicing. (See, graph 3)

THE MONTHS AHEAD

The closure of the country’s economy in response to the COVID-19 pandemic has, thus far, taken its heaviest toll on the lodging and retail sectors. With the recent spiking of the virus in much of the country, it is likely that overall CMBS delinquency rates will head higher next month as mitigation measures halt or walk back business openings. But as noted in the July Trepp report, it is worth watching the rate of growth of delinquencies as it is possible that over the next few months, “…most borrowers that felt the need for debt service relief (will) have requested it… If that is the case, the expectation would be that the increases in the delinquency rate going forward should be smaller than what we saw in May and June.”

Provided By

JOHN CHA

Director of Research

206.248.7338

john.cha@kidder.com

Written by John Fioramonti

Kidder Mathews Research