Cost Segregation is the key to unlocking hidden savings in commercial property. The cost segregation study analyzes building assets & classifies them in order to identify those that qualify for accelerated depreciation, often resulting in massive reductions in tax liabilities.

Benefits of Cost Segregation Analysis

A cost segregation analysis typically results in increased depreciation benefits by differentiating long-life property assets from short-lived assets for federal income tax purposes. Some of the key benefits include improving short term cash flow, identifying costs to be expensed, detailing fixed asset records, and creating a solid record for the IRS in terms of identifying assets. Cost segregation can also be used to lessen real estate tax liabilities, as well as identify sales and use tax savings.

Experienced Cost Segregation Professionals

Our cost segregation reports are completed by experienced professionals who perform true engineering based studies. Our engineers have backgrounds in construction, and can truly “reverse-engineer” a building on paper. Our reports follow the guidelines set forth by the IRS in their “Cost Segregation Audit Technique Guide”, and all providers meet and exceed the qualification requirements required. Our engineers have performed hundreds of engineering based cost segregation studies using MACRS analysis on properties ranging from restaurants, multifamily, distribution centers, manufacturing facilities, biotech facilities, wineries, food processing plants, cold storage, gaming, resorts and hotels, to offices. Property and project scope from $200,000 to an excess of $3 billion. They have responded to Information Document Requests (IDR) to document, support, and defend positions on various cost segregation studies.

Unlike some boutique firms, our engineers do the entire study from start to finish, including the on-site inspection. We feel there is no way to do a quality study if the engineer performing the study does not have this intimate knowledge of a property and its components.

Contact UsProperty Types for Cost Segregation Analysis

- Multifamily

- Residential Rentals

- Short-Term Rentals

- Retail/Restaurant/Nightlife

- Industrial/Manufacturing

- Hospitality/Gaming

- Golf courses

- Data centers

- Offices/Business centers

- Shopping centers

- Other “specialty use” properties

Why should a cost segregation study be performed?

Property owners who have recently acquired, constructed, renovated, or expanded new real estate assets can use a cost segregation study to help recover their capital investments quickly, as opposed to slowly over the standard tax-life of real property. Results of a cost segregation can help a tax payer in the following ways: Maximize tax savings by adjusting the timing of deductions. Depreciation expenses are accelerated and tax payments will be lessened in the earlier stages of owning the property, when the tax life is shortened. By shortening the tax life and allowing these larger depreciation expenses, the tax payer frees up cash flow for further investment opportunities or other business needs. Cost segregation also helps document costs, and provide an audit trail for the IRS. By performing a cost segregation study, assets can be properly documented at the earliest possible time to help solve IRS inquiries, thus providing an audit trail.

What properties are eligible for cost segregation studies?

Any property that has been recently acquired, constructed, renovated, or expanded since 1987. Typically assets worth over $200,000 will show a benefit from a study. The best time to perform a study is as soon construction is complete, or quickly before or after a building has been purchased. Older buildings can also benefit from what’s called “catchup” depreciation. In this case, a property owner that has constructed or acquired their property in the past catch up their savings and capture it in the first year, which can lead to a huge first year tax savings. This is typically beneficial on a building that is less than 7 years old.

Retroactive cost segregation studies to increase cash flow

Since 1996, taxpayers can capture immediate retroactive savings on property added since 1987. Previous rules, which provided a four-year catch-up period for retroactive savings, have been amended to allow taxpayers to take the entire amount of the adjustment in the year the cost segregation is completed. This opportunity to recapture unrecognized depreciation in one year presents an opportunity to perform retroactive cost segregation analyses on older properties to increase cash flow in the current year. Additional tax benefits. Cost segregation can also reveal opportunities to reduce real estate tax liabilities and identify certain sales and use tax savings opportunities.

Unlocking Tax Savings: How Cost Segregation Enhances the Short-Term Rental Loophole

Cost Segregation Services Case Studies

Four newly constructed Marriott flag hotels

Location: NM, CO, UT, & AZ

Combined total basis: $46,000,000

Post study – first year depreciation deduction: $11,534,919

Post-tax savings: $4,441,461

Acquired Medical Office Complex

Location: Phoenix, AZ

Total basis: $15,709,268

Post study - first year depreciation deduction: $3,392,868

Post-tax savings: $1,252,855

Acquired Net Leased Restaurant

Location: Chandler, AZ

Total basis: $3,675,000

Post study - first year depreciation deduction: $1,157,061

Post-tax savings: $447,429

Acquired Short-Term Rental Property

Location: Sevierville, TN

Total basis: $1,250,000

Post study – first year depreciation deduction: $375,934

Post-tax savings: $139,554

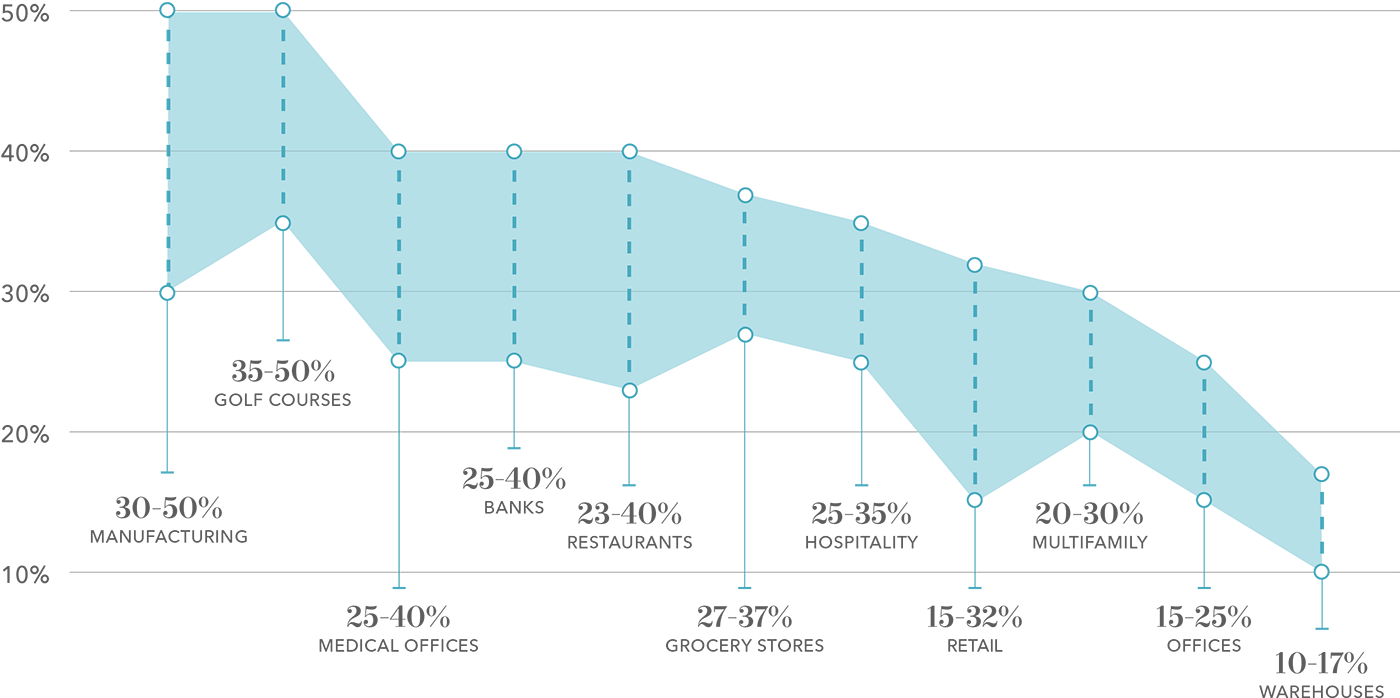

Typical Relocation by Property Type

Bonus Depreciation

Bonus depreciation allows taxpayers to deduct a specified percentage (30, 50, 80, or 100 percent) of depreciation in the year the qualifying property is placed in service. The adjusted basis of the qualifying property is reduced by the allowable amount of bonus depreciation before the remaining depreciation deductions are computed for the placed-in-service year and subsequent years.

Eligible Property

In order to qualify for 30, 50, 80, or 100 percent bonus depreciation, the original use of the property must begin with the taxpayer and the property must be one of the following:

– MACRS property with a recovery period of 20 years or less

– Depreciable computer software

– Water utility property

– Qualified Improvement Property

Certain acquisition requirements and placed in service dates must also be met in order to qualify for 30, 50, 80, or 100 percent bonus depreciation, and are discussed in more detail below.

The Tax Cuts and Jobs Act increased the bonus depreciation percentage from 50 percent to 100 percent for qualified property acquired and placed in service after September 27, 2017, and before January 1, 2023.

The Tax Cuts and Jobs Act increased the bonus depreciation percentage from 50% to 100% for qualified property acquired and placed in service after 9/27/2017, and before 1/1/2023. Bonus Depreciation percentage is 80%, when placed in service between 1/1/2023 and 12/31/2023.

Taxpayers may elect out of the additional first-year depreciation.

Contact Us

Cost Segregation Specialists

Ryan Begley, Executive Vice President, Cost Segregation Manager | Phoenix, AZ

Commercial Real Estate Trend Articles

“Big Beautiful” Bonus Depreciation Discussion Offers Lessons in Cost Segregation

As lawmakers debate the budget reconciliation bill—also referred to by some as the “One Big Beautiful Bill Act”—one provision drawing...

Read More

Kidder Mathews Releases Q2 2025 Research on Eastern Washington Apartment Market

Kidder Mathews has released its Q2 2025 Eastern Washington Apartment Market Dynamics report—offering an in-depth look at trends and the latest sales...

Read More

2025 Q2 Seattle & Puget Sound Apartment Market Dynamics

New construction projects that reached completion in the last year are leasing up well: Occupancy rates across Puget Sound held up this quarter,...

Read MoreValuation Advisory News

Kidder Mathews’ Daniel Boring Awarded the CRE® Designation from The Counselors of Real Estate®

Kidder Mathews Senior Vice President Daniel Boring, CRE®, MAI, ARA, ASA has been awarded the Counselor of Real Estate® designation. Only 1,000...

Read More

Kidder Mathews Grows Valuation Advisory Division — Welcoming Daniel Boring and Launching Machinery & Equipment Appraisals Nationwide

Daniel Boring, MAI, ARA, ASA has joined Kidder Mathews Valuation Advisory Services as a senior vice president. In this role, he will lead the firm’s...

Read More

Kidder Mathews Expands Expertise with Three Key Additions to Valuation Advisory Services

Kidder Mathews welcomes appraisal team, Babak Sammak, Michael Thiel, MAI, and Tommy Stuebe, specialists in market-rate and affordable multifamily...

Read More