The Inland Empire region of Southern California has emerged as one the largest warehousing hubs in the world over the past few decades, in large part due to the consumer goods that flow through the ports of Los Angeles and Long Beach, and turbo-charged by the growth of e-commerce.

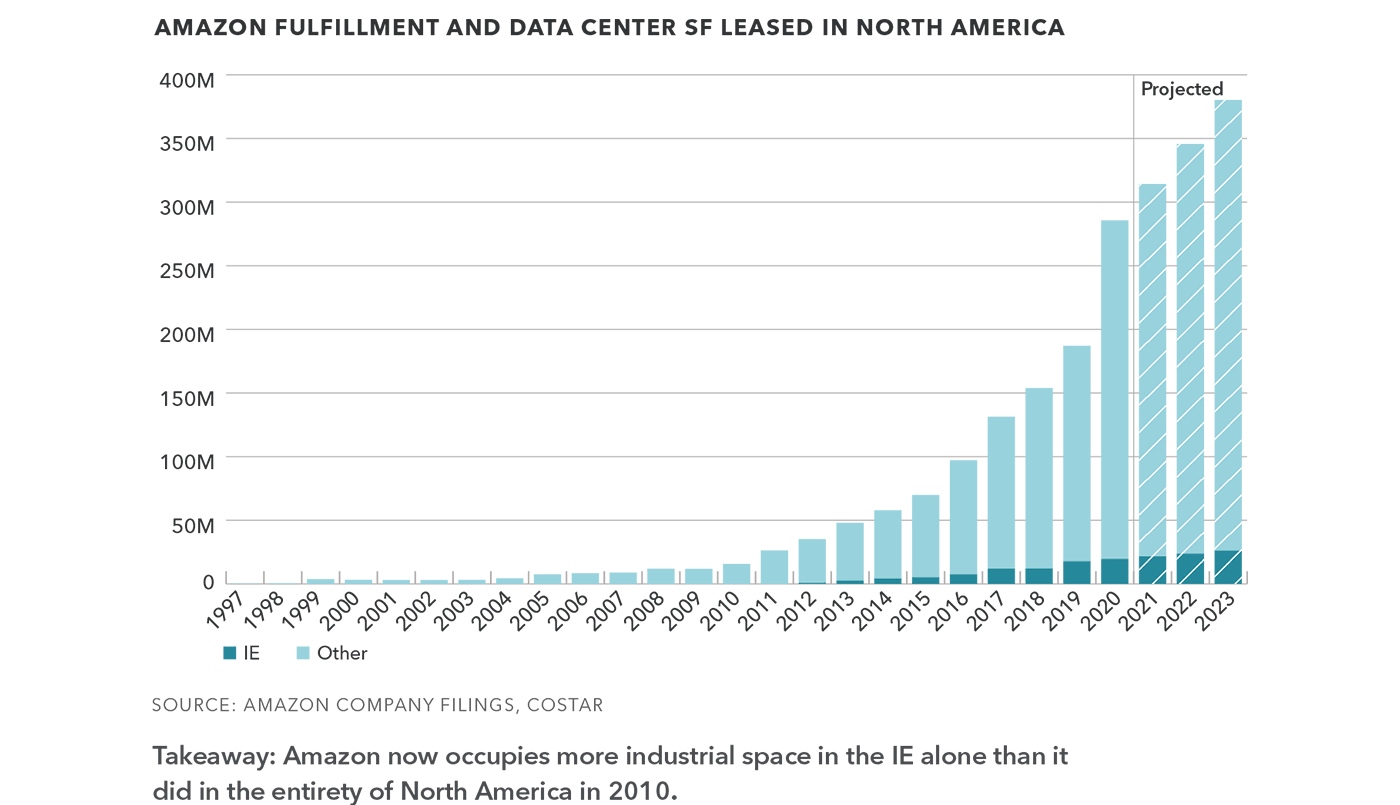

The IE sees nearly 40% of the nation’s goods flow through its borders, including those for over 23 million SoCal residents locally. Its appeal has led many large corporations across a variety of industries continue to relocate to or expand within its vast industrial market, but none more notable than Amazon. In fact, nowhere in the nation is Amazon’s astonishing rise more evident.

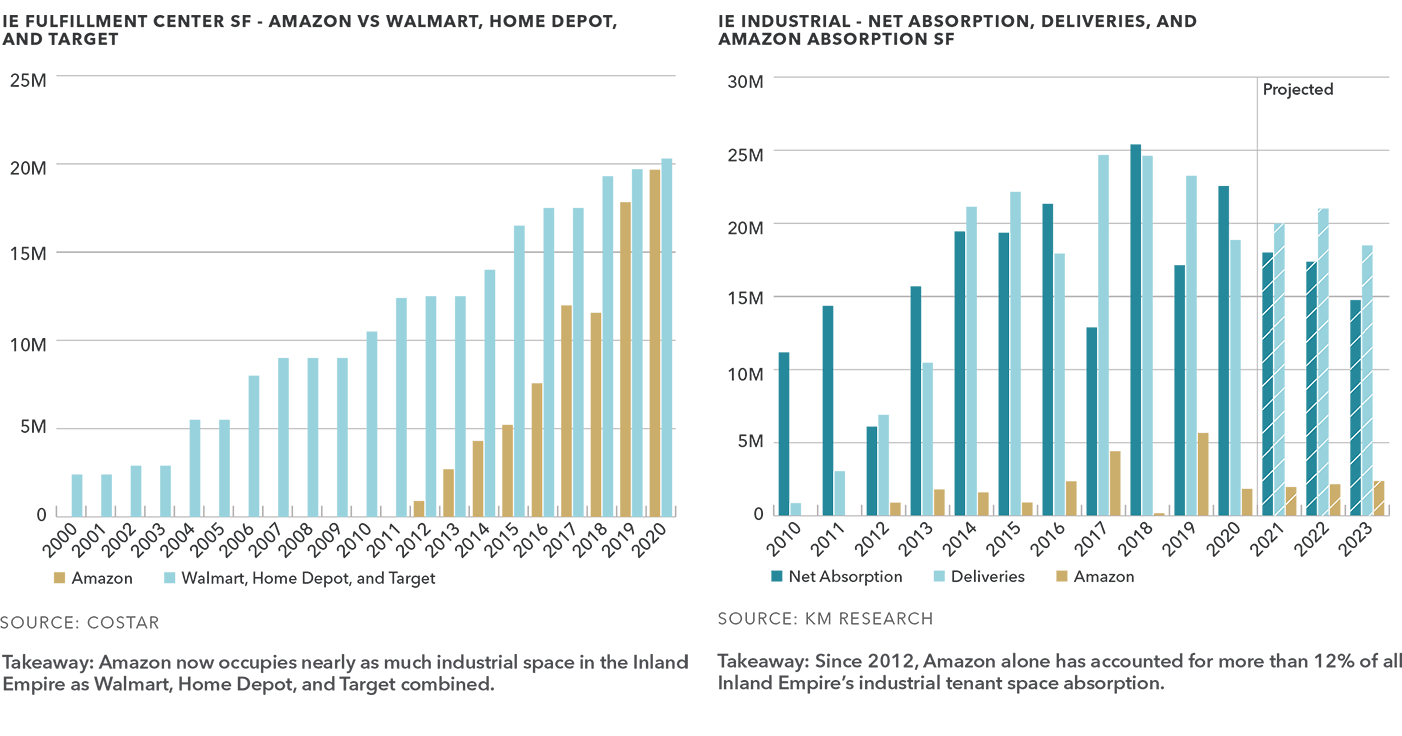

It’s hard to believe that the first Amazon warehouse, known as ONT2, wasn’t launched in the Inland Empire until 2012 (with fewer than 3,000 employees), long after big box store competitors like Target, Home Depot, and Walmart were established in the market. Since then, Amazon has become the largest private employer in the region, with 14 facilities and two logistics air hubs. More than 40,000 people now work for Amazon warehouses in the Inland Empire as pickers, packers, sorters, unloaders, and managers, as well as independent drivers, contract truckers, pilots, and aircraft technicians.

No Slowing Down

Amazon continues to expand its fulfillment network to accommodate a greater selection and in-stock inventory levels and to meet anticipated shipment volumes from sales of its own products as well as sales by third parties for which they provide the fulfillment services. In fact, they are scheduled to absorb an additional 100 million square feet of distribution facilities in the United States over the next 2 & 1/2 years.

In the Inland Empire, however, they’re going to have competition, as there are currently twelve one-million+ square foot requirements circling a market where land availability is shrinking fast. Increased pushback from local municipalities, heightened construction costs, NIMBYs, and longer entitlement processes have made developing in new supply in the IE increasingly more difficult. We expect this trend to manifest in near-term increases in both rental rates and land values.

Unprecedented Impact on Land Values & Rents

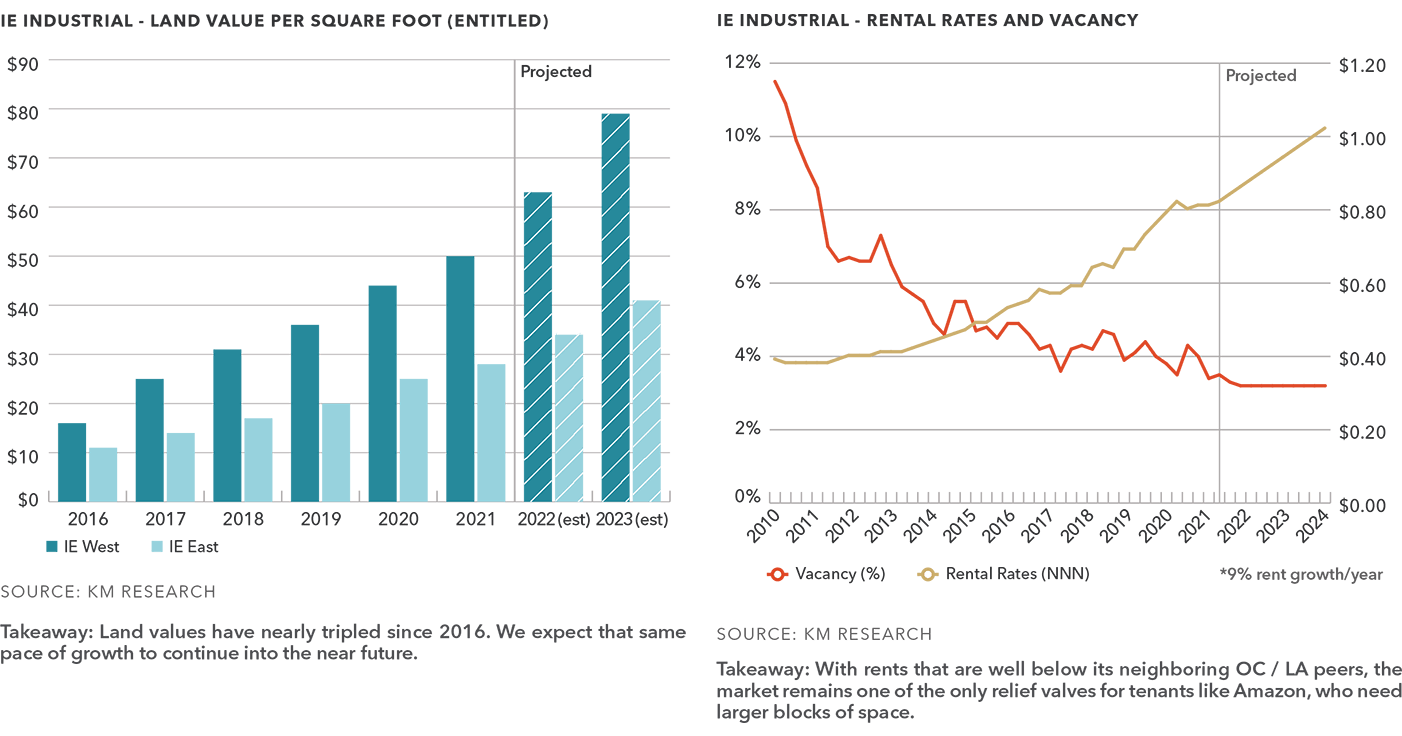

The IE has been the most active industrial market in the world for nearly 20 years. Demand for space, whether from Amazon or elsewhere, continues to outpace supply which, in turn, is impacting land values and ultimately lease rates, significantly.

Although certain areas, particularly in the IE-East, offer more available land relative to neighboring LA and Orange Counties, that availability is shrinking quickly as the increasing sense of urgency among developers is causing an intense clamor for any remaining parcels. As a result, industrial-entitled land values have tripled since 2016, growing at a 26% and 21% annual clip in the IE-West and IE-East respectively. We expect that same pace of growth to continue into the near future.

As new speculative projects are developed on more expensive land, higher development costs combined with increased competition among tenants to be in the most desired, modern spaces should continue to put significant upward pressure on rental rates. A projected 22% annual increase in land values during the next two years would imply that rents would need to increase 9% annually for a developer to hit the same stabilized yield on cost.

Notes on The Margin – KBC: “Amazon Commercial Realty, Inc.”

Due to these value increases and in a sign of a continuing reach into its vendor’s margins, Amazon has expanded its real estate procurement strategy towards monetizing the fees and value it helps create with its leases and occupancy. In addition to its established in-house logistics planning and strategy team, the company now also has acquired/partnered with a Seattle-based commercial services firm, KBC, to handle most/all lease negotiations with landlords, and so is moving away from working with third-party tenant-rep brokerages. While Amazon has so far originated land for new build-to-suit facilities through national developers, KBC may now originate, permit, and construct those facilities directly. Finally, in situations where Amazon needs to work with a third-party investor or developer that already controls the real estate, the venture will seek a JV or other structure with that third-party in order to capture some of the marginal investment value created by its lease and credit-worthiness.

Download ArticleContact

| Rick Putnam EVP, Shareholder 949.557.5067 rick.putnam@kidder.com CA LIC N° 01123195 NV LIC N° S.0178942 |

Eric Cohen Vice President 949.557.5049 eric.cohen@kidder.com CA LIC N° 01936037 NV LIC N° S.0183330 |

Luke Nakagawa Associate 949.557.5053 luke.nakagawa@kidder.com CA LIC N° 02065285 |