In recent weeks the “R” word, recession, has garnered more attention and analysis as familiar signs of a recession have arrived. Historic four-decade high inflation, rising interest rates, an inverted yield curve, and declining stock prices together with falling growth projections are stoking concern for an imminent economic downturn. Continuing economic uncertainties caused by the war in Ukraine, ongoing disruptions of the supply chain and the monetary policies of the Federal Reserve Bank (the “Fed”) are driving consumer confidence down and the likelihood of a recession up. These trends have led many economists to declare a recession inevitable, while others suggest that the economy can still avoid a recession in the near term.

Responding to the severe economic downturn caused by the pandemic in the spring of 2020, the Fed pursued a very aggressive expansionary monetary policy to, “forcefully, proactively and aggressively” put the economy “solidly on the road to recovery.”1 To achieve that end, the Fed cut the federal funds rate to near 0% in March of 2020 and held that rate to stimulate borrowing and purchasing until the recent interest rate hikes beginning in March of this year. In June 2020, the Fed also resumed quantitative easing by purchasing a massive amount of U.S. Treasury securities and mortgage-backed securities totaling more than $4 trillion from March 2020 through May 2022. This allowed congress to pass over $5.5 trillion in COVID-19 stimulus bills in the span of just 12 months, March 2020 through March 2021.

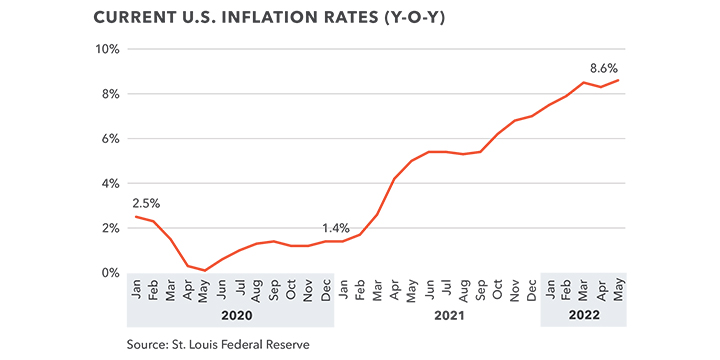

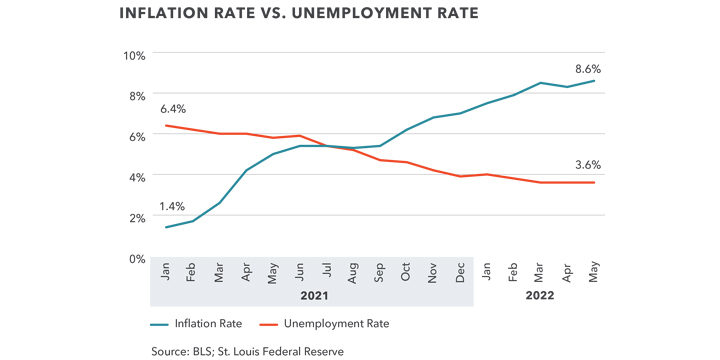

The last stimulus package of $1.9 trillion was passed in March 2021. At that time there was strong concern voiced that the economy was already running strong without being over-stimulated and that coupled with the Fed’s continued policies of near zero interest and quantitative easing, inflation would spike. Interestingly, as shown in the graph below, March of 2021 was when inflation began to accelerate.

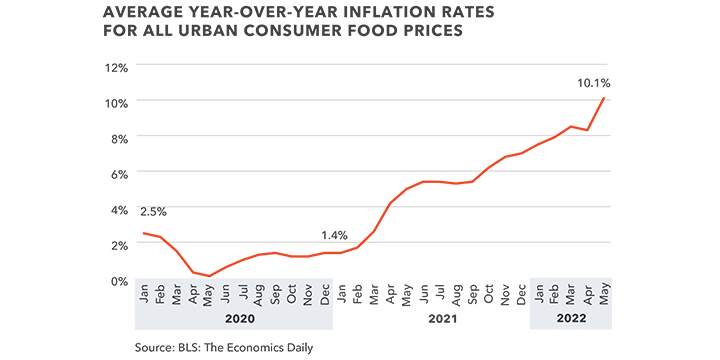

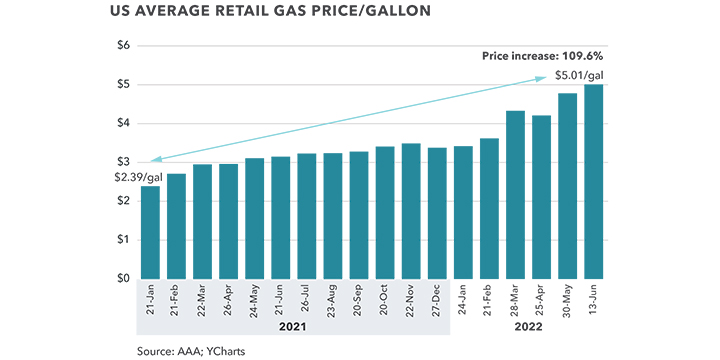

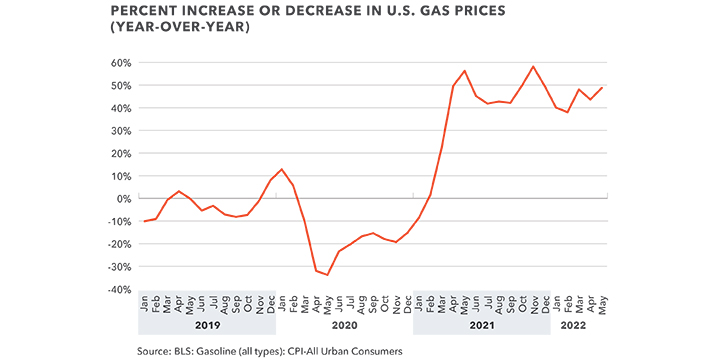

While the economy was strong in many ways last year, the unchecked inflation muted gains across the economy including record wage growth. Wages and salaries for civilian workers rose 4.5% in 2021, the fastest annual increase since 1983.2 Yet, due to the inexplicable inaction by the Fed in doing nothing to control the rising inflation from January 2021 to January of this year, inflation grew more than 700 basis points from 1.4% to 7.5%, resulting in a 3% loss in real wages. In that same time frame, average retail costs for gasoline jumped 43% to $3.42 per gallon and food costs increased 6.4% overall, with much higher increases for specific food items such as beef, which jumped 20.9%.3 For the 12 months ending in December 2021, consumer prices for all items rose 7%, the largest December to December percent change since 1981.4

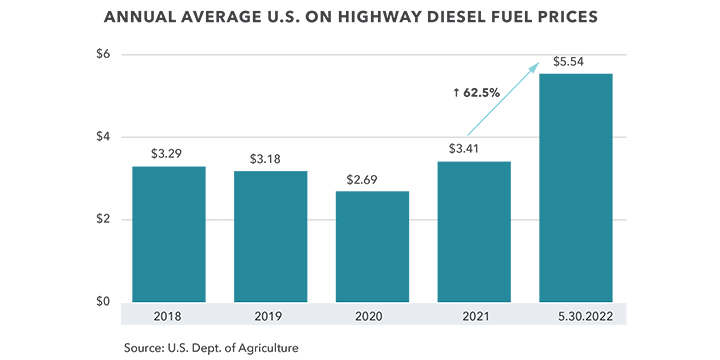

Last year’s runaway inflation accelerated this year due, in part, to the Russian invasion of Ukraine, continuing supply chain challenges, and another COVID-19 lockdown in China. From January 24 to June 13, the average retail price for a gallon of gas jumped 46.5% to $5.01 per gallon. According to the Consumer Price Index, the all-foods prices increased 10.1% from May 2021 to May 2022, and the CPI forecast for the 2022 full year is an increase between 6.5 and 7.5%. Overall inflation has grown 110 basis points since January to end May at 8.6%, the steepest increase since 1981.

While the precursors of a recession are already in play, the questions remain: Can the economy avoid a recession in the near term, are we heading into a recession, or has the recessionary period already begun? Opinion is divided on that question. Many economists and investors, such as Jamie Dimon and Carl Icahn, believe we are absolutely headed towards a recession while others, like the American Bankers Association, cite the strong labor market and strong consumer spending and believe the fear is overblown. Previous recessions have already provided us with key indicators to monitor going forward.

Inflation/Unemployment: Former Treasury Secretary Lawrence Summers noted the correlation between the inflation and unemployment rates that is a strong recession indicator. In a recent Washington Post op-ed, Mr. Summers pointed out that “Over the past 75 years, every time inflation has exceeded 4% and unemployment has gone below 5%, the U.S. economy has gone into a recession within two years.” Today, the inflation rate is 8.6% and the unemployment rate is 3.6%. At the time of that op-ed, inflation was “nearing 8%” and the unemployment rate was 3.6% and Mr. Summers predicted an 80% probability of a recession by next year.

The Yield Curve Inversion: An inverted yield curve results from bond traders’ and investors’ concerns about the economy and stock market. The inverted yield curve is a strong indication that investors expect weak economic growth in the future. The yield curve inverted on April 1 and again on June 13 for the first time since 2019. A yield curve inversion occurs when short-term treasury bills attract a higher interest rate than longer-term treasuries. Historically, investors consider an inverted yield curve a warning that a recession could follow as the yield curve has inverted before each recession since 1955 with only one false signal in that time.5

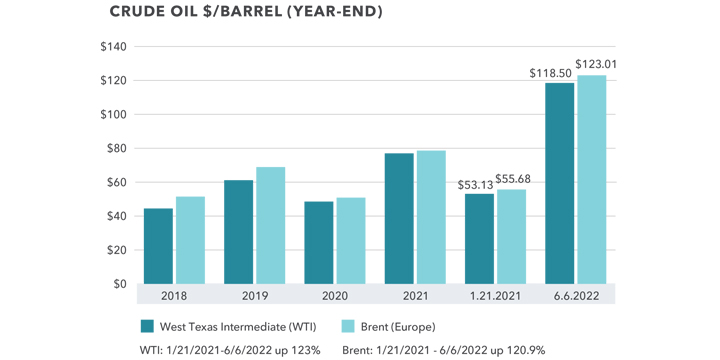

Oil Price Swings: Rising oil prices significantly impact inflation as increased prices of gasoline and diesel fuel increases the cost of transporting all goods. As a result, the prices for all goods that need to be transported will rise. Also, oil is a necessary raw commodity in the production of many goods such as plastics, asphalt, and cosmetics. Therefore, as oil prices rise, so does the cost of producing such goods. As consumers are forced to pay higher prices for gasoline, diesel, and all the products transported or made from oil, their disposable income is reduced, leading to lower demand and spending. Higher prices and less demand greatly increase the chances for a recession.

Historically a spike in oil prices has preceded or coincided with 10 out of 12 post-World War II recessions.6 According to Luca Paolini, chief economic strategist at Pictet Asset Management, in the past 50 years, every time oil prices, adjusted for inflation, rose 50% or more above trend in the U.S., a recession has followed.7 Since the cost of Brent oil (the European benchmark) crossed the 50% threshold in early March, Pictet Asset Management has seen a recession in our near future.

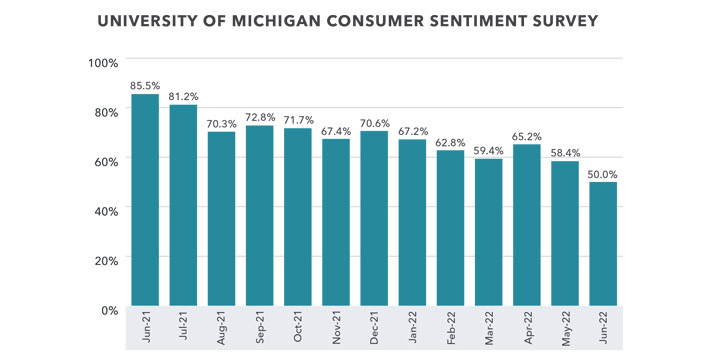

Consumer/Investor Confidence: Consumer sentiment is an important measure in gauging the health of the economy as household consumption accounts for approximately 70% of the U.S. GDP. When inflation drives prices up to the point that consumers lose confidence in the economy and cut back their spending, the GDP shrinks, and we move closer to a recession.

The University of Michigan has been administering a monthly consumer sentiment survey since the late 1940s. Consumer confidence is tracked through at least 500 telephone interviews asking 50 core questions. The May 2022 survey saw consumer sentiment drop to 58.4%, the lowest consumer sentiment reading since August, 2011. The decline was “broad based” and “visible across income, age, education, geography, and political affiliation,” according to Joanne Hsu, director of the survey. Driving the decline in confidence was the accelerating prices, which consumers expected to continue for at least a year. Expectations of buying durables “reached its lowest reading since the question began appearing on the monthly surveys in 1978, again primarily due to high prices,” added Hsu.

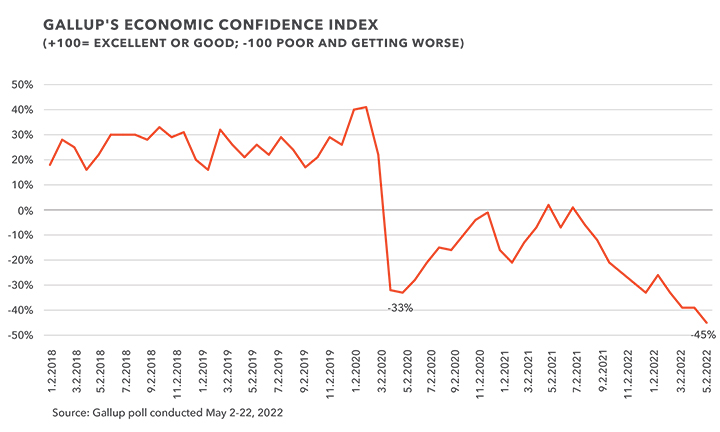

Gallup has been publishing a monthly Economic Confidence Index report since 1992. The lowest confidence reading in the Gallup survey registered a -72 in October 2008. In May 2022, the index came in at -45, down from -39 in each of the previous two months and the lowest reading since October 2008. The top U.S. problems identified in the survey were inflation, poor government leadership, the economy in general, and immigration.

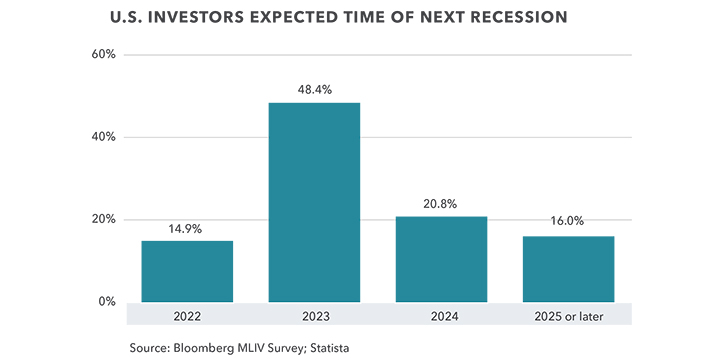

Both retail and professional investors shared their gloomy outlook for a coming recession in a Bloomberg Markets Live survey conducted between March 29 and April 1. Of the 525 respondents, 15% expect a recession to come this year, while 48% believed the recession will come in 2023, and 21% thought we would be in recession in 2024.

Conclusion: Recessions are caused by different factors requiring different responses. In many cases, there is a period of expansionary monetary policy in the years prior to the recession to jump-start the economy from a previous recession. That accurately describes the actions of the Fed in 2020 and 2021. During the pandemic, the Fed pursued a very aggressive expansionary monetary policy to support the economy. Near zero interest and quantitative easing during 2020 successfully positioned the economy for a strong rebound out of the pandemic. But flooding the economy with over $5 trillion in stimulus payments in just 12 months overheated the economy in 2021 driving accelerated inflation. By not moving to slow inflation at any time in 2021 or the first quarter of this year, the Fed watched as inflation jumped over 700 basis points to 8.5% in March. Now the Fed is too far behind the curve to bring down inflation without raising interest rates at a much faster pace, a move that has driven the U.S. into recessions eight times out of nine attempts since 1961.8

Current U.S. energy policy makes the Fed’s task even more challenging. Prioritizing “clean” energy over oil production, energy production has been reduced to less than pre-pandemic levels. In 2019 the U.S. produced nearly 13 million barrels per day of oil.9 The pandemic reduced demand for oil, and production fell by more than 3 million barrels per day to 9.7 million barrels per day. Since then, production has returned to near pre-pandemic levels at approximately 11.6 million barrels per day, 1.4 million barrels per day less than demand, creating a demand/supply imbalance driving gas prices to unprecedented levels. That spike in gas prices is the primary driver of the skyrocketing inflation we have seen over the last 18 months.10

Whether the Fed can navigate a “soft landing” and avoid a recession or not, additional aggressive interest rate hikes are certain through the end of this year, causing commercial real estate lenders to reevaluate their offerings. In the near term, it is clear that lending rates are going higher, creating headwinds for investors and developers. However, the proven track record of commercial real estate as a hedge against inflation and recessions together with the enormous volume of capital still chasing commercial real estate makes a broad-based decline in sales volume or pricing unlikely.

Contact

GARY BARAGONA

Director of Research

415.229.8925

gary.baragona@kidder.com

Written by John Fioramonti

Senior Business Writer

Kidder Mathews Research

Sources

1 Transcript of Chairman Powell’s Press Conference, April 29,2020, Transcript of Chair Powell’s Press Conference – April 29, 2020 (federalreserve.gov)

2 PIIE, US wages grew at fastest pace in decades in 2021, but prices grew even more

3 CNN, Food is more expensive than it has been in decades

4 BLS, The Economics Daily, Consumer Price Index: 2021 in review : The Economics Daily: U.S. Bureau of Labor Statistics (bls.gov)

5 Reuters, U.S. yield curve inversion – What is it telling us?

6 Bloomberg, History Suggests Oil Shock Raises Probability of U.S. Recession, Pictet Says

7 Id.

8 Piper | Sandler, How likely is a soft landing? A look at history since the 1960s

9 Forbes, What Is Holding Back U.S. Oil Production?

10 Id.

Stay in the know and subscribe to our monthly West Coast Market Trends report and our quarterly market research.